Not a Gold Bull in Sight

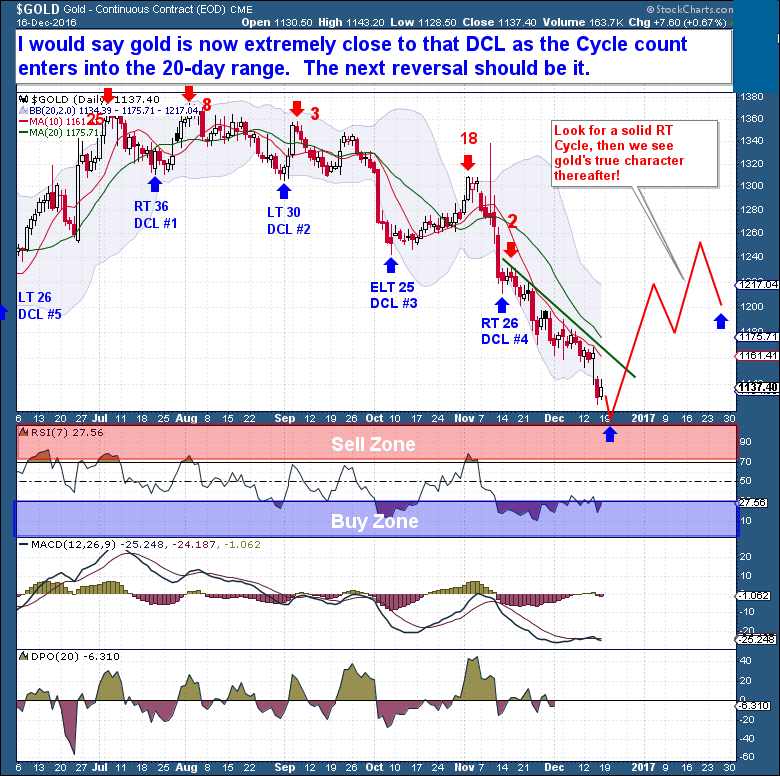

In last weekend’s report, we covered how the Daily Cycle count was stretching too far, so marking a Nov 15th Daily Cycle Low (DCL) made sense. Doing so means that another DC began on Nov 16, and that puts today’s date in the normal timing band for a new DCL. So with another DCL fast approaching, the capitulation decline we saw this week fits perfectly with expectations.

The large drops in Silver and the Miners are strong indications that the final capitulation for the current Daily and Investor Cycles is at hand.

(Keep in mind this is an except from a premium report published over the past weekend. Prices on charts reflect Friday’s close)

An outlook is not an absolute call, so until Gold bottoms we’ll be dealing in probabilities. I’m highlighting the most likely outcome to enable consideration of the risk/reward profiles on potential trades. So, while I expect that a major low in Gold is imminent, traders should still be cautious. I cannot stress enough that traders must be both realistic and patient as they consider possible market moves. And they need to understand that trading with a good probability of success does not guarantee that they will be correct.

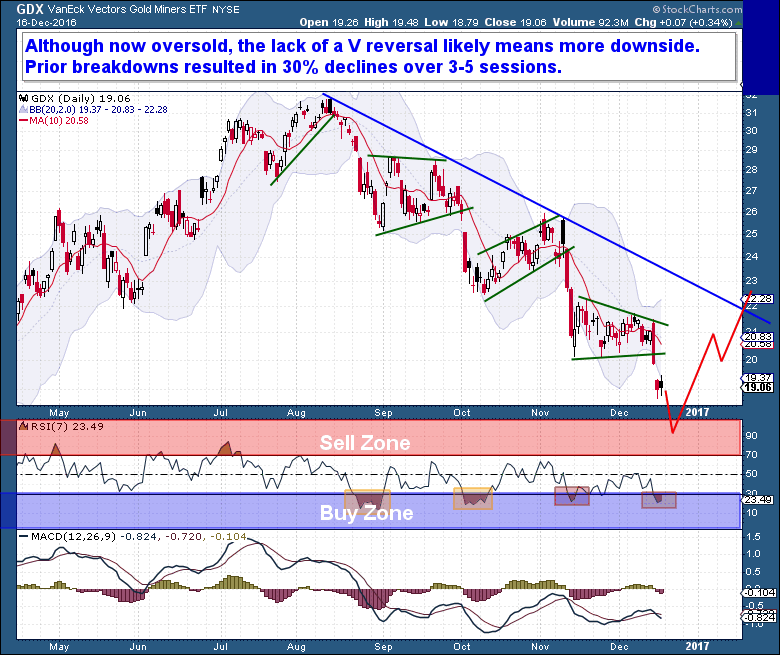

Turning to the Miners, the lack of a sharp “V” bounce after Thursday’s low suggests that more downside is ahead. The 20+ day triangle bear pattern cracked to the downside on Wednesday, and this type of decline typically runs for 3 to 5 sessions, so we should be close to the DCL/ICL. Another weak open next week should give way to a solid reversal higher.

But remember – the tail-end of any Cycle can be extremely dangerous. Too many traders fear missing the early part of the next rally and are burned by the declines that come with a final washout decline. The last week of any Cycle is typically the most volatile, and provides the largest price change, so I’d urge extreme caution with Gold.

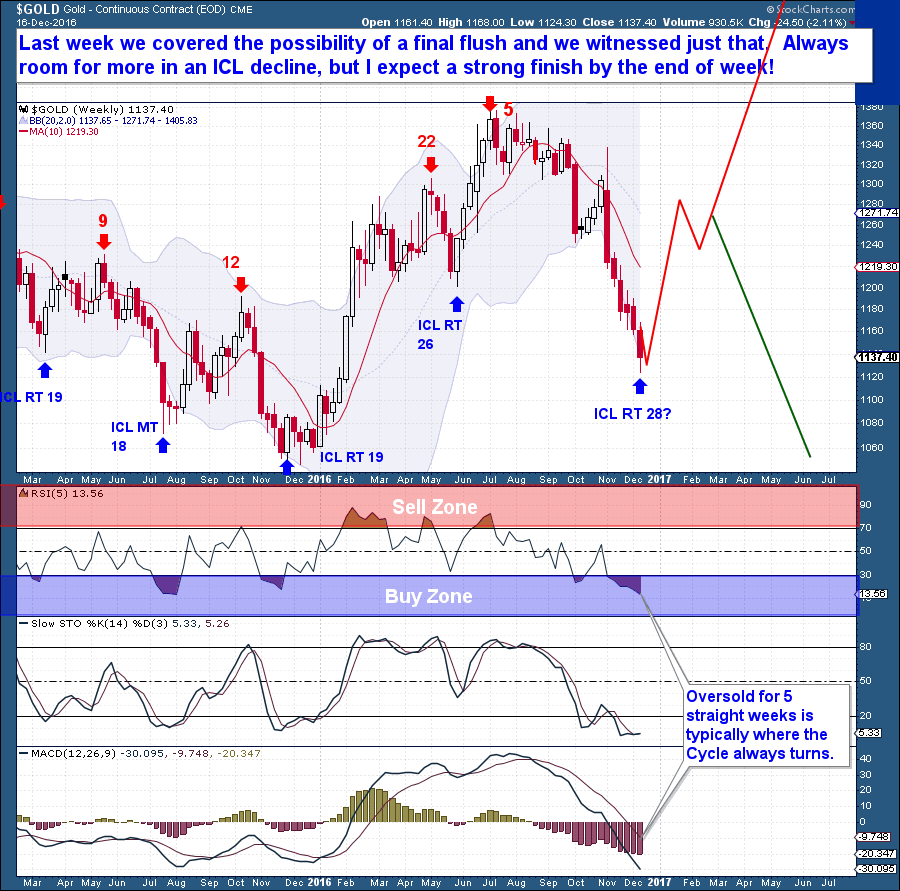

That said, we covered the possibility of a final flush lower last week, and that’s what has come to pass. While we can never rule out further declines, I believe that the end of the coming week will see Gold moving higher in a new Investor Cycle!

The Financial Tap – Premium

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s Cycles. Along with these reports, members enjoy access to a real-time portfolio with trade alerts.

NOTE: It’s just $99 for a full 3 months of membership, a fraction of what one stopped out trade is likely to cost you. Consider joining The Financial Tap and receive two reports per week and the education you need to become a better trader or investor See >> SIGN UP PAGE!

.

.

Bob.

.

Not a Gold Bull in Sight

/in Public /by Bob LoukasNot a Gold Bull in Sight

In last weekend’s report, we covered how the Daily Cycle count was stretching too far, so marking a Nov 15th Daily Cycle Low (DCL) made sense. Doing so means that another DC began on Nov 16, and that puts today’s date in the normal timing band for a new DCL. So with another DCL fast approaching, the capitulation decline we saw this week fits perfectly with expectations.

The large drops in Silver and the Miners are strong indications that the final capitulation for the current Daily and Investor Cycles is at hand.

(Keep in mind this is an except from a premium report published over the past weekend. Prices on charts reflect Friday’s close)

An outlook is not an absolute call, so until Gold bottoms we’ll be dealing in probabilities. I’m highlighting the most likely outcome to enable consideration of the risk/reward profiles on potential trades. So, while I expect that a major low in Gold is imminent, traders should still be cautious. I cannot stress enough that traders must be both realistic and patient as they consider possible market moves. And they need to understand that trading with a good probability of success does not guarantee that they will be correct.

Turning to the Miners, the lack of a sharp “V” bounce after Thursday’s low suggests that more downside is ahead. The 20+ day triangle bear pattern cracked to the downside on Wednesday, and this type of decline typically runs for 3 to 5 sessions, so we should be close to the DCL/ICL. Another weak open next week should give way to a solid reversal higher.

But remember – the tail-end of any Cycle can be extremely dangerous. Too many traders fear missing the early part of the next rally and are burned by the declines that come with a final washout decline. The last week of any Cycle is typically the most volatile, and provides the largest price change, so I’d urge extreme caution with Gold.

That said, we covered the possibility of a final flush lower last week, and that’s what has come to pass. While we can never rule out further declines, I believe that the end of the coming week will see Gold moving higher in a new Investor Cycle!

The Financial Tap – Premium

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s Cycles. Along with these reports, members enjoy access to a real-time portfolio with trade alerts.

NOTE: It’s just $99 for a full 3 months of membership, a fraction of what one stopped out trade is likely to cost you. Consider joining The Financial Tap and receive two reports per week and the education you need to become a better trader or investor See >> SIGN UP PAGE!

.

.

Bob.

.

Don’t Believe the Hype

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Cycles Update – Dec 14th

/in Premium /by Bob LoukasYou don’t have access to view this content

Approaching the Extremes

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Cycles Update – Dec 7th

/in Premium /by Bob LoukasYou don’t have access to view this content

The Unwind

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Cycle’s Update – Nov 30th

/in Premium /by Bob LoukasYou don’t have access to view this content

A Break or a Trap

/in Premium /by Bob LoukasYou don’t have access to view this content

All is not what it seems

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Update – Nov 16th

/in Premium /by Bob LoukasYou don’t have access to view this content