It suddenly seems as though the good times in equities might be ending. Though my perspective is based only on “gut feel”, there seems to be an underlying level of fear that has crept into the markets. If so, it’s a real problem for equities. Any market trading at all-time highs and with a valuation far above historical averages requires a continued level of irrational excitement and speculative ignorance to remain sustainable. And fear is not consistent with irrational, speculative ignorance.

When equities price in Risk, it can happen quickly, and I believe the markets are in the early stages of doing just that. Though equities don’t want to believe that significant downside is possible, crashes in commodity prices and massive demand for high quality debt are harbingers of significant declines ahead. In my opinion, the early stages of an equity market decline are unfolding, and it’s only a matter of time before it erupts into a serious event.

Macroeconomic measures don’t always correlate directly with equity market performance, at least not in the immediate term. But when economic numbers begin to look as ugly as they are at present, I can assure you that an overheated and extended market will stand up and take notice. Of particular note this week are several ominous signs:

- Earning season is off to a slow start; big names are missing earnings expectations, and forward guidance is at the lowest level since 2007.

- US Q4 real GDP came in at 2.6% annualized vs 3% expected.

- Durable goods fell 3.4% month-over-month, far below expectations.

- World bond market yields are crashing, and in some cases have become negative. Negative rates extend almost to the 10 year bonds, representing an insane level of safe haven buying.

- The S&P 500 had back-to-back down months for the first time since 2012, the last time we had a major Yearly Cycle Low.

- The German economy fell 0.3%, its first negative quarter since 2009.

- Inflation rates in Europe are now negative.

- Crude oil continues to crash.

In quoting the above statistics, I’m mindful of the fact there are always both negative and positive points that an analyst can use to support a point of view. In this case, though, I honestly feel that the severity and depth of current macroeconomic developments are well outside of the norm. The extreme movements in many markets are interrelated, and seem to be a reflection of a rapidly deteriorating economic landscape.

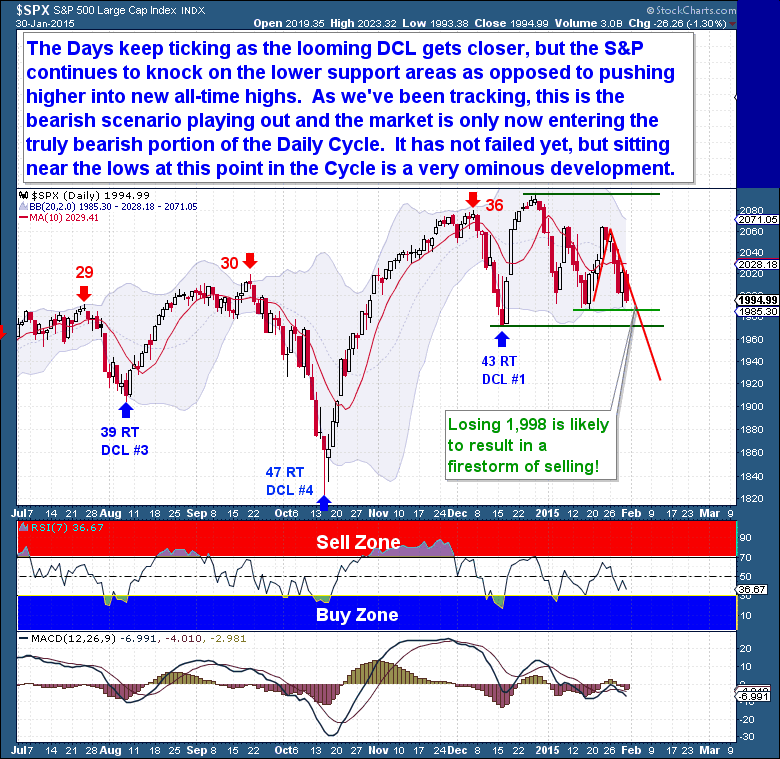

These shifts are showing up as weakness in equity markets. As days tick by, and as the Daily Cycle Low (DCL) draws closer, the S&P has continued to knock against lower support areas. Throughout the past 3 year bull advance, at this point in the Cycle the S&P has pushed higher to new all-time highs. So the current position – bumping against support – is definitely a change in character, one that is telling us that the market may be exhausted. In my opinion, it is also telling us that 2015 is going to be a difficult period for markets. The current Daily Cycle (DC) has not failed yet, but it’s sitting near the lows, and at this point, that’s a very ominous development.

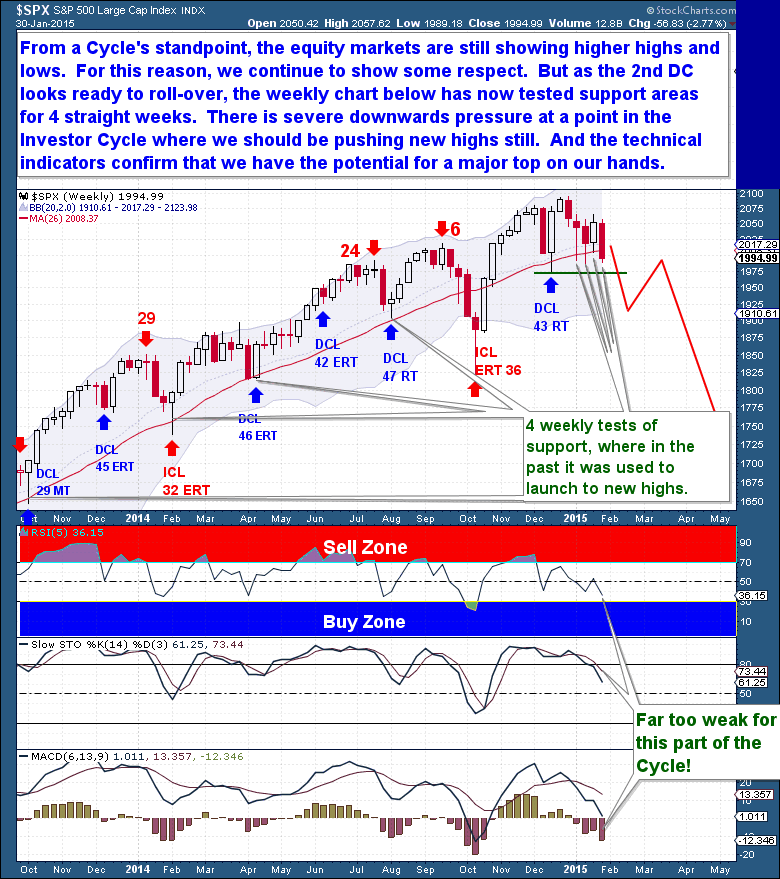

From a Cycle standpoint, the equity markets are still showing higher highs and higher lows. So, following strict Cycle discipline, I could make the argument that the bull market is alive and well. And for this reason, we are forced to show it some respect. But the most surprising development from here would be for equities to roar higher. Such a move would catch many (yet again) by surprise, but I think it’s unlikely this time.

The bull market has had its time, and the bears look like they will finally have a chance to control the action. With the 2nd DC looking ready to roll-over, and with numerous tests of the 26 week moving average in play, the market’s change in character appears ready to play out in prices.

Severe downward pressure is obviously building, and at a point in the Investor Cycle (IC) where a continuing bull market should see us pushing to new highs. The technical indicators confirm that this is an Investor Cycle in its declining phase, and it would be very rare to have the Cycle suddenly change course at this point.

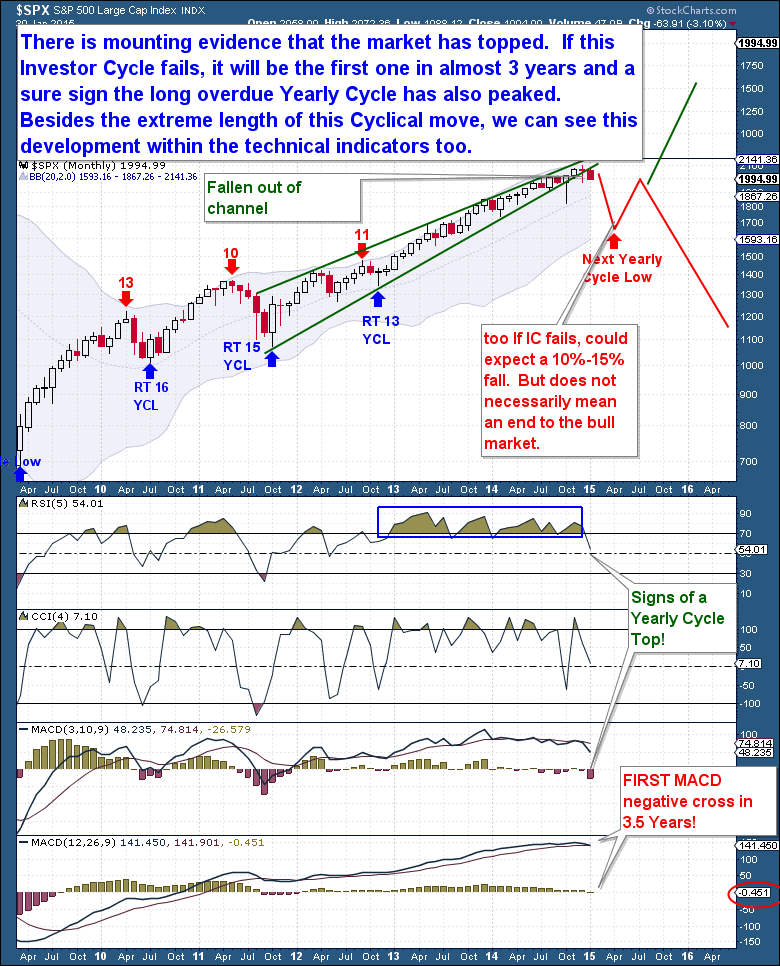

Recent developments are, perhaps, most apparent on a monthly chart. With January’s close, for the first time since the up-move began in 2011, we have a monthly candle that is entirely below the massive bull market channel. This alone is fairly strong evidence to support the idea that the market has topped.

The technical indicators paint a similar picture. The monthly RSI is showing diverging weakness, while the first negative monthly MACD cross since the 19%, 2011 decline is a serious warning sign. When we combine the negative technical indicators and macro-economic weakness with recent Daily Cycle struggles, and then consider them in the context of an overextended cyclical bull market, there’s compelling evidence that the market is on the verge of a major decline.

If the current Daily Cycle fails in the coming weeks, it will set off a domino effect of cascading Cycle failures. A DC failure would almost certainly result in an IC failure with a move below 1,816. This would be, at a minimum, a deep Yearly Cycle decline by the early spring. From there, how deep equities might fall is really anybody’s guess.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.

Midweek Market Update – Feb 4th

/in Premium /by Bob LoukasYou don’t have access to view this content

Precarious Times for Equity Markets

/in Public /by Bob LoukasIt suddenly seems as though the good times in equities might be ending. Though my perspective is based only on “gut feel”, there seems to be an underlying level of fear that has crept into the markets. If so, it’s a real problem for equities. Any market trading at all-time highs and with a valuation far above historical averages requires a continued level of irrational excitement and speculative ignorance to remain sustainable. And fear is not consistent with irrational, speculative ignorance.

When equities price in Risk, it can happen quickly, and I believe the markets are in the early stages of doing just that. Though equities don’t want to believe that significant downside is possible, crashes in commodity prices and massive demand for high quality debt are harbingers of significant declines ahead. In my opinion, the early stages of an equity market decline are unfolding, and it’s only a matter of time before it erupts into a serious event.

Macroeconomic measures don’t always correlate directly with equity market performance, at least not in the immediate term. But when economic numbers begin to look as ugly as they are at present, I can assure you that an overheated and extended market will stand up and take notice. Of particular note this week are several ominous signs:

In quoting the above statistics, I’m mindful of the fact there are always both negative and positive points that an analyst can use to support a point of view. In this case, though, I honestly feel that the severity and depth of current macroeconomic developments are well outside of the norm. The extreme movements in many markets are interrelated, and seem to be a reflection of a rapidly deteriorating economic landscape.

These shifts are showing up as weakness in equity markets. As days tick by, and as the Daily Cycle Low (DCL) draws closer, the S&P has continued to knock against lower support areas. Throughout the past 3 year bull advance, at this point in the Cycle the S&P has pushed higher to new all-time highs. So the current position – bumping against support – is definitely a change in character, one that is telling us that the market may be exhausted. In my opinion, it is also telling us that 2015 is going to be a difficult period for markets. The current Daily Cycle (DC) has not failed yet, but it’s sitting near the lows, and at this point, that’s a very ominous development.

From a Cycle standpoint, the equity markets are still showing higher highs and higher lows. So, following strict Cycle discipline, I could make the argument that the bull market is alive and well. And for this reason, we are forced to show it some respect. But the most surprising development from here would be for equities to roar higher. Such a move would catch many (yet again) by surprise, but I think it’s unlikely this time.

The bull market has had its time, and the bears look like they will finally have a chance to control the action. With the 2nd DC looking ready to roll-over, and with numerous tests of the 26 week moving average in play, the market’s change in character appears ready to play out in prices.

Severe downward pressure is obviously building, and at a point in the Investor Cycle (IC) where a continuing bull market should see us pushing to new highs. The technical indicators confirm that this is an Investor Cycle in its declining phase, and it would be very rare to have the Cycle suddenly change course at this point.

Recent developments are, perhaps, most apparent on a monthly chart. With January’s close, for the first time since the up-move began in 2011, we have a monthly candle that is entirely below the massive bull market channel. This alone is fairly strong evidence to support the idea that the market has topped.

The technical indicators paint a similar picture. The monthly RSI is showing diverging weakness, while the first negative monthly MACD cross since the 19%, 2011 decline is a serious warning sign. When we combine the negative technical indicators and macro-economic weakness with recent Daily Cycle struggles, and then consider them in the context of an overextended cyclical bull market, there’s compelling evidence that the market is on the verge of a major decline.

If the current Daily Cycle fails in the coming weeks, it will set off a domino effect of cascading Cycle failures. A DC failure would almost certainly result in an IC failure with a move below 1,816. This would be, at a minimum, a deep Yearly Cycle decline by the early spring. From there, how deep equities might fall is really anybody’s guess.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.

Markets on a Ledge

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Market Update – Jan 28th

/in Premium /by Bob LoukasYou don’t have access to view this content

Test of Strength

/in Public /by Bob LoukasAn update to the Jan 15th post “A Cycle Test for Equity Markets” https://thefinancialtap.com/public/a-cycle-test-for-equity-markets

Until the ECB announcement of €1 trillion in QE, the equity markets were struggling to maintain their upside, near-vertical trajectory. The equity market Cycles seemed to have recently changed in character, and were at serious risk of rolling over and failing. And a failure at this point in the Investor Cycle, after such a massive and speculative bull market, would open the door to a significant decline and possibly even signal that the current great bull market was finally over.

But the ECB changed the game. It stepped on to the track and cleanly took the QE baton from the FED. At €60 billion per month until September 2016, the stimulus is massive, and we can’t discount the possibility that it will drive world markets higher until then. Since similarly-sized FED QE programs were credited with driving world equity markets higher, I see no reason why the ECB’s action will have a different outcome.

But, as stated many times before, eventually fundamentals always matter. And in this case, the action by the ECB, although significant, may be too late. With bond yields across Europe dipping into negative territory, my fear is that Europe may be already locked into a powerful deflationary cycle that is impossible to exit.

This idea brings us to the current Daily Cycle, and the importance of the “test” for equities that I’ve outlined recently. I made it clear last week that, regardless of the long term Cycle implications, I expected a rally in equities. And that’s what we got. The market has risen to the 2,060 area, the most likely point for a change in long term trend to present itself. The current DC is on Day 27, but the market has yet to exceed the high set on Day 8. If the market is topping, its current position is exactly where I would expect the rally to stall and fail as price turns lower.

So, this is it! I believe the longer term trend is coming down to the action over a handful of days! If, on the back of a €1 trillion QE program, the market cannot rally 45 points to a new all-time high, there is nothing that can save it. And if the market turns lower from here, it will print a Left Translated Daily Cycle (DC), and is likely to face a terrible and rapid sell-off. As I’ve been saying for some weeks, it’s up to the bulls to prove they want to keep the current rally alive.

I believe that all the important moves will present themselves on the Daily Chart – the weekly chart (below) offers no additional insight. If we see a new all-time high in the coming weeks, it will negate the recent bearish behavior and open the possibility of another 200-300 point rally.

The weakness in the 2nd DC is evident on the weekly chart, with the market repeatedly testing the 26 week moving average support. In the past price would typically just bounce off the 26 wma and move higher, but this time the 26 wma is acting as resistance that could potentially give way. If the market fails to make new ATH’s, we will point to the current developments as evidence that the market was topping.

It should not be lost on anyone that this is the same analysis I presented in the Gold Cycle, but on the other side of the equation. The trend for equities is up, so we should expect a continuation. But as with Gold, there’s a lot of evidence that suggests that the long term trend might be changing. More importantly, we should see the potential for long term Gold and equity market trend changes as symbiotic. Equity market weakness and Gold relative strength are inextricably linked.

A Changing of the Guard

/in Premium /by Bob LoukasYou don’t have access to view this content

Draghi to Deflate Gold

/in Public /by Bob LoukasIt has been a nice run of late for gold here in the latter part of this Daily Cycle. Gold has closed above the 10 day moving average for 13 straight sessions, which is the type of bullish, Right Translated Cycle behavior we’ve been longing for. And I continue to believe that gold has found a floor here on the longer time-framed Cycle, which means that this positive action is part of a larger move that will eventually show gold has moved out of a wide, 18 month basing pattern.

But all assets move in predictable, ebb & flow patterns, across multiple time-frames. And seeing as though gold is nowhere near a parabolic state, which could negate this expectation, I see the next significant move for gold as much more likely being a quick retrace of the recent gains, leading into an expected Daily Cycle Low.

Based on my Gold Cycle count, today marked Day 21 and a natural (actually slightly past due) topping point. Gold has rarely managed to become this overbought in the past 3 years and whenever it did, gold fell almost immediately back towards a Cycle Low. Today’s intra-day reversal was telling in my opinion, leaving behind an indecision candle and the type of action I would expect around a Daily Cycle Top.

Let’s also not get too greedy or ahead of ourselves, this Cycle has after-all added $130 and is now overbought. For all these reasons, we should not be at all surprised to see a decline back below the 10dma ($1,246 and rising), over 3 to 7 sessions, to complete the Daily Cycle. Tomorrow’s ECB meeting is obviously widely anticipated and is likely to be market moving. Therefore, it will likely also be the catalyst to send gold lower into the next Cycle Low. It would after all actually be an expected, normal and healthy decline at this stage.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.

Midweek Market Update – Jan 21st 2015

/in Premium /by Bob LoukasYou don’t have access to view this content

Is This Fool’s Gold?

/in Premium /by Bob LoukasYou don’t have access to view this content

A Cycle Test for Equity Markets

/in Public /by Bob LoukasAn element of uncertainty has crept into the equity space as varying external risks are beginning to weigh on this market. The economic risks are certainly there, highlighted by an “average” FED beige book released yesterday. Retail sales were much worse too and they are a leading predictor of where the economy currently stands.

In my opinion, it’s only a matter of time before the world-wide deflationary pull and economic weakness begins to directly impact the US economy. Considering the FED has tapered all QE programs, in an interconnected and dependent world, the US economy has not healed enough to withstand this weakness, let alone continue to “carry the world” on its back.

The rush to bond markets world-wide continues to provide the evidence to support an economic slowdown/recession. Yesterday, the US 30 year bond hit the lowest yields ever recorded, yet market pundits wish to ignorantly remain quiet on its significance. The flattening of the yield curve represents smart money heading for safety before the oncoming storm.

On a day to day basis, volatility continues to increase and the intra-day swings have become much more severe and unpredictable. And the market’s character appears to be changing, in my opinion, reflecting the challenges outlined above and more resembling the action seen during past market turning points. Where the market in the past would recover the losses and rally sharply into the close, now it’s the early session rallies that are being sold into the close.

The current Cycle shows just a Day 8 high, at this point it remains a classic Left Translated topping Cycle. It will remain Left Translated, meaning it will likely fail, unless somehow the S&P can recover here and rally to make All-time highs. I expect a multi-day rally from here, because we are short-term oversold, but the Cycle picture is becoming bearish by the day now.

If the Dec 1,972 low is lost it will constitute a Daily Cycle failure and print a picture perfect Investor Cycle top. If that failure does occur, Cycles tell us (with high probability) that the S&P would have at least 8 weeks of sharply lower prices into the next Weekly Cycle Low.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.