Daily Cycle Trader

The Daily Cycle Trader portfolio went live 3 months ago and we’ve now closed out the first quarter. It’s been a hugely successful launch to this portfolio and I wanted to share some of specific results of the portfolio with you:

Total Portfolio Return (3 months): 15.56%

Total Trades: 26

Winning Trades: 16

Winning Trade %: 61.5%

Avg Winning Trade Profit: 6.4%

Avg Losing Trade Loss: -3.1%

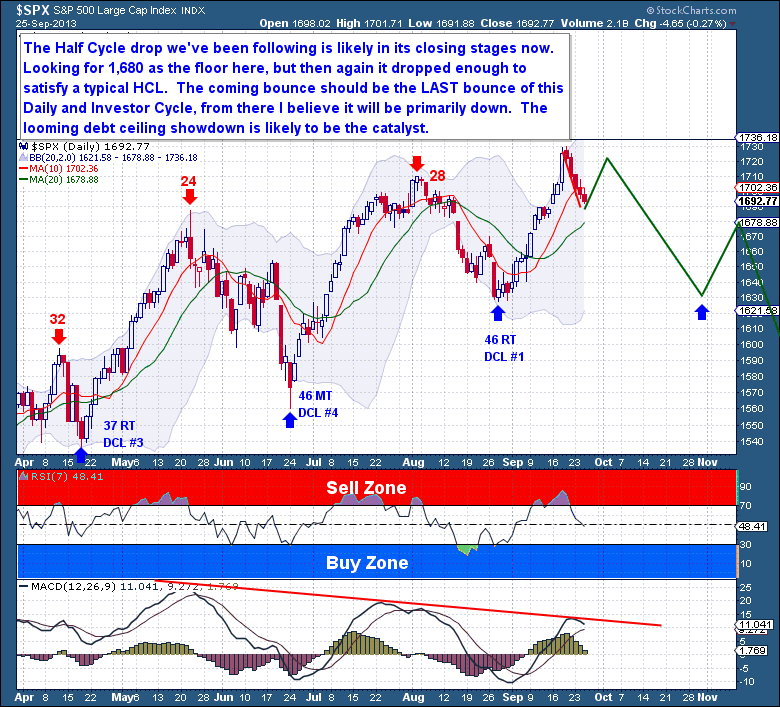

The Daily Cycle Trader portfolio is a consolidation of our shortest duration trades. With the Daily Cycle Trader, we expect to trade at Daily Cycle highs and lows. These Cycles generally occur every 18-25 days, so there will be relatively frequent trading. Daily Cycle trades will generally utilize ETFs and leveraged ETFs.

SPECIAL OFFER: If you would like to take advantage of this new Portfolio, please consider a membership; we now have Monthly, Quarterly, and Yearly options. To celebrate the launch of this new portfolio, we’re offering a $28.95 off coupon which could be used against any of the membership options. Apply it to a monthly membership, making the first month just $1. Or use it against our already discounted Quarterly and Yearly memberships.

To sign up, go to:

Use COUPON CODE: Trader (code is case sensitive). This will drop the price by $28.95.