Reminiscent of Pompeii

We’re at the point in the equity bull market Cycle that every piece of news is construed as positive for the equity markets. In many cases, the news even appears to accentuate positive possibilities. The speculative nature of the current advance has by now captured the vast majority of market participants; the media and the pundits are no exception.

For example, the markets were pushed higher last week by several news events, even though the headlines hit the same themes that have been recycled for the past 3 years, and that are almost certainly, by now, fully discounted in prices. The news events included Japan calling off next year’s planned sales tax increase, China surprising with an interest rate decrease, and the ECB announcing that they will be buying assets. These are all related to the tired narrative that central banks and related authorities can alter the natural long term pricing/valuation trajectory of the markets. The world’s equity markets soared on the announcements, and in the process completely ignored the weak fundamentals that gave rise to them. The S&P and Dow even reached new all-time highs, in general very bullish developments. But in this case, the gains were built upon the shifting sand of sound bites rather than economic fundamentals.

The economic reality behind the announcements is anything but positive. To start the week, Japan surprised the world by declaring that it has – again – entered into recession. In addition, China’s HSBC manufacturing index fell to 50, a six-month low, burdened by an extremely high level of non-performing internal debt from overbuilding. And in Europe, the economies are tottering on the brink of recession, while inflation is very close to turning negative. Even in the U.S, where the landscape is relatively better, industrial production fell 0.1% and the Markit manufacturing PMI hit a 10 month low.

It’s clear that the meddling of the world’s central banks is in response to a rapidly deteriorating world economy. And equity markets, if not the underlying economies, are responding. For now, equities are choosing to ignore the fact that the patient – the world economy – is sick, and that these policy changes are only artificial responses to symptoms, and are far from cures. Central banks may have the ability to artificially raise asset prices, but it is only temporary. The idea behind current central bank actions, that higher asset prices create a “wealth effect” that will become self-sustaining and spur economic growth, ignores two key facts: world economies are laden with high, non-performing debt, and the economies’ problems are structural in nature.

In Japan, an easy-money policy has failed for 20+ years due to a highly inefficient domestic economy. Since 2008, when foreign consumers stopped buying cheap Chinese knock-off consumer goods on credit, China has bridged the economic gap through trillions of Dollars of debt used to fuel construction projects. The debt is largely non-performing, and its creation has led to a speculative bubble in real estate as well as massive oversupply. Adding to the world’s troubles, Europe is structurally a political and regulatory nightmare, with a banking system that’s holding huge amounts of bad loans. The European banking system is woefully under-capitalized and is not in a position to extend additional credit.

These problems are structural and can’t be fixed with liquidity, so pumping additional cheap money into these economies is not a solution. Money can be created through cheap credit, but money velocity cannot. Until we see a real business cycle downturn, one in which non-performing debt is finally expunged from the system, we will never have a foundation for organic economic growth and an expansion of GDP. In short, the world needs to experience a fair amount of pain before it has the potential for real gain.

The implications for world equity markets are significant. Given the world’s poor economic fundamentals, equity markets at current levels are both artificial and unsustainable. They are far from reflecting the current economic state and, more importantly, are completely misaligned with future risks. Once the business cycle turns lower again – as it inevitably will – the market will collapse on itself and will be seen to have been hugely, woefully overpriced. The market re-pricing which occurs during these periods is always severe and generally swift. It’s the market’s mechanism for closing the imbalance between prices at the peak of speculative fever, and the market’s intrinsic value. But since pricing imbalances often work both ways, during true secular bear markets, prices (valuation) typically fall well below a market’s true value.

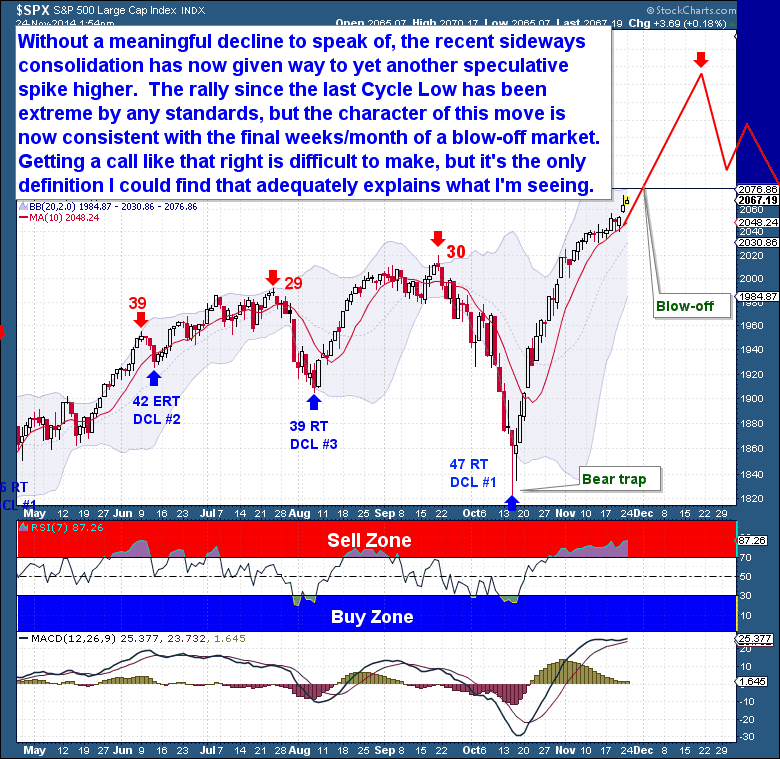

Markets are often ignorant of what lies directly ahead, and I believe that’s the case with equities today. After a relentless move higher, the recent sideways consolidation has given way to yet another speculative spike higher. The rally since the last Daily Cycle Low has been extreme by any standard, but the character of the current move is now consistent with the final weeks of a blow-off top.

Calling a top is difficult at best, and I’m much less interested in being right about a top than I am in generating grounded analysis and presenting it well to readers. In this case, it’s hard to see the current spike in equities as anything other than a blow-off move into a final top. It’s the only description for what the equity markets are doing. Blow-offs end with a final exhaustive peak, we’re not there yet. And to be perfectly honest, I’m not sure exactly when it will peak…only that it’s likely to be in the coming month. A possible clue is the length of the typical Daily Cycle, roughly 40 to 45 trading days in total. If this breathless trajectory continues, then this Cycle is likely to mark that peak. As it’s already on Day 27, that Cycle top is just another 13 to 20 sessions away, just in time for the holidays.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

View the Site: The Financial Tap

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com/landing/try#

Feel free to share this post via the below social media avenues.