The Right Turn

This content is for members only

Bob Loukas is the founder of The Financial Tap. With over 30 years of experience in market analysis and trading, Bob is a life-long student of economics and has an abiding passion for the financial markets.

He is a leading expert in Market Cycles. His love of Cycles emerged from the study of the work of Walter Bressert, a pioneer in the field.

This content is for members only

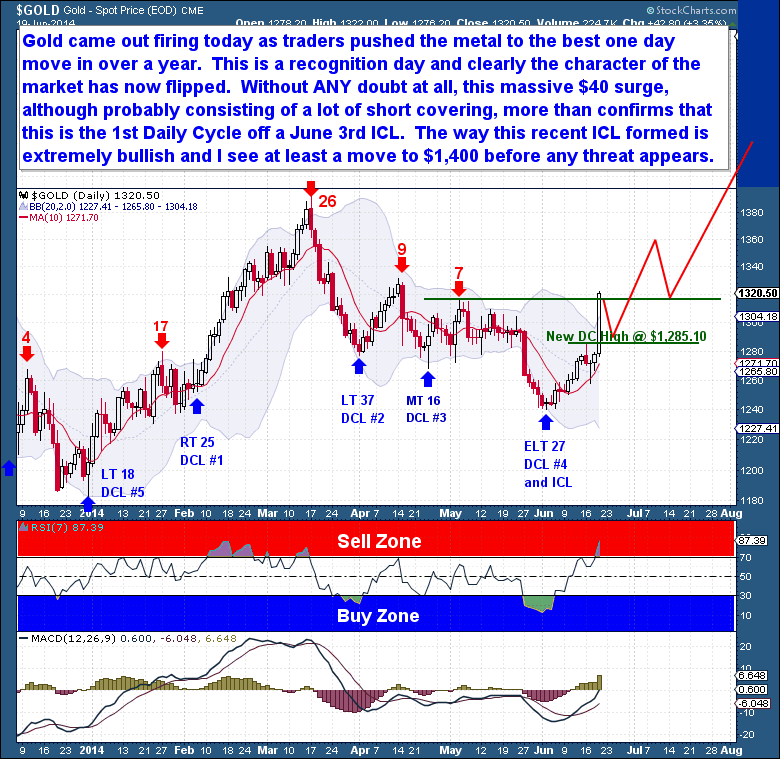

Although I had become far more optimistic recently and my stance of late had rapidly shifted towards the bullish side, I certainly wasn’t expecting a $40 surge at this point in the Cycle. But that’s gold for you, easily capable of leaving traders behind while making extreme moves. What I like most about this move is that it was not reactionary, it did not respond to a fleeting sound bite. It also did not come from an oversold position where you would expect a natural counter trend bounce. What I had warned members about last night was that gold was looking stronger, and that a move above $1,285 would be completely out of character for a final (falling) Daily Cycle. Any move above $1,285, especially on a closing basis, almost certainly meant that gold had already begun a new Investor (Weekly timeframe) Cycle.

This content is for members only

This content is for members only

This content is for members only

This content is for members only

Another week has gone by with yet another all-time high. There has been no material change in either the long term outlook for equities or in FED policy, so one can be forgiven for being dumbfounded by the relentless march higher.

However, as I’ve said often during the past 12 months, the current move cannot be quantified. This is the tail-end of one of the strongest bull markets in history, and the forces at play are far too powerful and extreme to be rationalized with traditional metrics. The current move entered into a runaway phase long ago, and the final speculative blow-off is driving non-believers absolutely insane.

By non-believers, I refer to those who fail to understand that markets are often irrational. And that during the end of large cyclical moves, assets can be divorced from underlying fundamentals and can even behave in ways that almost seem counter to them. These extreme moves are self-fulfilling and relentless, and can cause even rational observers to raise the question of whether this time may be different. As humans, we quickly forget that all things in life, and especially in financial markets, move in distinct Cycles. How else is it possible to explain the FED missing some of the largest financial storms in history?

This content is for members only

This content is for members only

This content is for members only