Now that Gold has pushed to a three month high, it’s clear that my bullish read of the Gold tape is at least partially correct. In the face of recent negative price action, I had managed to remain cautiously bullish given Gold’s position in a new Investor Cycle – it was far too early for Gold to be rolling over, even if it remained locked in an extreme bear market. But now, after this week’s action, Gold is in a much better position, and with the possibility of upside ahead. (Glossary of Cycle terms)

The market analysts who have been overwhelming bearish on Gold (many holding Shorts) are now in the position of potentially needing to play catch up, which would chase the market higher. We’ll be eagerly watching for upside confirmation, but for now, we’ll be content with finally gaining clarity on Gold’s Cycles.

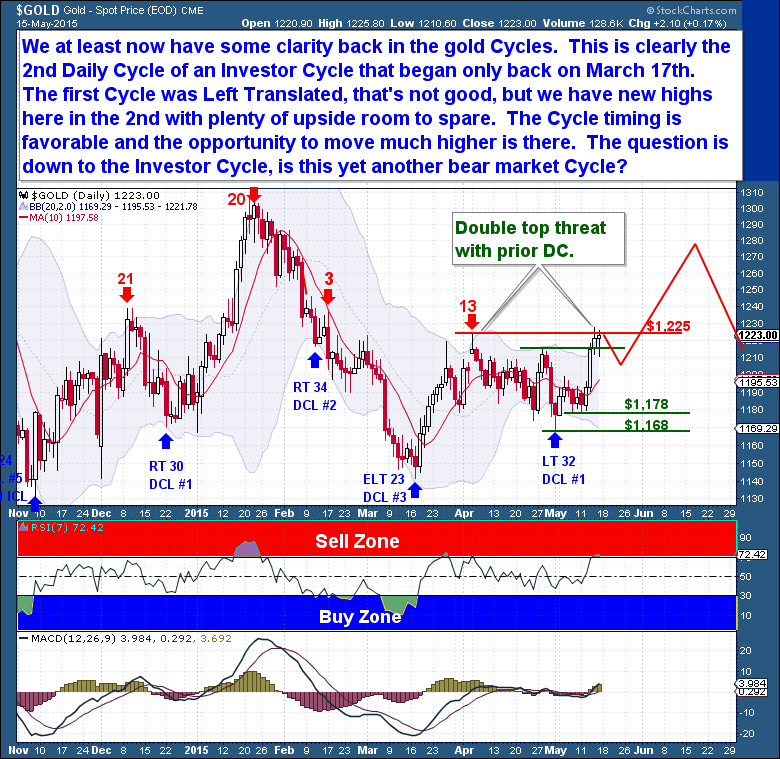

With a comfortable Cycle count, we can construct a new framework of expectations. We know now that the current Daily Cycle is the 2nd of the Investor Cycle that began on March 17th. The first Daily Cycle was Left Translated – I’m not thrilled with that – but we have reached new highs in the 2nd DC, and there is plenty of room to the upside.

As a preview of a later section, the Investor Cycle shows that Gold has room to move higher, even if it remains in a down-trending bear market Cycle. So with favorable Cycle timing, I expect Gold to have at least one more decent rally before again confront the question of where Gold is headed. It should come when Gold reaches the intermediate term downtrend line that dates back to early 2014.

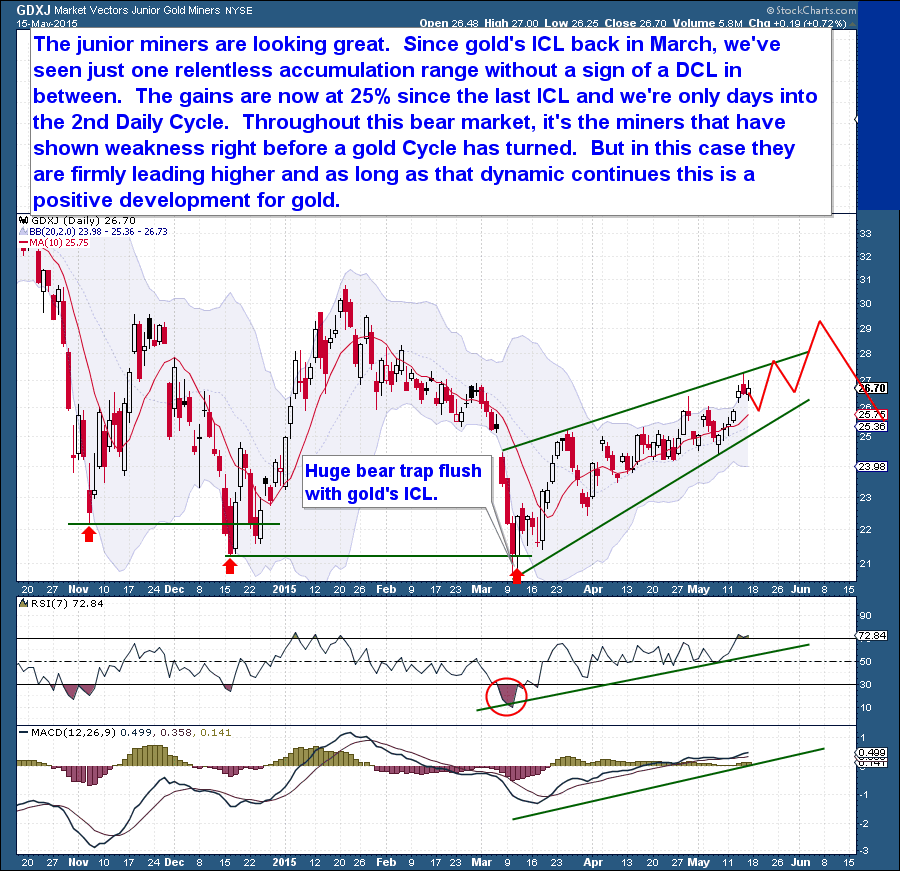

The Junior Miners are looking great. I’ve studied Gold long enough to know that a healthy market for Junior Miners is always a bullish sign. Since Gold’s Investor Cycle Low (ICL) in March, there’s been a seemingly relentless accumulation of the Miners, and without a typical DCL decline. This is fairly uncommon for the Miners as they are high beta in relation to Gold, so a sell-off in the precious metals complex typically hits them much harder than Gold.

This behavior speaks to the potential accumulative bid under the Miners. Although it’s too early for grandiose claims, relative strength in the Miners is consistent with buying near a bear market low. In fact, the Miners have already gained 25% since the last ICL Gains like this are not unusual for an IC, but in this case, we’re only days into the 2nd Daily Cycle. In relation to Gold, the Miners have been especially impressive. Throughout the bear market, the Miners have led Gold, and have typically shown weakness right before a Gold Cycle turned down. In today’s case, the Miners are firmly leading Gold and the sector higher. As long as that dynamic continues, it is positive for Gold.

The same can be said for sentiment; the COT report is bullish for Gold. No one has given Gold any chance of mounting a real rally, and 9 weeks into the Investor Cycle, short speculative positions are at levels near those typical for an ICL.

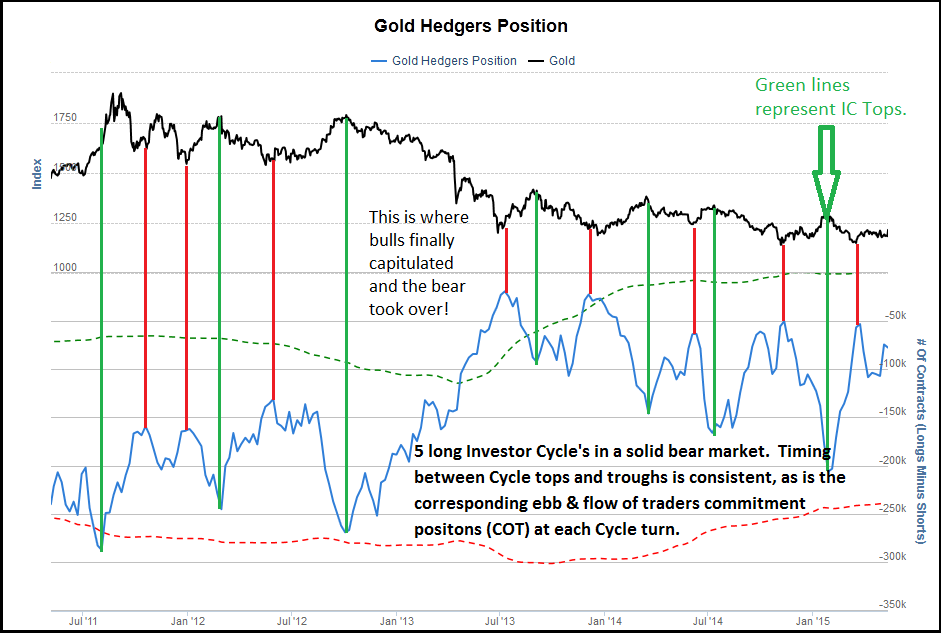

From the below chart, we see that Gold is still locked in a bear market trend, as marked by 5 long Investor Cycles. In looking at traders’ positions and the ebb & flow between being Short and being Long, the current Cycle is nowhere near a typical topping point. The timing between Cycle tops and troughs is fairly consistent, and the chart shows that Gold still needs a Short-covering rally before an IC top. This has been the behavior of the current bear market: Short-covering drives a final rally that fizzles once the Shorts have been exhausted.

If the bear market is over, once the Short-covering rally ends, Gold will transition into an organic rally based on wholesale speculative buying. This organic buying will be from traders who prefer to risk capital in Gold rather than other bullish assets. It’s a stretch to be even considering that possibility at this point, but it is worth mentioning as an illustration of the difference between buyers in bull and bear markets.

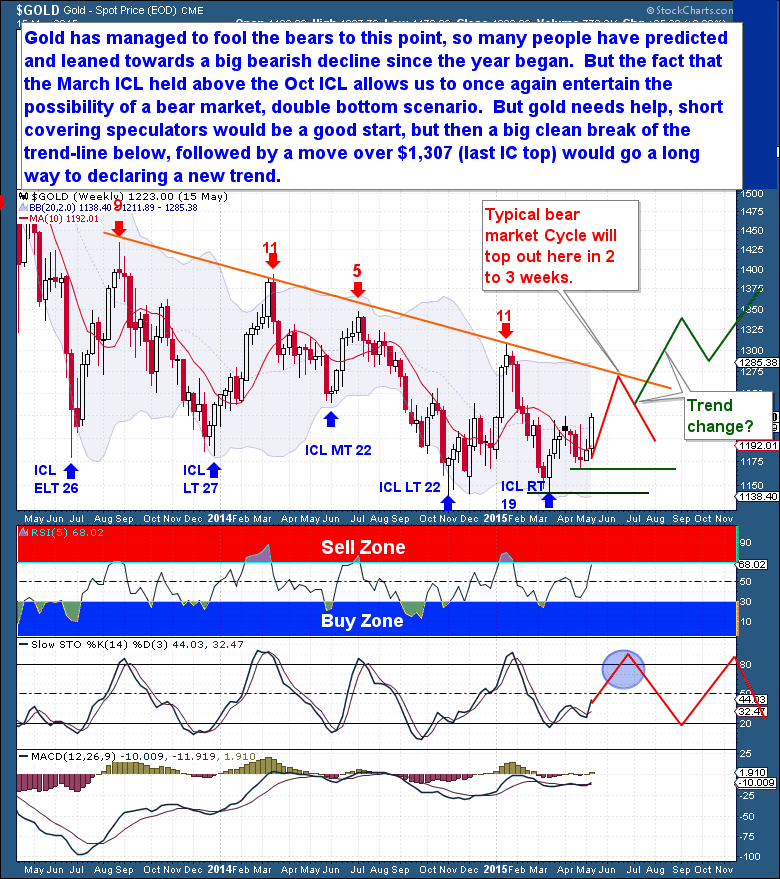

Since the beginning of 2015, there have been widespread calls for much lower Gold prices, with $1,000 and even $725 as popular targets. Gold’s current upside move has proceeded under the radar, and has managed to fool these bears so far. In the process, the Gold market is presenting my favorite type of rally, one where there is fuel remaining in the market to support a much greater move.

The COT report underscores this idea. Traders are still Short the Gold market while Gold sits at a 3 month high and on the verge of further upside that will force traders to begin covering their Shorts.

Longer term, remember that the March ICL held above the October ICL. With our newfound Cycle clarity, we no longer need to be concerned with the possibility of an early IC failure, so we can once again at least entertain the possibility that the bear market double bottomed in March. I believe that we’re about to see a Short covering rally from the speculators, one that will drive price up to the declining trend-line that marks the place where the last 5 bear market ICs topped.

Beyond that, further upside will require that speculators turn bullish and begin buying Long positions again. If that unfolds, we should expect to see Gold cleanly break and exceed the trend-line, and eventually push into the $1,300+ range, perhaps as high as $1,375. And if that happens, Gold will be in a new up-trend because of the double bottom ICL followed by a higher Investor Cycle top. It would be an exciting development for long-suffering bulls!

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.

Midweek Market Update – June 3rd

/in Premium /by Bob LoukasYou don’t have access to view this content.

You Don’t Know Where the Market is Heading!

/in Public /by Bob LoukasI’ve been of two minds recently regarding the current Cycle picture in equities. So this week I focused more attention on finding secondary evidence to support a more definitive position on direction. As I suspected it might, my research provided an almost endless array of contradictory evidence and facts.

The internet and social media are a mixed blessing to researchers – they can lead to a huge number of hypotheses and points of view, but the quality of information is generally pretty low. At its best, however, the internet can lead to ideas and links to compelling analysis and primary sources. The point is that there exists online a mass of data points, ideas, opinions, analyses and thesis that can occasionally help to bring real clarity of thought, but more often, the information serves only to confuse, and even obfuscate. From a trader’s perspective, the information is generally unable to answer the questions that are of greatest import.

This lack of clarity is especially pointed today. We are faced with an equity environment where it is impossible to know what the next 3, 6 or 12 months will hold. The FED and other central banks are meddling in the market in unprecedented ways and at unprecedented levels, all while the market is at its most unpredictable. Equities are in the late stage of a cyclical move, significantly overvalued, but without the huge “blow off” that typically marks the end of a bull market. So the S&P could drop like a stone or rally for 300 points, and neither would be a surprise.

The upshot is that we don’t need, and should not attempt, to predict the next move. Instead, we need to understand and accept the different possibilities that emerge from the market’s position in its cycles. There is power, and peace, in understanding the different possibilities and being ready to take advantage of them.

On the daily chart, the whipsawing action has continued. It is demonstrated clearly by the alternating red and white candles (below), each of which signifies a single day, down or up. The market will remain trend-less until we see either a) a Cycle failure (price moving below 2,067) or b) a burst to a convincing new high. Until one of these happens, we won’t know if this remains an extended (declining) Investor Cycle, or the beginning of a massive breakout. There is no sense trying to front-run a major move in either direction. It’s better that we simply remain patient.

The weekly chart is much more interesting than the daily because it shows that time appears to be running out for this sideways move. Price is being contained by a narrowing wedge, and I’d expect the S&P to begin its next significant move within 1-2 weeks. The first clue on direction will be how price breaks from the tightening wedge, whether it breaks up or down. Confirmation of the move will come via a failed Daily Cycle (< 2,067) on the downside, or a clean break and rally on the upside.

Either way, with Oct 2014 as the last Investor Cycle Low, equities are on Week 33 and (well past) due for an Investor Cycle Low. Therefore, any upside break and rally from this point must mark a new Investor Cycle, and would support the idea that the S&P has been in a sideways consolidation for the past 2 months. They occur rarely, but those are very powerful Cycle Lows, so an upside break, if it comes, should not be expected to top quickly. Alternatively, a breakdown from this point would be a continuation of the October Cycle, likely resulting in a fast 3-5 week collapse into a long and extended ICL.

Possible Trading Strategy

I am convinced that if the market breaks higher it will mark a new Investor Cycle. A breakout would be a sign of a massive new move in a new Investor Cycle, and I would consider buying it with decent size.

Alternatively, a failed Daily Cycle (Below 2,067) would mean that the current Investor Cycle is on week 33 and just 3 to 6 weeks from an extended Investor Cycle Low. The downside will likely be capped, so I don’t expect the October Low to be threatened. There would, however, be plenty of downside potential to warrant taking a Short position.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Summer Doldrums

/in Premium /by Bob LoukasYou don’t have access to view this content.

Gold Cycle Update

/1 Comment/in Public /by Bob LoukasRecently within the article More Breathing Room I had outlined how gold had at least 3 to 4 weeks of upside surprise left within the current weekly Cycle. Unfortunately, gold failed to take advantage and has since shown signs of breaking down. And within the recent weekend premium report, I outlined a rather significant shift in my gold Cycle outlook based almost exclusively on the bearish COT report.

Those concerns materialized almost immediately once the trading week began, as gold dropped a solid $20 straight out of the gate. The other concerns were a dollar showing signs of a major Cycle Low, while gold itself is now up to week 10 of the Cycle, near the point where bear market Cycles top, as every Cycle since 2011 has failed to exceed week 11 with new highs.

In the very near term, this decline seen in the chart below has become oversold. And because we’ve yet to see a Low that resembles the Half Cycle point, it’s likely that gold will reverse at this time and mount some type of bullish looking advance. But that’s where gold bulls should begin to worry, as the Investor Cycle headwinds mentioned earlier are likely to pressure gold as it attempts to break back over $1,200 and the 10 day moving average at $1,208.

Still keeping an open mind on the possibilities here, as technically the Cycle has not failed, which means both bullish and bearish options remain on the table. How gold performs after a quick rally in the coming days will be very important and ultimately it will reveal golds intentions for the remainder of the Investor Cycle. But we can’t ignore the bearish evidence now; I would give a failed Daily Cycle a 75% chance. Only a push over $1,232 can turn this into a bullish setup. Caution to the downside therefore, a failed Cycle opens the door to much larger degree declines.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com/landing/try#

Feel free to share this post via the below social media avenues.

Market Update – May 28th

/in Premium /by Bob LoukasYou don’t have access to view this content.

Game Changer

/in Premium /by Bob LoukasYou don’t have access to view this content.

Midweek Market Update – May 20th

/in Premium /by Bob LoukasYou don’t have access to view this content.

Some Breathing Room

/in Public /by Bob LoukasNow that Gold has pushed to a three month high, it’s clear that my bullish read of the Gold tape is at least partially correct. In the face of recent negative price action, I had managed to remain cautiously bullish given Gold’s position in a new Investor Cycle – it was far too early for Gold to be rolling over, even if it remained locked in an extreme bear market. But now, after this week’s action, Gold is in a much better position, and with the possibility of upside ahead. (Glossary of Cycle terms)

The market analysts who have been overwhelming bearish on Gold (many holding Shorts) are now in the position of potentially needing to play catch up, which would chase the market higher. We’ll be eagerly watching for upside confirmation, but for now, we’ll be content with finally gaining clarity on Gold’s Cycles.

With a comfortable Cycle count, we can construct a new framework of expectations. We know now that the current Daily Cycle is the 2nd of the Investor Cycle that began on March 17th. The first Daily Cycle was Left Translated – I’m not thrilled with that – but we have reached new highs in the 2nd DC, and there is plenty of room to the upside.

As a preview of a later section, the Investor Cycle shows that Gold has room to move higher, even if it remains in a down-trending bear market Cycle. So with favorable Cycle timing, I expect Gold to have at least one more decent rally before again confront the question of where Gold is headed. It should come when Gold reaches the intermediate term downtrend line that dates back to early 2014.

The Junior Miners are looking great. I’ve studied Gold long enough to know that a healthy market for Junior Miners is always a bullish sign. Since Gold’s Investor Cycle Low (ICL) in March, there’s been a seemingly relentless accumulation of the Miners, and without a typical DCL decline. This is fairly uncommon for the Miners as they are high beta in relation to Gold, so a sell-off in the precious metals complex typically hits them much harder than Gold.

This behavior speaks to the potential accumulative bid under the Miners. Although it’s too early for grandiose claims, relative strength in the Miners is consistent with buying near a bear market low. In fact, the Miners have already gained 25% since the last ICL Gains like this are not unusual for an IC, but in this case, we’re only days into the 2nd Daily Cycle. In relation to Gold, the Miners have been especially impressive. Throughout the bear market, the Miners have led Gold, and have typically shown weakness right before a Gold Cycle turned down. In today’s case, the Miners are firmly leading Gold and the sector higher. As long as that dynamic continues, it is positive for Gold.

The same can be said for sentiment; the COT report is bullish for Gold. No one has given Gold any chance of mounting a real rally, and 9 weeks into the Investor Cycle, short speculative positions are at levels near those typical for an ICL.

From the below chart, we see that Gold is still locked in a bear market trend, as marked by 5 long Investor Cycles. In looking at traders’ positions and the ebb & flow between being Short and being Long, the current Cycle is nowhere near a typical topping point. The timing between Cycle tops and troughs is fairly consistent, and the chart shows that Gold still needs a Short-covering rally before an IC top. This has been the behavior of the current bear market: Short-covering drives a final rally that fizzles once the Shorts have been exhausted.

If the bear market is over, once the Short-covering rally ends, Gold will transition into an organic rally based on wholesale speculative buying. This organic buying will be from traders who prefer to risk capital in Gold rather than other bullish assets. It’s a stretch to be even considering that possibility at this point, but it is worth mentioning as an illustration of the difference between buyers in bull and bear markets.

Since the beginning of 2015, there have been widespread calls for much lower Gold prices, with $1,000 and even $725 as popular targets. Gold’s current upside move has proceeded under the radar, and has managed to fool these bears so far. In the process, the Gold market is presenting my favorite type of rally, one where there is fuel remaining in the market to support a much greater move.

The COT report underscores this idea. Traders are still Short the Gold market while Gold sits at a 3 month high and on the verge of further upside that will force traders to begin covering their Shorts.

Longer term, remember that the March ICL held above the October ICL. With our newfound Cycle clarity, we no longer need to be concerned with the possibility of an early IC failure, so we can once again at least entertain the possibility that the bear market double bottomed in March. I believe that we’re about to see a Short covering rally from the speculators, one that will drive price up to the declining trend-line that marks the place where the last 5 bear market ICs topped.

Beyond that, further upside will require that speculators turn bullish and begin buying Long positions again. If that unfolds, we should expect to see Gold cleanly break and exceed the trend-line, and eventually push into the $1,300+ range, perhaps as high as $1,375. And if that happens, Gold will be in a new up-trend because of the double bottom ICL followed by a higher Investor Cycle top. It would be an exciting development for long-suffering bulls!

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.

A Period of Speed

/in Premium /by Bob LoukasYou don’t have access to view this content.

Midweek Market Update – May 13th

/in Premium /by Bob LoukasYou don’t have access to view this content.