The Dollar Showing Signs of a 3 Year Cycle Top

$US Dollar Cycles

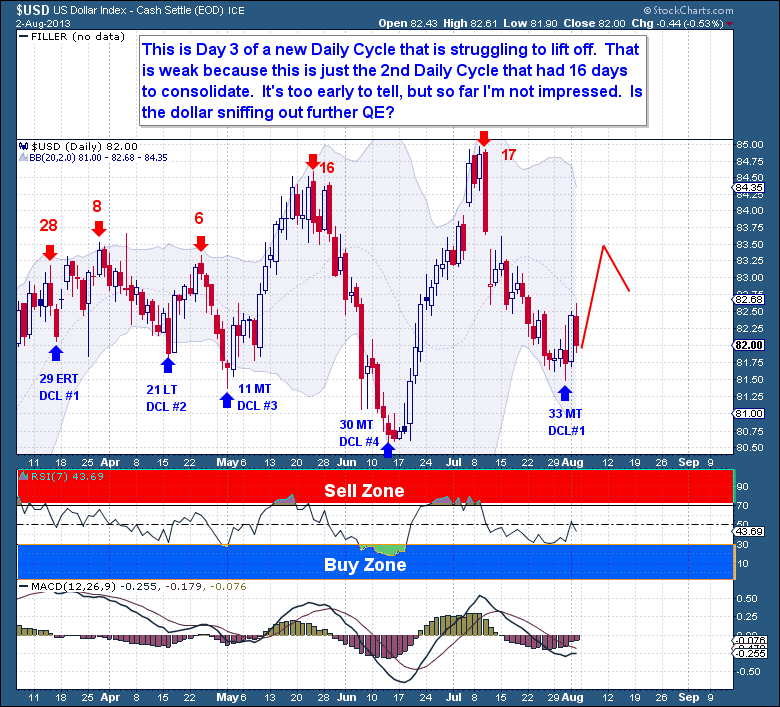

This is only Day 3 of a new Daily Cycle, but the Dollar is struggling to lift off. Normally after a long decline and consolidation we would be looking at a much more powerful response here. Since the first Daily Cycle rallied 17 straight days to make new 3 Year Cycle highs, this 2nd Daily Cycle should be following through with more upside. It's a little early to tell, but so far I'm not impressed with the muted response.

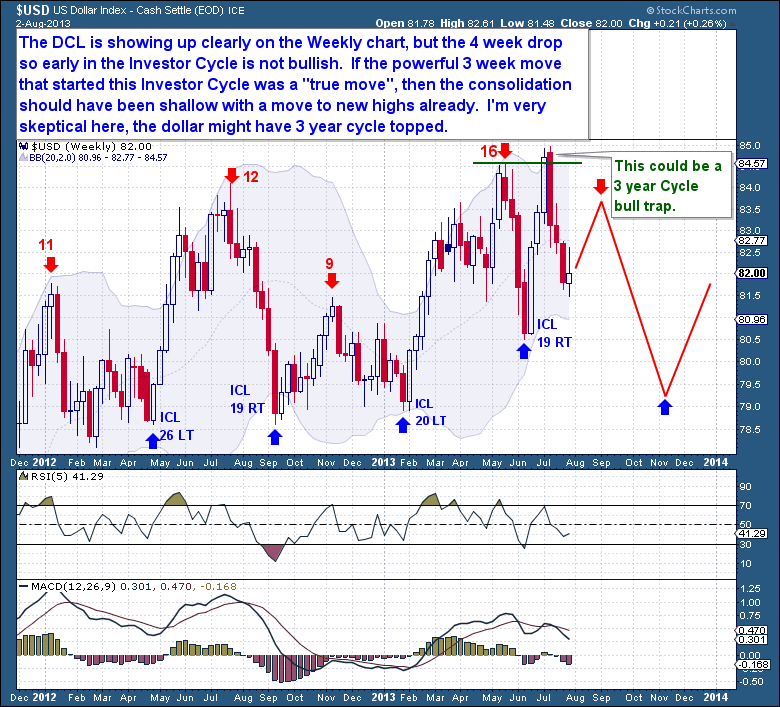

The Daily Cycle Low is showing up clearly on the Weekly chart below, but the 4 week drop it left behind so early in the Investor Cycle is not a bullish sign. If the powerful start to this Investor Cycle was a true bull market move, then this recent consolidation should have formed as flag pattern and a move to new highs already in motion.

The Daily Cycle Low is showing up clearly on the Weekly chart below, but the 4 week drop it left behind so early in the Investor Cycle is not a bullish sign. If the powerful start to this Investor Cycle was a true bull market move, then this recent consolidation should have formed as flag pattern and a move to new highs already in motion.

Instead the initial 4 week surge in June to marginal new Investor Cycle highs now exhibits signs of a bull trap. Unless this Daily Cycle gets busy putting in a similar rally as it did in the 1st Daily Cycle, then I will remain skeptical. Because the 3 Year Dollar Cycle is now well past its midpoint, we must now entertain the thought that the recent highs were also the top of the 3 Year Cycle.

We don’t have any confirmation of a pending Cycle failure, but the recent weakness here is most likely confirming that the FED is not going to be tapering anytime soon. As long as we don’t experience a crisis like event that would spike the dollar, I believe that the coming equity bear market will force the dollar down towards its own 3 Year Cycle Low. True equity bear markets normally coincide with a drop in the dollar and the dovish stance the FED will maintain during a bear market ensures the dollar will fall too.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences. If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/landing/try#

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences. If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/landing/try#