Posts

Midweek Market Update – Dec 10th

/in Premium /by Bob LoukasA Time to be Sitting

/in Premium /by Bob LoukasMidweek Market Update – Dec 3rd

/in Premium /by Bob LoukasMidweek Market Update – Thanksgiving Day

/in Premium /by Bob LoukasReminiscent of Pompeii

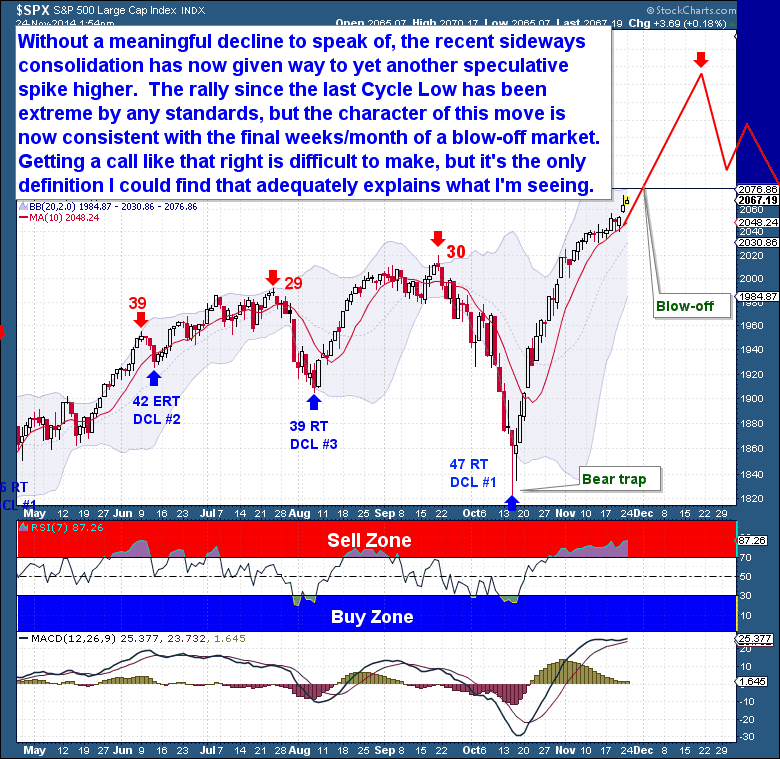

/in Public /by Bob LoukasWe’re at the point in the equity bull market Cycle that every piece of news is construed as positive for the equity markets. In many cases, the news even appears to accentuate positive possibilities. The speculative nature of the current advance has by now captured the vast majority of market participants; the media and the pundits are no exception.

For example, the markets were pushed higher last week by several news events, even though the headlines hit the same themes that have been recycled for the past 3 years, and that are almost certainly, by now, fully discounted in prices. The news events included Japan calling off next year’s planned sales tax increase, China surprising with an interest rate decrease, and the ECB announcing that they will be buying assets. These are all related to the tired narrative that central banks and related authorities can alter the natural long term pricing/valuation trajectory of the markets. The world’s equity markets soared on the announcements, and in the process completely ignored the weak fundamentals that gave rise to them. The S&P and Dow even reached new all-time highs, in general very bullish developments. But in this case, the gains were built upon the shifting sand of sound bites rather than economic fundamentals.

The economic reality behind the announcements is anything but positive. To start the week, Japan surprised the world by declaring that it has – again – entered into recession. In addition, China’s HSBC manufacturing index fell to 50, a six-month low, burdened by an extremely high level of non-performing internal debt from overbuilding. And in Europe, the economies are tottering on the brink of recession, while inflation is very close to turning negative. Even in the U.S, where the landscape is relatively better, industrial production fell 0.1% and the Markit manufacturing PMI hit a 10 month low.

It’s clear that the meddling of the world’s central banks is in response to a rapidly deteriorating world economy. And equity markets, if not the underlying economies, are responding. For now, equities are choosing to ignore the fact that the patient – the world economy – is sick, and that these policy changes are only artificial responses to symptoms, and are far from cures. Central banks may have the ability to artificially raise asset prices, but it is only temporary. The idea behind current central bank actions, that higher asset prices create a “wealth effect” that will become self-sustaining and spur economic growth, ignores two key facts: world economies are laden with high, non-performing debt, and the economies’ problems are structural in nature.

In Japan, an easy-money policy has failed for 20+ years due to a highly inefficient domestic economy. Since 2008, when foreign consumers stopped buying cheap Chinese knock-off consumer goods on credit, China has bridged the economic gap through trillions of Dollars of debt used to fuel construction projects. The debt is largely non-performing, and its creation has led to a speculative bubble in real estate as well as massive oversupply. Adding to the world’s troubles, Europe is structurally a political and regulatory nightmare, with a banking system that’s holding huge amounts of bad loans. The European banking system is woefully under-capitalized and is not in a position to extend additional credit.

These problems are structural and can’t be fixed with liquidity, so pumping additional cheap money into these economies is not a solution. Money can be created through cheap credit, but money velocity cannot. Until we see a real business cycle downturn, one in which non-performing debt is finally expunged from the system, we will never have a foundation for organic economic growth and an expansion of GDP. In short, the world needs to experience a fair amount of pain before it has the potential for real gain.

The implications for world equity markets are significant. Given the world’s poor economic fundamentals, equity markets at current levels are both artificial and unsustainable. They are far from reflecting the current economic state and, more importantly, are completely misaligned with future risks. Once the business cycle turns lower again – as it inevitably will – the market will collapse on itself and will be seen to have been hugely, woefully overpriced. The market re-pricing which occurs during these periods is always severe and generally swift. It’s the market’s mechanism for closing the imbalance between prices at the peak of speculative fever, and the market’s intrinsic value. But since pricing imbalances often work both ways, during true secular bear markets, prices (valuation) typically fall well below a market’s true value.

Markets are often ignorant of what lies directly ahead, and I believe that’s the case with equities today. After a relentless move higher, the recent sideways consolidation has given way to yet another speculative spike higher. The rally since the last Daily Cycle Low has been extreme by any standard, but the character of the current move is now consistent with the final weeks of a blow-off top.

Calling a top is difficult at best, and I’m much less interested in being right about a top than I am in generating grounded analysis and presenting it well to readers. In this case, it’s hard to see the current spike in equities as anything other than a blow-off move into a final top. It’s the only description for what the equity markets are doing. Blow-offs end with a final exhaustive peak, we’re not there yet. And to be perfectly honest, I’m not sure exactly when it will peak…only that it’s likely to be in the coming month. A possible clue is the length of the typical Daily Cycle, roughly 40 to 45 trading days in total. If this breathless trajectory continues, then this Cycle is likely to mark that peak. As it’s already on Day 27, that Cycle top is just another 13 to 20 sessions away, just in time for the holidays.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

View the Site: The Financial Tap

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com/landing/try#

Feel free to share this post via the below social media avenues.

Roll the Dice

/in Premium /by Bob LoukasMidweek Market Update – Nov 19th

/in Premium /by Bob LoukasHas the Trap Been Set

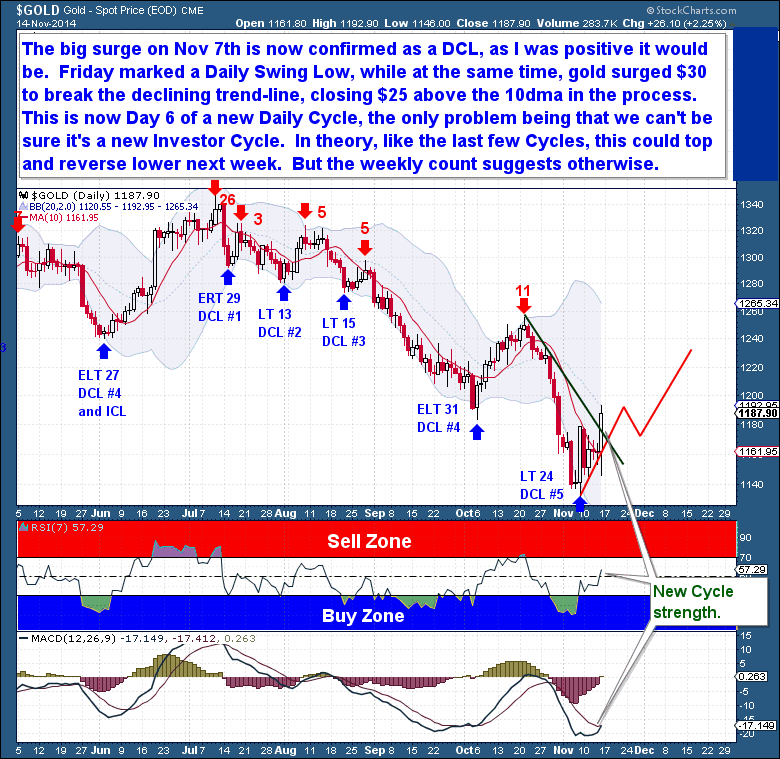

/in Public /by Bob LoukasWe finally have some movement within the gold complex, and for a welcomed change, it’s to the upside. It has been dicey lately, as the back and forth daily swings have been unnerving. It’s not common within bear markets to see an asset form a Cycle Low and then just take off to the upside. This is why anyone trading the precious metals sector needs to understand that the Long traders carry with them a lot of anxiety. Past experiences have them guarded, which is why we see these frequent quick intra-day reversals…they’re spooked far too easily.

Fortunately, we are into the timing band for these big Cycle Low events now. Within this report, I bolster the idea that we’re seeing evidence to support these lows as having pasted already. Shifting the main question now away from whether we have new Cycle’s in play over to a discussion on what these Cycles could potentially bring.

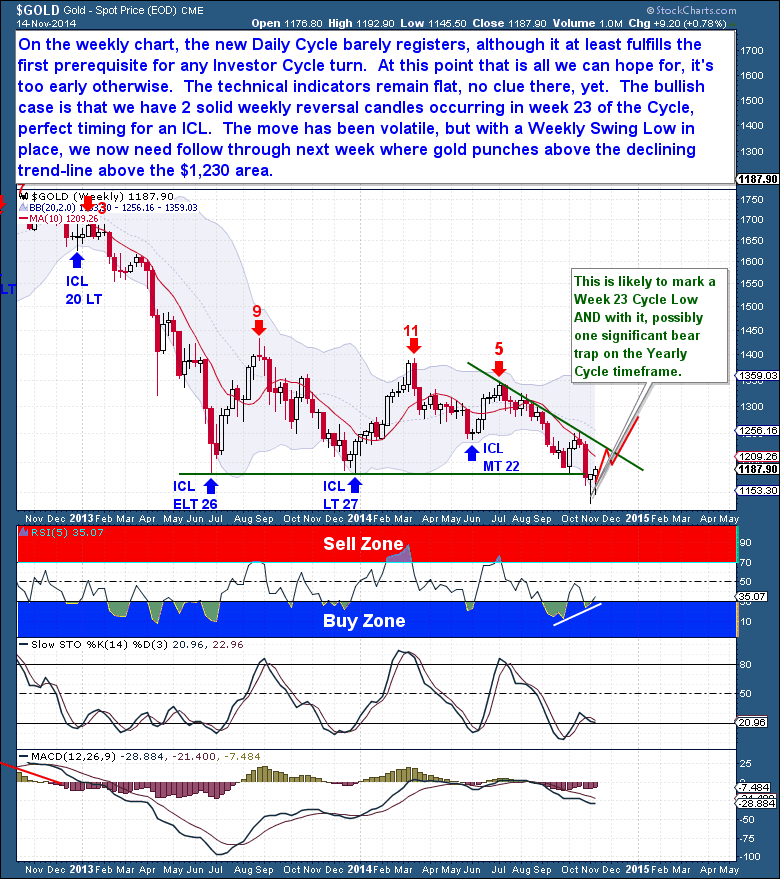

Almost since the day it occurred, I have expected the big surge back on Nov 7th to be marked as a Daily Cycle Low (DCL). And with Friday’s repeat (upside) performance of the prior Friday, the $30 move finally marked a Daily Swing Low and a clean break of the declining trend-line. Along with the clear and bullish rise in our technical indicators, it’s safe to say that gold is into a new Daily Cycle.

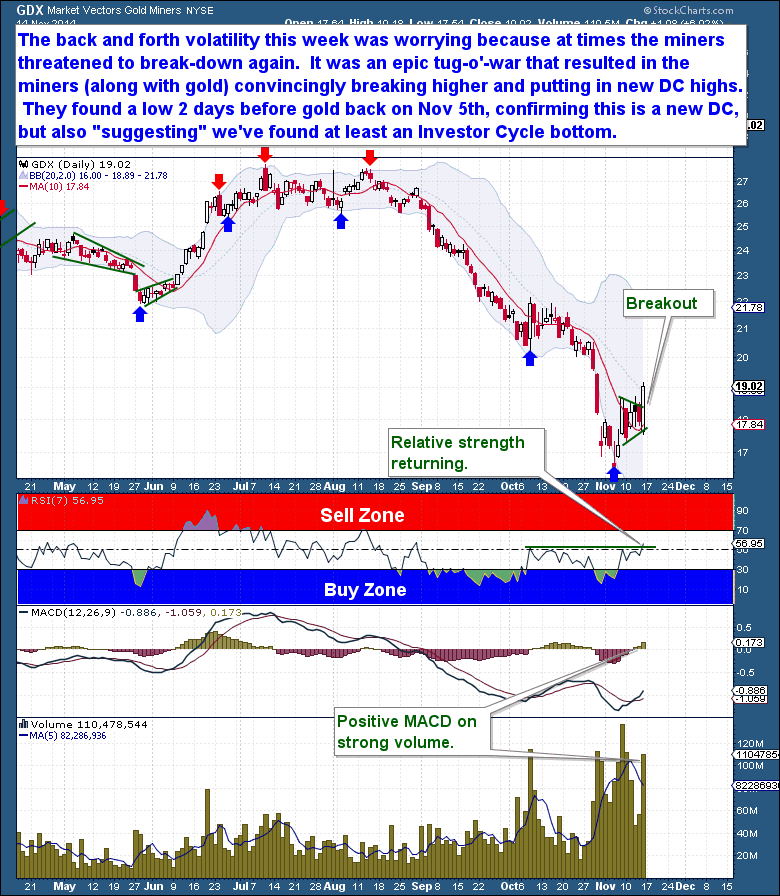

The miners are confirming this gold move and are encouragingly leading the Cycle again. The back and forth volatility this past week was worrying; in the sense they were showing us a potential gold decline was at hand. The mini triangle pattern, resulting from all this volatility did eventually resolve itself, with the miners convincingly breaking higher as confirmation gold was in a new Daily Cycle.

I’m encouraged by the action within the miners because back on Nov 5th they did find a low 2 days before gold did. The sell-off they experienced, leading into that low, was of the extreme capitulation variety seen only during major (Yearly and Cyclical) Cycle turns. And because we’re in the timing band for a gold Investor and Yearly Cycle Low, this early recovery off a 40% “crash” is suggesting that we have found, in the least, an Investor Cycle bottom.

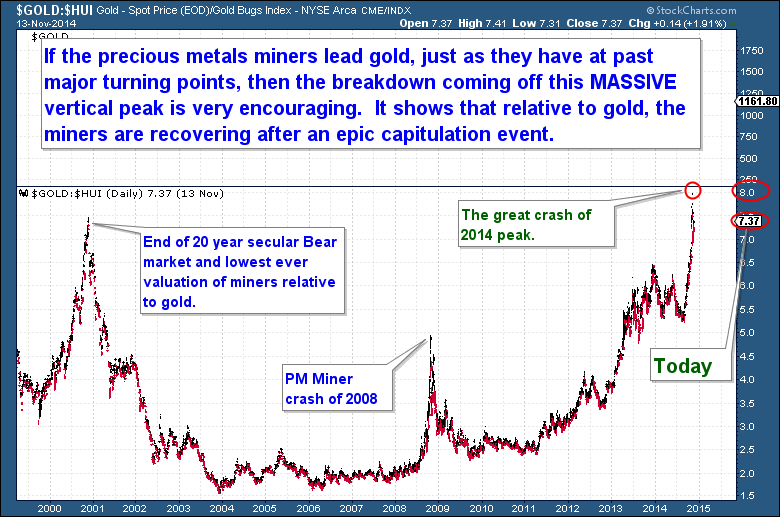

I presented the below gold to miners ratio chart a few weeks ago (members site) as a way to represent just how much the miners had been sold relative to gold. I find this chart important, not because it necessarily predicts where gold is heading, but that during major declines, the miners are sold-off indiscriminately and with extreme prejudice.

It is clear from the chart that relative to gold, the miners became the most undervalued in over 20 years. Having already decline some 65% up until this past summer, the miners since crash another 40% within the past 8 weeks, a classic capitulation event that I can only equate to events on (or bigger than) the scale seen during the 2000 and 2008 bear market lows. I’m showing the chart again because the reversal shown by the miners this week holds promise of a much bigger turn. In all past cases, reversals on the ratio chart after massive vertical peak have always marked at least a Yearly Cycle Low.

So we have rock solid action to support a new Daily Cycle. But on the weekly chart, that new Daily Cycle barely registers, except that it shows up as a pair of bullish hammer candles comfortably into the timing band for a Cycle Low. Although we can project our expectations, based on this ancillary evidence, the reality is that it just takes patience when waiting for actual confirmation of a new Investor Cycle.

At this point, seeing a new Daily Cycle is encouraging, because it holds the promise of marking a Cycle Low at the longer time-frames too. A DCL is after-all a prerequisite for any new Investor and Yearly Cycle Low, they are intertwined. Although the move so far has been (intra-day) volatile, gold has managed to close out the week with a Weekly Swing Low in place. The foundation stones have been laid.

What I like about this move is that nobody expects it to do much or go far. A long and punishing bear market has set the scene for a much larger counter-trend rally here. Yes, obviously caution is recommended, a bear market surprises to the downside with uncanny and unforgiving consistency.

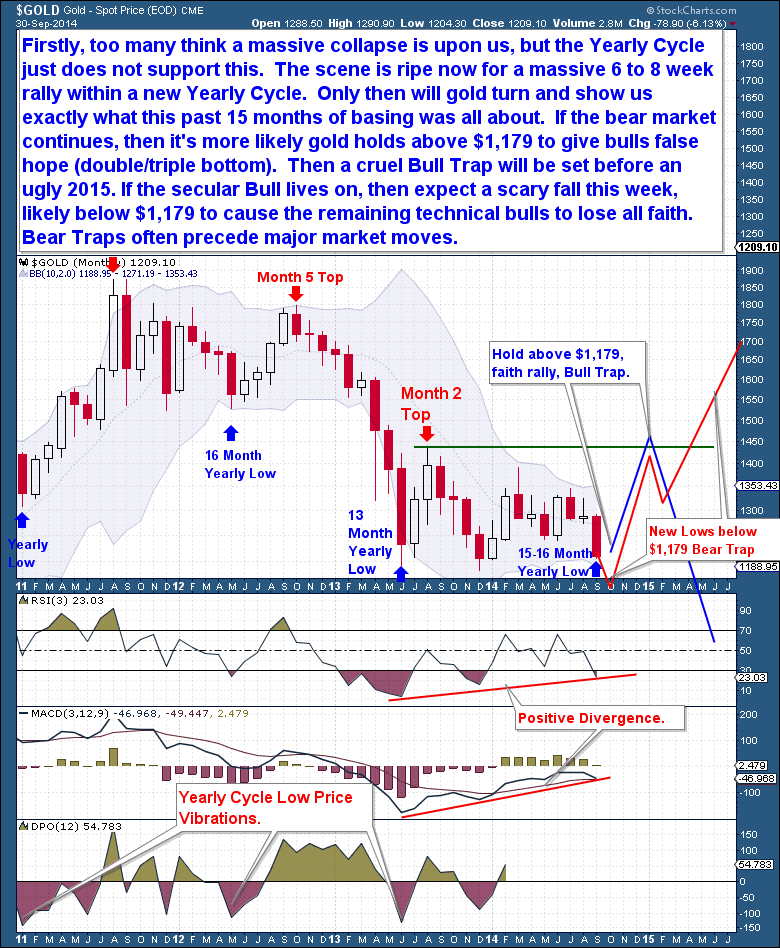

But I like the setup, because it’s exactly the type of contrarian environment that should support a powerful counter-trend rally. I particularly like the fact that gold dropped below the June 2013 lows, that technical break-down automatically turned a large percentage of technical traders against the sector. In past reports, over a month ago (see chart below from public post “Gold Will Surprise in More Ways Than One“, I had stated that losing the June 2013 Lows was potentially the more bullish scenario, because that development offered up the potential for a significant bear trap. I have found that many bear markets end on such technical break-downs, as the break-down encourages so many more speculators to join the foray on the short side. It’s akin to that final vertical spike in a bull market.

“Bear traps often proceed major market moves” – Early Oct chart.

As a result of seeing fresh 4 year lows, the COT report shows that a significant gold short position has amassed. We’re at the level (near record) where Cycle Lows form, mainly because the position again gold is such that little further upside will set off a massive short squeeze. I always try to end with a balanced viewpoint, which is why I will remind everyone that the bear market demands respect. But it’s been all down for so long and it’s time for the Cycle to reverse. Form what I can tell, a new Investor and Yearly Cycle rally is now in progress, this outlook I favor with much more confidence this week.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

View the Site: The Financial Tap

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com/landing/try#

Feel free to share this post via the below social media avenues.