When it comes to the Daily Cycle, especially 1st Daily Cycles from a series of up trending Investor Cycles, there is only so much downside one should expect. That’s essentially what we have in the equity markets, a long history (4 years) of 1st Daily Cycles finding the necessary bid to power out of Cycle Lows.

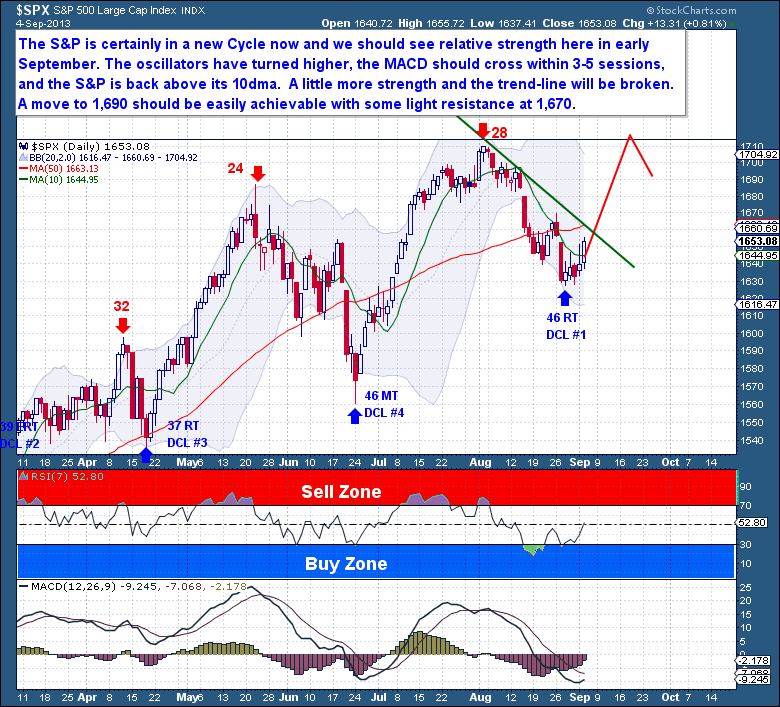

In this particular case, there is now little doubt that a new Cycle is underway. The Cycle extended out to 46 trading days (4 more than normal) and was technically a much deeper correction than one would expect. The oscillators have turned higher, the MACD should cross within 3-5 sessions, and the S&P is back above its 10dma. A little more strength and the trend-line will be broken too.

So with a new Daily Cycle we should see relative strength in early September. Although I believe one should now treat the equity markets with caution, the fact remains that the overall trend (Investor Cycles) is up and every single 1st Daily Cycle Low of this past 4 Year Cycle has gone on to make comfortable new Investor Cycle highs.

So with a new Daily Cycle we should see relative strength in early September. Although I believe one should now treat the equity markets with caution, the fact remains that the overall trend (Investor Cycles) is up and every single 1st Daily Cycle Low of this past 4 Year Cycle has gone on to make comfortable new Investor Cycle highs.

Those are some formidable odds for the bears, and I see no reason why one should go out on a limb by trading against those odds. This is why I expect a move to 1,690 should be easily achieved in the coming weeks. Beyond that a test of the all-time highs and a surge into the 1,700’s simply cannot be ruled out.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences. If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/landing/try#

Free Report – Complete the form below

Another Step Closer

/in Premium /by Bob LoukasYou don’t have access to view this content

Don’t Fight the Trend

/in Public /by Bob LoukasWhen it comes to the Daily Cycle, especially 1st Daily Cycles from a series of up trending Investor Cycles, there is only so much downside one should expect. That’s essentially what we have in the equity markets, a long history (4 years) of 1st Daily Cycles finding the necessary bid to power out of Cycle Lows.

In this particular case, there is now little doubt that a new Cycle is underway. The Cycle extended out to 46 trading days (4 more than normal) and was technically a much deeper correction than one would expect. The oscillators have turned higher, the MACD should cross within 3-5 sessions, and the S&P is back above its 10dma. A little more strength and the trend-line will be broken too.

Those are some formidable odds for the bears, and I see no reason why one should go out on a limb by trading against those odds. This is why I expect a move to 1,690 should be easily achieved in the coming weeks. Beyond that a test of the all-time highs and a surge into the 1,700’s simply cannot be ruled out.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences. If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/landing/try#

Free Report – Complete the form below

Midweek Market Update

/in Premium /by Bob LoukasYou don’t have access to view this content

Distant Rumbling

/in Premium /by Bob LoukasYou don’t have access to view this content

Buy on Cannons

/in Public /by Bob LoukasIs the Syrian rhetoric really to blame for this more than expected weakness, I highly doubt it. In fact I can barely keep a straight face thinking how ludicrous the idea that potentially striking Syria is bringing the equity markets down. The simple fact is that this is weaker than expected action for a 1st Cycle Low decline and there appears to be some significant distribution occurring in this market now. I firmly believe that the more dominant weekly and monthly Cycles are topping out here, but one should not expect the equity markets to simply roll-over. We’re still seeing a massive influx of retail and margin debt capital which will continue to sustain these markets for the immediate future.

For time being though sentiment has reached fairly extreme (negative) levels and the Cycle has stretched to 46 Days (Average is 38 to 42 days). Based on the recovery this morning and now a confirmed Daily Swing Low we have to assume that we just left behind a slightly stretched (46 days) Cycle making this just Day 1 of a new Cycle.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences. If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/landing/try#

Free Report – Complete the form below

Midweek Market Update

/in Premium /by Bob LoukasYou don’t have access to view this content

Weekend Update

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Update

/in Premium /by Bob LoukasYou don’t have access to view this content

Switching to Auto Pilot

/in Premium /by Bob LoukasYou don’t have access to view this content

Laying Out Bear Traps

/in Public /by Bob LoukasThe Bollinger Bands on the S&P are as tight as I’ve ever seen and there is no doubt now that the Daily Cycle has topped. This being Day 37 (of an expected 40 day Cycle) this action is certainly part of a decline down towards a Cycle Low. But the problem (for bears) is that the S&P isn’t dropping in price! I will grant you that the chart is looking a little “toppy” here, but at the same time the bears have unsuccessfully tried to roll this market over for 17 sessions now. You will notice that from a technical and detrended price standpoint this Cycle is well and truly approaching DCL levels.

A divergence between price and technicals here tells me that the S&P is consolidating its massive Cycle gains and is readying for the next leg higher. I don’t see a significant drop as a real possibility here simply because it’s too early in the Investor Cycle and also now fairly late in this Daily Cycle. What we’re more likely to see is a solid 1-3 day drop this week to paint a very convincing breakdown, but that would only serve to trap in the bears. The problem for the shorts is that the Daily Cycle is already deep in its count and it will not support the type of sustained move they’re expecting.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences. If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/landing/try#