Keep It Simple

What a crazy equity market this has become. The swings are just insane. I know in this business what’s “normal” is often tough to define, with the markets fully capable of a variety of wild but still-acceptable swings. Still, I have no qualms in calling the current market “irrational”. It’s a condition often found near major market lows and highs.

It was just two weeks ago that we witnessed the largest weekly selloff in over two years. That 5% decline occurred in a single week and sent the S&P tumbling below 2,000. What followed was a pair of 2% daily gains, packaged in a 3 day rally that added an amazing 100 points. This level of volatility and price fluctuation is indicative of a market controlled by speculative forces. Equities have been divorced from fundamentals for at least 3 years, leaving the market at the mercy of speculative actors: under-performing funds, speculative traders, hedge funds, and programmed bots designed to perpetuate the trend for as long as possible.

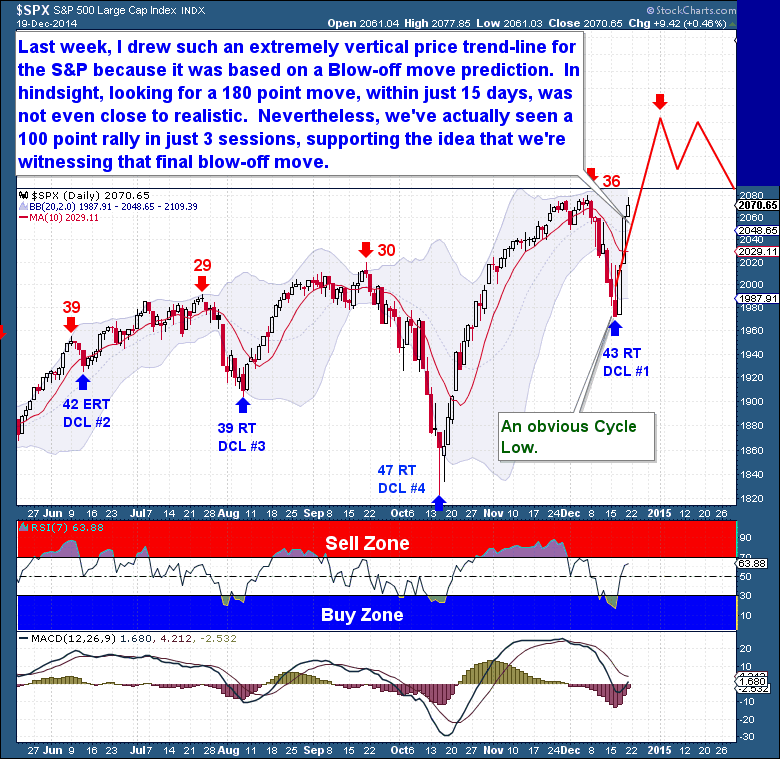

Last week, when I expected the Cycle to reverse and turn higher, I drew a projected price trend-line for the S&P that was nearly vertical. It was based on what appeared to be a blow-off move in the making. In hindsight, expecting a 180 point move, in the year’s remaining 15 days, seems unrealistic. Nevertheless, we’ve seen a 100 point rally in just 3 sessions, supporting the idea that we’re witnessing a final blow-off move.

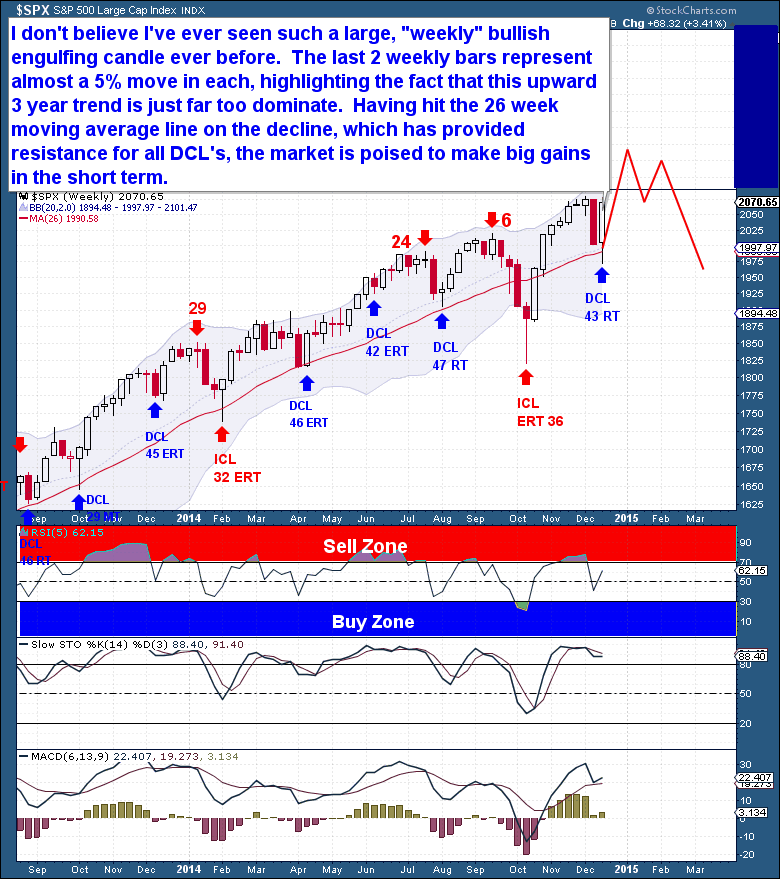

There have been a number of surprising elements to the current bull market, but I don’t believe I’ve ever before seen such a large bullish engulfing candle on the weekly chart. The last 2 weekly bars represent an almost 5% move in each direction, with this past week highlighting the dominance of the upward 3 year trend.

The 26 week (6 month) moving average has acted as solid support for the current 3 year move. Every time the S&P has tagged or moved below the 26wma during a DCL, price almost immediately bounced back to the upside. Because the S&P clearly put in a Day 43 DCL early last week, it’s in the early stages of a Daily Cycle that could potentially rally for 30 sessions. The upside potential from this point is massive. If the trend continues, the market could add another 150 points in the current DC. And if my theory of a final blow-off move is correct, the S&P could add that 150 points in a very short period of time.

The point is that all evidence points to continued upside gains. For a fundamentalist, the market at these levels is difficult to comprehend. I appreciate that people trade and invest with different objectives and on different time-frames, so if you just can’t see the market moving higher because of fundamentals, step away from trading. And in no instance should you let your bias lead you to bet against the market through a Short trade. You should either accept the market’s trend and ride with it, or acknowledge that you do not understand the market and choose to step aside. Either one is fine. But trying to bet against the market before a declining trend has been established is a very low probability trade.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.