Midweek Market Update

This content is for members only

Bob Loukas is the founder of The Financial Tap. With over 20 years of experience in market analysis and trading, Bob is a life-long student of economics and has an abiding passion for the financial markets.

He is a leading expert in Market Cycles. His love of Cycles emerged from the study of the work of Walter Bressert, a pioneer in the field.

Originally from Sydney, Australia, Bob has been settled in New York City for the past 16 years. His background is in Computer Sciences, with extensive experience in the Financial Software arena. Prior to launching The Financial Tap, Bob served as a senior executive at various Fortune 50 firms where he led development of financial trading and reporting software.

This content is for members only

This content is for members only

This content is for members only

This content is for members only

The Bollinger Bands on the S&P are as tight as I’ve ever seen and there is no doubt now that the Daily Cycle has topped. This being Day 37 (of an expected 40 day Cycle) this action is certainly part of a decline down towards a Cycle Low. But the problem (for bears) is that the S&P isn’t dropping in price! I will grant you that the chart is looking a little “toppy” here, but at the same time the bears have unsuccessfully tried to roll this market over for 17 sessions now. You will notice that from a technical and detrended price standpoint this Cycle is well and truly approaching DCL levels.

This content is for members only

This post is a small excerpt from the weekend Financial Tap member report.

Gold spent 11 sessions moving lower from the top of the Cycle, giving back 6% of the gains. Judging by the blogosphere reaction during that decline I get the impression that very few people believed in this Cycle. From what I can tell a majority expected gold to once again rollover in a steep decline. That’s just the problem with bear markets; they scar us to the point where we can’t fully embrace potential when we see it.

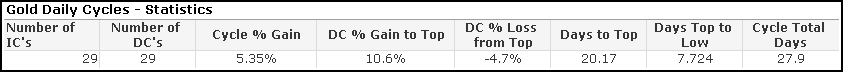

As the longs started bailing out in fear and the bears gained confidence again, gold come out with a 2 session $40 pop. In its wake gold confirmed an end to the 1st Daily Cycle that in retrospect turned out to be a bullish Cycle. From the table below we see that 1st Daily Cycles (excludes bear market Cycles) top on average after gaining 10.6% in some 20 trading days. This daily cycle gained 14.3% to a top taking just 16 days. In the end it was a bullish 1st Daily Cycle which from a timing standpoint ran the expected 27 day average.

The surge out of the Cycle low regained back half of the prior Cycle losses in just one session. By the close of Day 2 gold has regained the 10dma and closed above the declining Cycle trend-line, ending what has been a fairly textbook Cycle transition. In my opinion we’re still looking at a bullish Daily and Investor Cycle that have none of the characteristics matching the Cycles that haunted investors since last summer. What I expect now is for more follow through early next week with a quick move above $1,348 (current IC high). This next target will likely offer some resistance with a possible 2-5 session consolidation period.

The surge out of the Cycle low regained back half of the prior Cycle losses in just one session. By the close of Day 2 gold has regained the 10dma and closed above the declining Cycle trend-line, ending what has been a fairly textbook Cycle transition. In my opinion we’re still looking at a bullish Daily and Investor Cycle that have none of the characteristics matching the Cycles that haunted investors since last summer. What I expect now is for more follow through early next week with a quick move above $1,348 (current IC high). This next target will likely offer some resistance with a possible 2-5 session consolidation period.

This content is for members only

This content is for members only

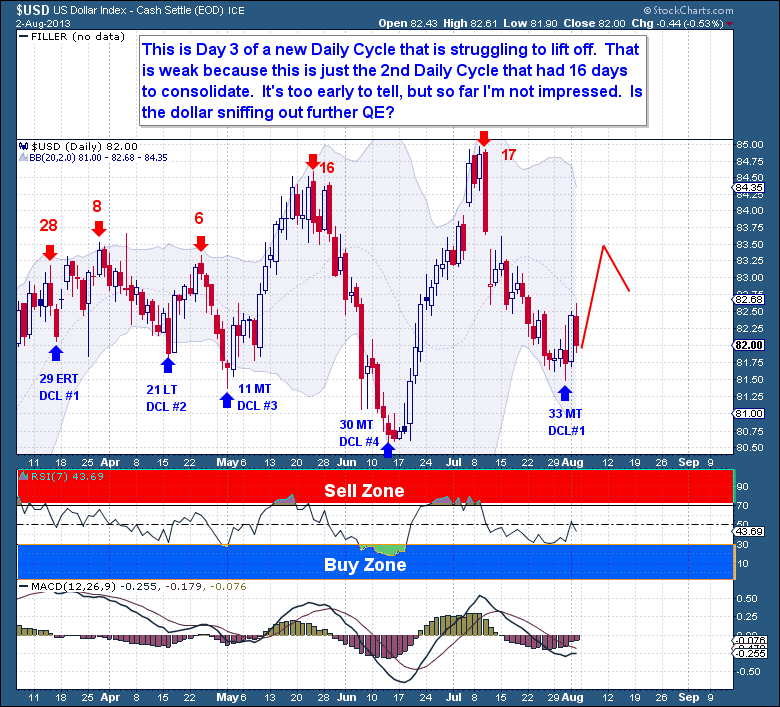

This is Day 3 of a new Daily Cycle that is struggling to lift off. Normally after a long decline and consolidation we would be looking at a much more powerful response here. Since the first Daily Cycle rallied 17 straight days to make new 3 Year Cycle highs, this 2nd Daily Cycle should be following through with more upside. It's a little early to tell, but so far I'm not impressed with the muted response.

The DCL is showing up clearly on the Weekly chart, but the 4 week drop it left behind so early in the Investor Cycle is not bullish. If the powerful start to this Investor Cycle was a true bull market move, then this recent consolidation should have formed as flag pattern and a move to new highs already in motion.

The DCL is showing up clearly on the Weekly chart, but the 4 week drop it left behind so early in the Investor Cycle is not bullish. If the powerful start to this Investor Cycle was a true bull market move, then this recent consolidation should have formed as flag pattern and a move to new highs already in motion.