Is the Gold Silver Ratio Predictive

Gold Silver Ratio

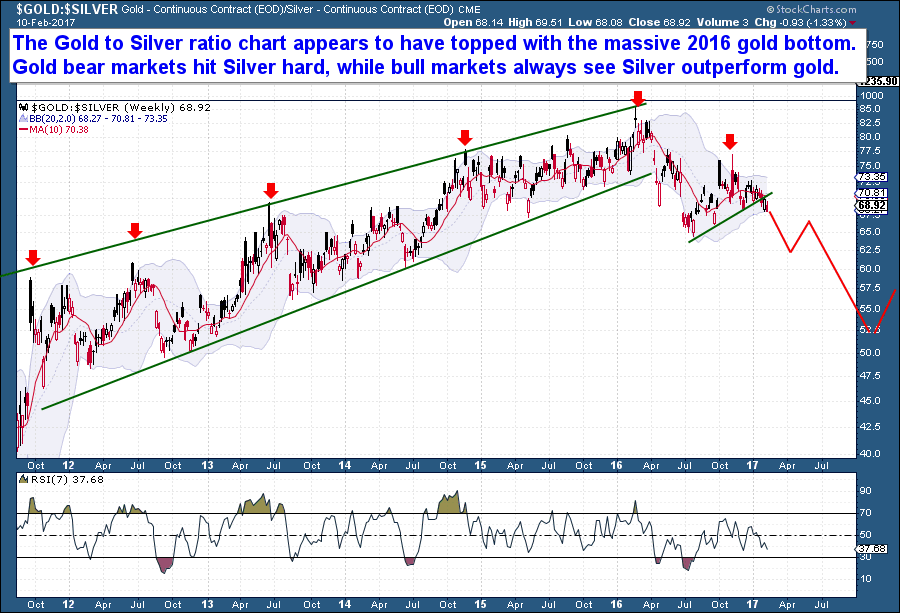

One aspect of the precious metals market today that I like is the Gold Silver Ratio. It appears to have topped, right along with the 2016 gold bottom, and for all gold bull followers out there this is certainly a welcomed development. Precious metals bear markets always hit silver hard, while bull markets always see Silver outperform gold. As a result, the Gold Silver Ratio rises during bear markets and then falls during bull markets.

On the chart below, the long rising channel represents the precious metals bear market when gold/silver were both sold aggressively. Each peak in the ratio, as seen with the red arrows, correspond with major Cycle price lows. Meaning that as gold sold and collapsed into each yearly low, Silver as a ratio was hammered further.

But that trend has reversed, and silver has for the first time in five years outperformed gold. The chart shows the Gold Silver Ratio has turned lower, meaning that with the last big gold selloff, Silver actually outperformed gold, on a relative basis. It’s not proof of a bear market low, but we do know that every precious metals bull market saw silver dramatically outperform gold. In every case, the Gold Silver ratio turn lower as the entire metals complex went higher. From my perspective, it would appear that the ratio has broken lower and that a new downtrend has been established.

The Financial Tap – Premium

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s Cycles. Along with these reports, members enjoy access to a real-time portfolio with trade alerts.

Anniversary Offer – End Soon

We have just one sale per year at The Financial Tap and it’s our anniversary sale.

In honor of our 5th year as a service, consider membership today and save a significant 20% with your purchase.

We operate a risk adverse, capital protection first strategy. Which means we significantly watch our bottom line and avoid lengthy draw-downs. Even so, we’re up almost 10% in 2017 alone.

The price of membership is just a small fraction of one’s trading account and a great way to learn proper risk management techniques and be privy to some great trade ideas along the way.