Midweek Market Update Report

This content is for members only

Bob Loukas is the founder of The Financial Tap. With over 20 years of experience in market analysis and trading, Bob is a life-long student of economics and has an abiding passion for the financial markets.

He is a leading expert in Market Cycles. His love of Cycles emerged from the study of the work of Walter Bressert, a pioneer in the field.

Originally from Sydney, Australia, Bob has been settled in New York City for the past 16 years. His background is in Computer Sciences, with extensive experience in the Financial Software arena. Prior to launching The Financial Tap, Bob served as a senior executive at various Fortune 50 firms where he led development of financial trading and reporting software.

This content is for members only

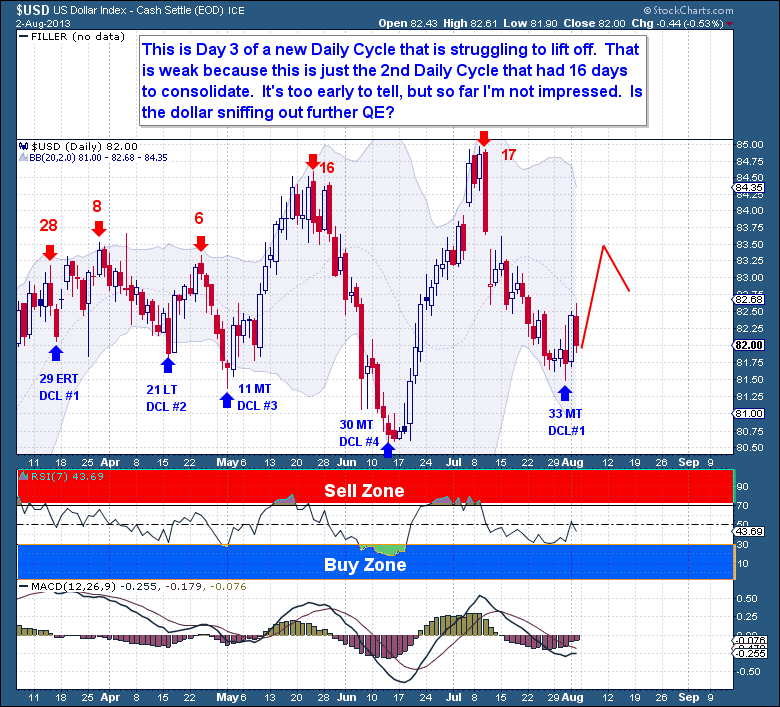

This is Day 3 of a new Daily Cycle that is struggling to lift off. Normally after a long decline and consolidation we would be looking at a much more powerful response here. Since the first Daily Cycle rallied 17 straight days to make new 3 Year Cycle highs, this 2nd Daily Cycle should be following through with more upside. It's a little early to tell, but so far I'm not impressed with the muted response.

The DCL is showing up clearly on the Weekly chart, but the 4 week drop it left behind so early in the Investor Cycle is not bullish. If the powerful start to this Investor Cycle was a true bull market move, then this recent consolidation should have formed as flag pattern and a move to new highs already in motion.

The DCL is showing up clearly on the Weekly chart, but the 4 week drop it left behind so early in the Investor Cycle is not bullish. If the powerful start to this Investor Cycle was a true bull market move, then this recent consolidation should have formed as flag pattern and a move to new highs already in motion.

This content is for members only

Yesterday’s GDP release of a 1.7% gain underscored just how lethargic the economic recovery remains. Now 4.5 years since the last recession, the fear for the FED is that the business Cycle is in the process of turning over. Forget the rhetoric that the economy is going to gain steam and start growing quicker; we’ve been hearing this same nonsense since 2010. The fact remains that the FED is keeping the economy artificially elevated and the best they can do is keep it right above stall speed.

So when we hear talk of tapering asset purchases, I really do not see how they could do this. The last time that thought gained any traction bonds sold off very quickly and this forced borrowing costs to spike. I seriously doubt the FED is going to allow the stock market to tank and interest rates to spike right when the economy looks the most vulnerable.

The FED’s message in the end was that as long as the economy remains near stall speed then asset purchases at $85 per month will continue. They say if the economy improves enough then they will begin tapering purchases, but I still see that as being years from reality. To me the new black swan event is the need for even larger asset purchases. The thought of a new round of QE is never discussed, but I believe there is a greater chance we see more QE before we see any tapering.

This content is for members only

This content is for members only

Summary

Gold appears to have wakened from what has been a very challenging 10 month decline. Ever since its failed attempt to test the all-time highs last September, it has literally been straight downhill for gold. But the signs of a trend change are everywhere, and this is evident technically in the charts and within the changing composition of the Cycles. Be warned we are due a $50 pullback this week towards a Daily Cycle Low. However beyond that, all indications point to a substantial rally about to take hold. According to my Cycles analysis, we’re looking at a 10 week gold rally back to the $1,520-50 region.

The Weekly Cycle

There are plenty of reasons to get excited here, as the early developments of this new Weekly Cycle point to a longer term trend change. Gold is now 4 good weeks into a Weekly Cycle (these Cycle average 20 weeks) which was confirmed once it broke above the declining trend-line and the Weekly Swing Low point (Above $1,301). The technical indicators show strength is building while the slow moving weekly oscillators are beginning to bullishly cross. There is no way of knowing for sure how far this Cycle will run, but the early indications are very encouraging as the Cycles on every time-frame are turning higher.

This content is for members only

This content is for members only

This content is for members only