Gold is Following Through

This post is a short excerpt from the weekend Financial Tap member report.

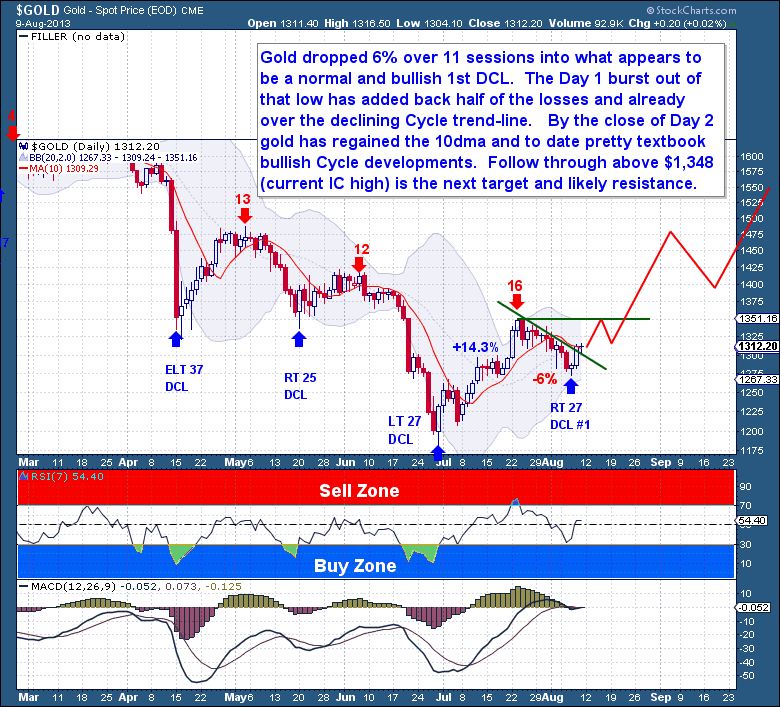

Gold spent 11 sessions moving lower from the top of the Cycle, giving back 6% of the gains. Judging by the blogosphere reaction during that decline I get the impression that very few people believed in this Cycle. From what I can tell a majority expected gold to once again rollover in a steep decline. That’s just the problem with bear markets; they scar us to the point where we can’t fully embrace potential when we see it.

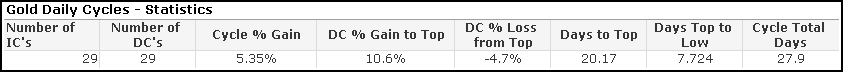

As the longs started bailing out in fear and the bears gained confidence again, gold come out with a 2 session $40 pop. In its wake gold confirmed an end to the 1st Daily Cycle that in retrospect turned out to be a bullish Cycle. From the table below we see that 1st Daily Cycles (excludes bear market Cycles) top on average after gaining 10.6% in some 20 trading days. This daily cycle gained 14.3% to a top taking just 16 days. In the end it was a bullish 1st Daily Cycle which from a timing standpoint ran the expected 27 day average.

Perfomance of Gold 1st Daily Cycles (2000-2013)

The surge out of the Cycle low regained back half of the prior Cycle losses in just one session. By the close of Day 2 gold has regained the 10dma and closed above the declining Cycle trend-line, ending what has been a fairly textbook Cycle transition. In my opinion we’re still looking at a bullish Daily and Investor Cycle that have none of the characteristics matching the Cycles that haunted investors since last summer. What I expect now is for more follow through early next week with a quick move above $1,348 (current IC high). This next target will likely offer some resistance with a possible 2-5 session consolidation period.

The surge out of the Cycle low regained back half of the prior Cycle losses in just one session. By the close of Day 2 gold has regained the 10dma and closed above the declining Cycle trend-line, ending what has been a fairly textbook Cycle transition. In my opinion we’re still looking at a bullish Daily and Investor Cycle that have none of the characteristics matching the Cycles that haunted investors since last summer. What I expect now is for more follow through early next week with a quick move above $1,348 (current IC high). This next target will likely offer some resistance with a possible 2-5 session consolidation period.

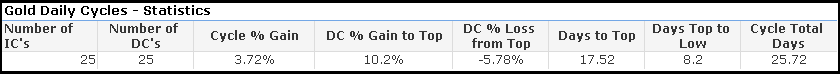

Ultimately though I believe in this gold Investor Cycle which means I’m expecting a lot from the 2nd Daily Cycle. Looking back at the prior 2nd Daily Cycles of this 13 year bull market tells me we should expect another 10%+ gain here over the next 17 sessions. An average gain puts this new Daily Cycle topping out at around the $1,400-15 area by the end of August. However if we see a similar Daily Cycle to the last one it will be topping out around $1,450.

Ultimately though I believe in this gold Investor Cycle which means I’m expecting a lot from the 2nd Daily Cycle. Looking back at the prior 2nd Daily Cycles of this 13 year bull market tells me we should expect another 10%+ gain here over the next 17 sessions. An average gain puts this new Daily Cycle topping out at around the $1,400-15 area by the end of August. However if we see a similar Daily Cycle to the last one it will be topping out around $1,450.

Perfomance of Gold 2nd Daily Cycles (2000-2013)

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences. If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/landing/try#

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences. If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/landing/try#