Yen Troubles to Continue

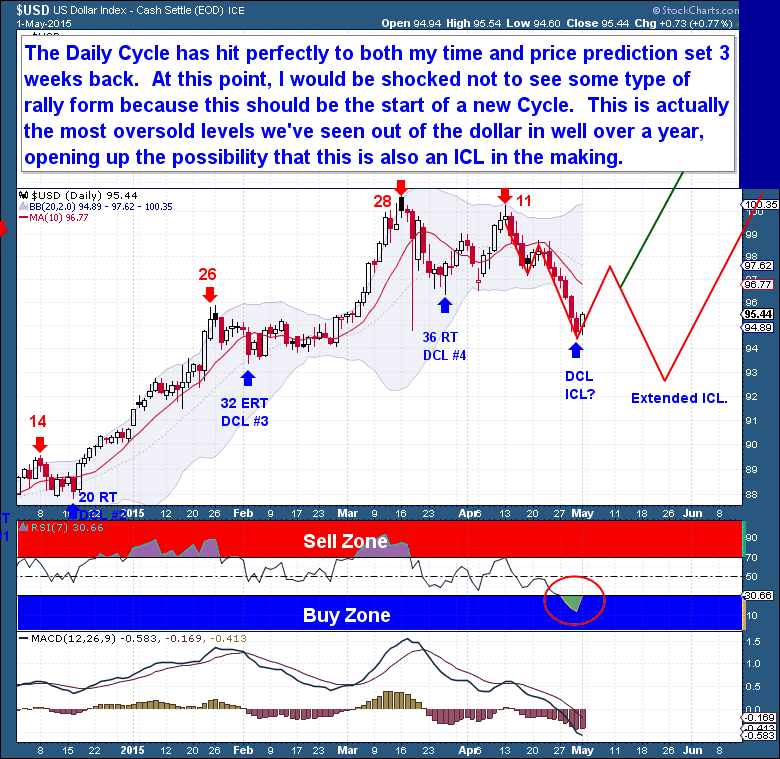

A clear and decisive US Dollar Cycle pattern has emerged, and that’s always good news. We have a Daily Cycle that moved perfectly to both time and price expectations, and price is now poised to turn higher in a new Daily Cycle. With the Dollar at oversold levels not seen in well over a year, it is interesting to note that sentiment has quickly started to turn against the Dollar. From the perspective of a longer time-frame, it’s possible that this is also an Investor Cycle Low in the making. (Glossary of Cycle terms)

Looking at this week’s COT report, we see that US Dollar Longs are at the lowest level since mid-December. Sentiment remains elevated overall, but a marked retreat the past few weeks has moved sentiment back to level that could support a new Investor Cycle rally in a bull market.

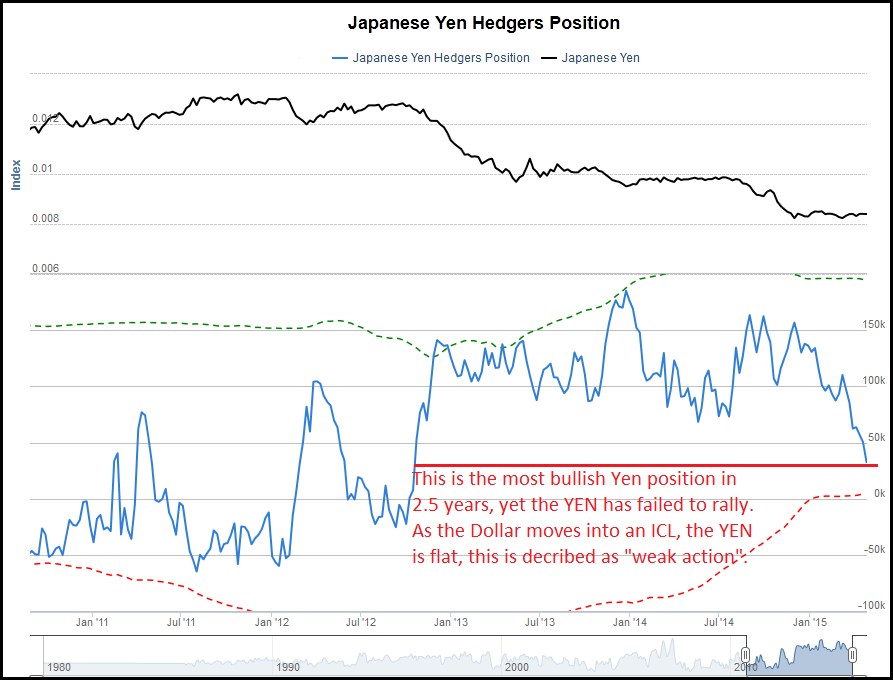

Of particular interest is the US Dollar to Yen COT report. It shows traders have entirely retreated from bearish bets against the Yen, and the net Short position is the least bearish since October 2012. Not coincidentally, the COT positioning in the summer of 2012 was the basis from which the Yen began a correction. I believe a good setup is presenting itself at present.

Source: Sentimentrader.com

Source: Sentimentrader.com

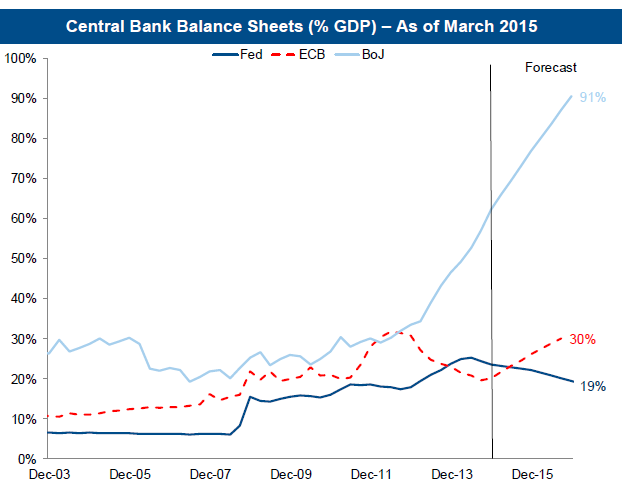

The structural problems in Japan are too great to ignore, and the Japan Central Bank is compensating for them by engaging in quantitative easing. I do not believe that the JCB thinks that QE is the best policy, but, rather, that it needs to buy its own debt due to a dearth of other buyers. The JCB has openly made it very clear that it will not stop buying debt, and the result of a massive balance sheet expansion can only be a huge realignment in the Yen versus other currencies.

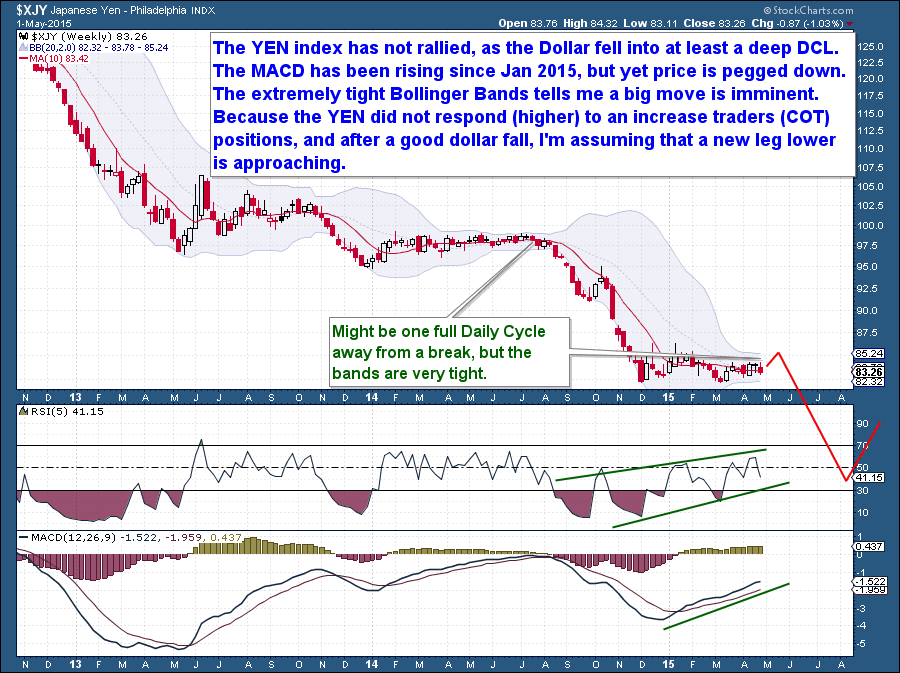

A look at the weekly Yen index (below) shows that it has not rallied despite the Dollar’s falling for 8 weeks into at least a deep Daily Cycle Low (DCL). There has been no demand to push the Yen higher while the Dollar has fallen, unlike the Euro, which has staged a counter-trend move.

In addition, the MACD has been rising since Jan 2015, but the Yen’s price has remained flat. Because the Yen did not respond (higher) as the Dollar fell and as traders increased (COT) Longs and covered Shorts, I can only assume that a new leg lower is approaching. One more thing to note: extremely tight Bollinger Bands tell me that a big move is imminent.

Trade Idea: One could consider taking a Short Yen position at this point. The position could be a full Daily Cycle too early, because the dollar might have another Cycle of retracement before putting in a deeper Investor Cycle turn. But because the Yen did nothing during the last (failed) Dollar Daily Cycle, a short Yen position here should hold above reasonable stops if the trade is a little early. The idea is to capture what I believe is a larger degree Yen fall over a longer time-frame. (3-4 months).