Considering that Gold has risen $80 off its low and the precious metals Miners have screamed higher, it’s surprising how little bullish cheering we’ve heard. My discussion forum, Bull & Bear Talk, is very sensitive to Gold, but has barely seen an uptick in traffic during this move. In past moves out of Investor Cycle Lows, Bull and Bear Talk has had an immediate surge in traffic and a significant rise in the number of excited posts.

This is just a small sampling of sentiment, but I think it’s telling. We’ve had a 3 year bear market in Gold that has battered and beaten the bulls into complete submission. All speculative interest and fond memories of the past bull market have been completely erased. This lack of interest was evident in the recent 3rd test of the bear market low – the volume and volatility was much lower than during the first two retests. The bear market has achieved its goal – to clear sentiment on a longer timeframes and lay the foundation for a real change in trend. The view of Gold and its sentiment on longer timeframes is a picture perfect example of the ebb & flow of Cycles.

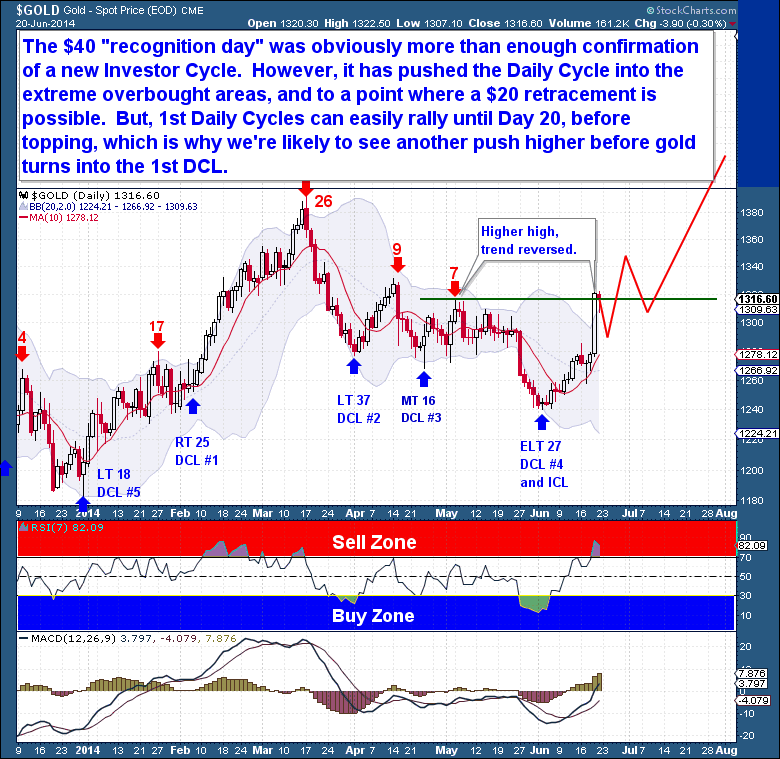

The $40 “recognition day” last week was obviously more than enough confirmation to declare a new Daily Cycle (Daily Cycle is 24-28 trading days), but it was powerful enough for declaration of a new Investor Cycle (Investor Cycle is 22-26 Weeks) as well. This is the development we’ve patiently waited for. However, on shorter time frames, Gold has pushed the Daily Cycle into an extremely overbought state, so a $20 or more retracement is possible.

This is only a problem for short term traders; a decision to take a new position now at such overbought levels could mean entering just as the market cools off. Nobody ever said that trading is easy, and determining when to enter a fast-moving asset is a frequent dilemma. Getting the trend right is only part of the challenge. Gold’s 1st Daily Cycle typically rallies until day 18-20 before topping, so on day 13 here we’re likely to see another push higher before Gold turns down into its 1st Cycle Low. There is no way of knowing how powerful the remainder of the Cycle will be, but the average 1st Daily Cycle adds 10%. If that happens this time, Gold will top at around $1,364.

Read more

Read more

Midweek Market Update – July 9th

/in Premium /by Bob LoukasYou don’t have access to view this content

All Fireworks and Smiles

/in Premium /by Bob LoukasYou don’t have access to view this content

Nothing to Fear

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Market Update – June 25th

/in Premium /by Bob LoukasYou don’t have access to view this content

Few Believe Gold Can Shine

/in Public /by Bob LoukasConsidering that Gold has risen $80 off its low and the precious metals Miners have screamed higher, it’s surprising how little bullish cheering we’ve heard. My discussion forum, Bull & Bear Talk, is very sensitive to Gold, but has barely seen an uptick in traffic during this move. In past moves out of Investor Cycle Lows, Bull and Bear Talk has had an immediate surge in traffic and a significant rise in the number of excited posts.

This is just a small sampling of sentiment, but I think it’s telling. We’ve had a 3 year bear market in Gold that has battered and beaten the bulls into complete submission. All speculative interest and fond memories of the past bull market have been completely erased. This lack of interest was evident in the recent 3rd test of the bear market low – the volume and volatility was much lower than during the first two retests. The bear market has achieved its goal – to clear sentiment on a longer timeframes and lay the foundation for a real change in trend. The view of Gold and its sentiment on longer timeframes is a picture perfect example of the ebb & flow of Cycles.

The $40 “recognition day” last week was obviously more than enough confirmation to declare a new Daily Cycle (Daily Cycle is 24-28 trading days), but it was powerful enough for declaration of a new Investor Cycle (Investor Cycle is 22-26 Weeks) as well. This is the development we’ve patiently waited for. However, on shorter time frames, Gold has pushed the Daily Cycle into an extremely overbought state, so a $20 or more retracement is possible.

This is only a problem for short term traders; a decision to take a new position now at such overbought levels could mean entering just as the market cools off. Nobody ever said that trading is easy, and determining when to enter a fast-moving asset is a frequent dilemma. Getting the trend right is only part of the challenge. Gold’s 1st Daily Cycle typically rallies until day 18-20 before topping, so on day 13 here we’re likely to see another push higher before Gold turns down into its 1st Cycle Low. There is no way of knowing how powerful the remainder of the Cycle will be, but the average 1st Daily Cycle adds 10%. If that happens this time, Gold will top at around $1,364.

The Right Turn

/in Premium /by Bob LoukasYou don’t have access to view this content

Don’t Let Gold Lock You Out

/in Public /by Bob LoukasAlthough I had become far more optimistic recently and my stance of late had rapidly shifted towards the bullish side, I certainly wasn’t expecting a $40 surge at this point in the Cycle. But that’s gold for you, easily capable of leaving traders behind while making extreme moves. What I like most about this move is that it was not reactionary, it did not respond to a fleeting sound bite. It also did not come from an oversold position where you would expect a natural counter trend bounce. What I had warned members about last night was that gold was looking stronger, and that a move above $1,285 would be completely out of character for a final (falling) Daily Cycle. Therefore, any move above $1,285, especially on a closing basis, almost certainly would have meant that gold had already begun a new Investor (Weekly timeframe) Cycle.

What we have here is a good old honest “recognition day”, as traders suddenly realized that they needed to be on the other side of this trade. For Cycle’s followers, this more than confirms, no it essentially guarantees, that we’re now in a new Investor Cycle with potentially 12-14 weeks of upside ahead! But more importantly, it brings us that much closer to confirming my call for an end to the gold bear market back in 2013. If my longer term expectation holds, then a resumption of the gold secular bull market is already underway.

If anyone does not have any exposure to this sector or has found it difficult to buy into this surge, don’t be disheartened. As I’ve expected since the December lows, this is now likely that successful retest of the 2013 bear market lows and a resumption of the bull market is now underway. There will be plenty of opportunity to capitalize; gold still has a 45% move to eventually match all-time highs, while most precious metals miners are still 75% off their highs.

Gold Market Update

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Market Update – June 18th

/in Premium /by Bob LoukasYou don’t have access to view this content

Expectations are Brewing

/in Premium /by Bob LoukasYou don’t have access to view this content