It suddenly seems as though the good times in equities might be ending. Though my perspective is based only on “gut feel”, there seems to be an underlying level of fear that has crept into the markets. If so, it’s a real problem for equities. Any market trading at all-time highs and with a valuation far above historical averages requires a continued level of irrational excitement and speculative ignorance to remain sustainable. And fear is not consistent with irrational, speculative ignorance.

When equities price in Risk, it can happen quickly, and I believe the markets are in the early stages of doing just that. Though equities don’t want to believe that significant downside is possible, crashes in commodity prices and massive demand for high quality debt are harbingers of significant declines ahead. In my opinion, the early stages of an equity market decline are unfolding, and it’s only a matter of time before it erupts into a serious event.

Macroeconomic measures don’t always correlate directly with equity market performance, at least not in the immediate term. But when economic numbers begin to look as ugly as they are at present, I can assure you that an overheated and extended market will stand up and take notice. Of particular note this week are several ominous signs:

- Earning season is off to a slow start; big names are missing earnings expectations, and forward guidance is at the lowest level since 2007.

- US Q4 real GDP came in at 2.6% annualized vs 3% expected.

- Durable goods fell 3.4% month-over-month, far below expectations.

- World bond market yields are crashing, and in some cases have become negative. Negative rates extend almost to the 10 year bonds, representing an insane level of safe haven buying.

- The S&P 500 had back-to-back down months for the first time since 2012, the last time we had a major Yearly Cycle Low.

- The German economy fell 0.3%, its first negative quarter since 2009.

- Inflation rates in Europe are now negative.

- Crude oil continues to crash.

In quoting the above statistics, I’m mindful of the fact there are always both negative and positive points that an analyst can use to support a point of view. In this case, though, I honestly feel that the severity and depth of current macroeconomic developments are well outside of the norm. The extreme movements in many markets are interrelated, and seem to be a reflection of a rapidly deteriorating economic landscape.

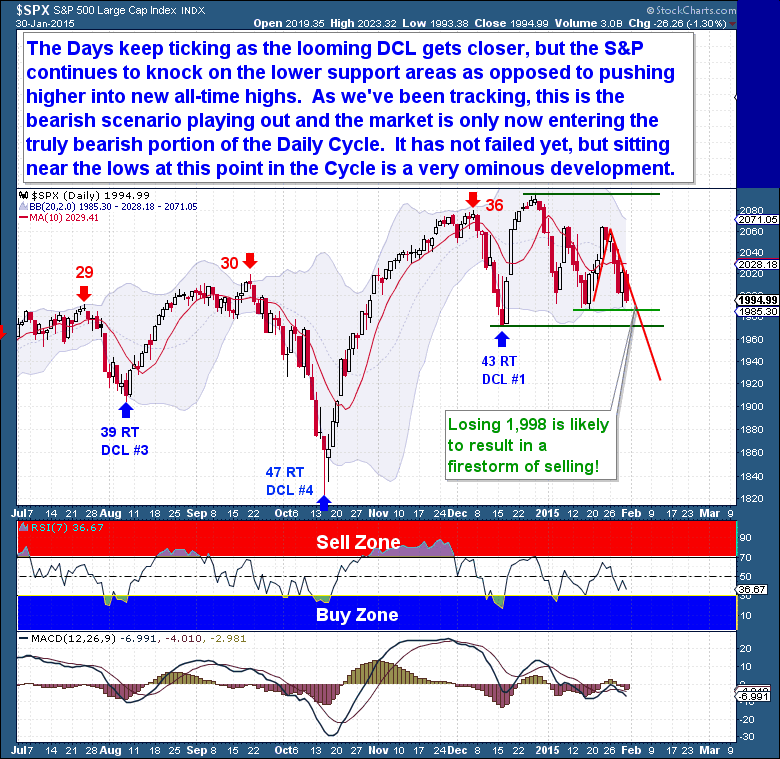

These shifts are showing up as weakness in equity markets. As days tick by, and as the Daily Cycle Low (DCL) draws closer, the S&P has continued to knock against lower support areas. Throughout the past 3 year bull advance, at this point in the Cycle the S&P has pushed higher to new all-time highs. So the current position – bumping against support – is definitely a change in character, one that is telling us that the market may be exhausted. In my opinion, it is also telling us that 2015 is going to be a difficult period for markets. The current Daily Cycle (DC) has not failed yet, but it’s sitting near the lows, and at this point, that’s a very ominous development.

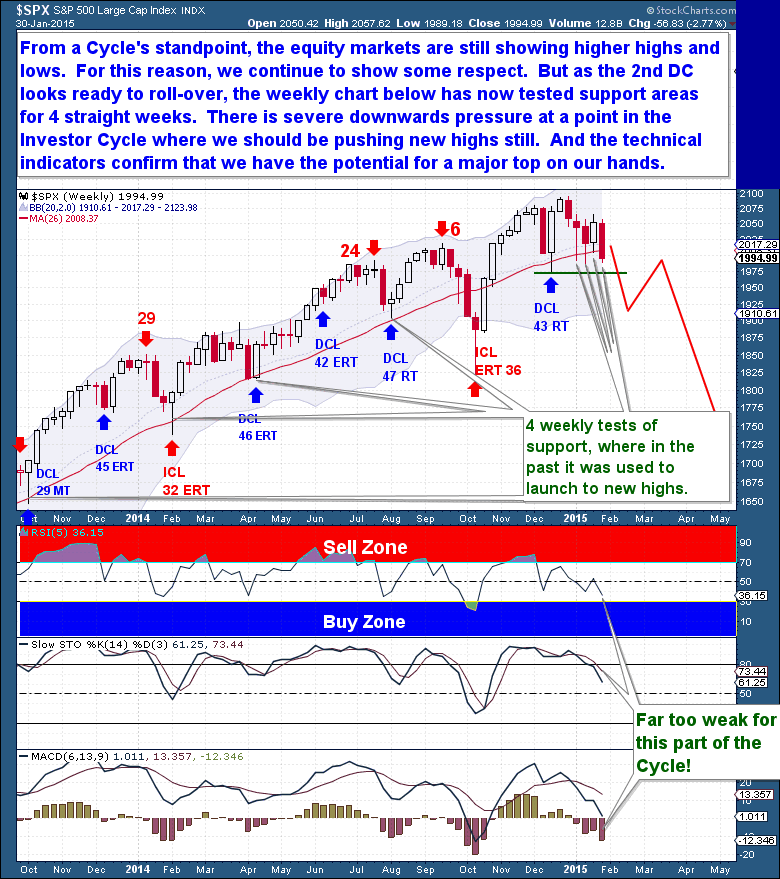

From a Cycle standpoint, the equity markets are still showing higher highs and higher lows. So, following strict Cycle discipline, I could make the argument that the bull market is alive and well. And for this reason, we are forced to show it some respect. But the most surprising development from here would be for equities to roar higher. Such a move would catch many (yet again) by surprise, but I think it’s unlikely this time.

The bull market has had its time, and the bears look like they will finally have a chance to control the action. With the 2nd DC looking ready to roll-over, and with numerous tests of the 26 week moving average in play, the market’s change in character appears ready to play out in prices.

Severe downward pressure is obviously building, and at a point in the Investor Cycle (IC) where a continuing bull market should see us pushing to new highs. The technical indicators confirm that this is an Investor Cycle in its declining phase, and it would be very rare to have the Cycle suddenly change course at this point.

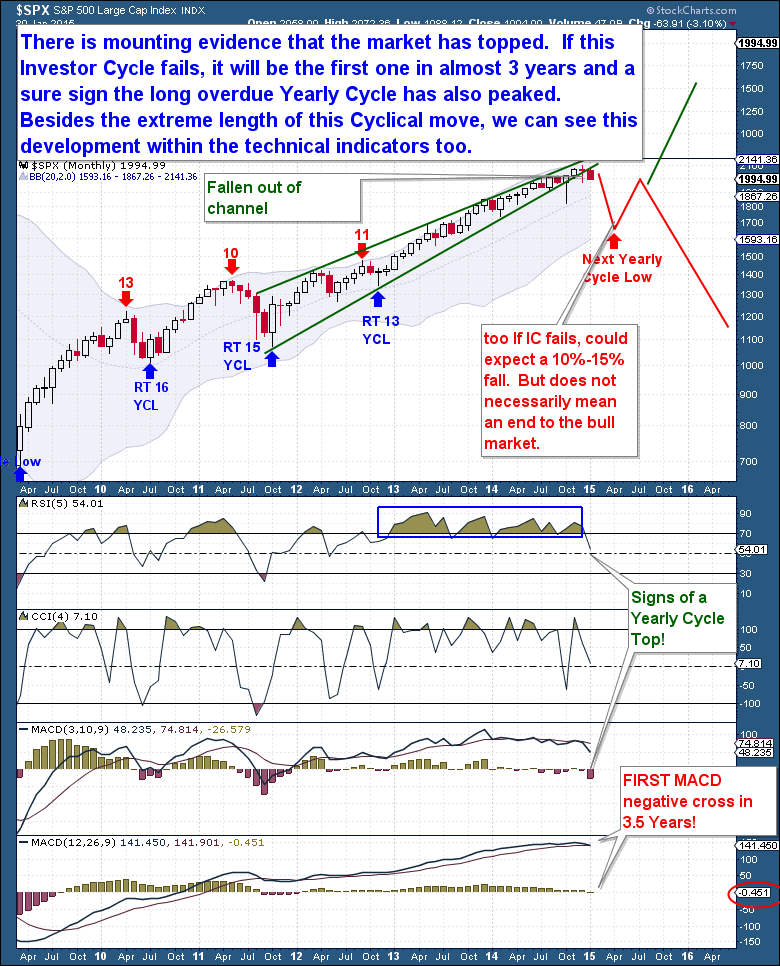

Recent developments are, perhaps, most apparent on a monthly chart. With January’s close, for the first time since the up-move began in 2011, we have a monthly candle that is entirely below the massive bull market channel. This alone is fairly strong evidence to support the idea that the market has topped.

The technical indicators paint a similar picture. The monthly RSI is showing diverging weakness, while the first negative monthly MACD cross since the 19%, 2011 decline is a serious warning sign. When we combine the negative technical indicators and macro-economic weakness with recent Daily Cycle struggles, and then consider them in the context of an overextended cyclical bull market, there’s compelling evidence that the market is on the verge of a major decline.

If the current Daily Cycle fails in the coming weeks, it will set off a domino effect of cascading Cycle failures. A DC failure would almost certainly result in an IC failure with a move below 1,816. This would be, at a minimum, a deep Yearly Cycle decline by the early spring. From there, how deep equities might fall is really anybody’s guess.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.

Gold Just Needs More Time

/in Public /by Bob LoukasThe Gold market appears to be in reverse gear at present. It’s at fresh 6 week lows with a 2nd Daily Cycle that continues to wind lower, and is showing nothing that’s at all positive. Gold is trading very lethargically, and is uninteresting from most perspectives.

Assets move higher or lower in direct relation to the sentiment of traders and investors. And sentiment swings like a pendulum, from bullish to bearish and then back again. Sentiment is the primary driver of demand, with greater buyer engagement – both in numbers and enthusiasm – required to drive prices higher. Unfortunately for Gold bulls, it appears that the sentiment pendulum has already peaked, and is heading back toward bearish lows. We see this clearly in the COT reports, with traders continuing to shift from net Long to net Short positions. The report’s actual survey data confirms that sentiment for the current Investor Cycle has topped, and is now in decline.

Ultimately, price action rules. In this case, with the current Daily Cycle having declined for 22 days (and counting), Gold’s price shows clear confirmation of an Investor Cycle decline. Bullish Cycles generally contain declines of no more than 10 days.

Headlines don’t always drive asset prices, but if Gold were inclined to move higher, last week’s sound bites around both a potential Greek exit and a breakdown of the Ukraine ceasefire offered plenty of fuel for it. Instead, Gold continued moving lower without a hint of strength. Given the geopolitical backdrop, Gold’s lack of upside movement speaks volumes about its underlying demand.

On the Investor Cycle timeframe, the current 4 week decline also creates problems for bulls. There is no way to sugar coat it: the action has been downright bearish. In my opinion the evidence clearly shows that the current Investor Cycle has topped and is on the way to a Investor Cycle Low.

From a review of past Cycles, especially those of the past 4 years, it’s clear that the week 11 high is almost certainly the top of the current Investor Cycle. Having price fall through the weekly trend-line is one issue, but the firm close below the 10 week moving average creates even more of a concern. In addition, an Investor Cycle in an uptrend rarely sees price spend an entire week below the 10 wma, but that’s what happened to Gold this week.

With Gold now 15 weeks into the current Investor Cycle and with a 10 wma that has turned lower, it’s clear that the current Investor Cycle is in decline and on its way to a trough. At this point, the evidence is conclusive, so only an outlying Cycle development would shift our outlook. Traders need to be aware that an oversold Daily Cycle rally should come this week, but that is an opportunity to sell on strength and capture the larger move lower over the coming months.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.

Gas It Up

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Market Update – Feb 18th

/in Premium /by Bob LoukasYou don’t have access to view this content

The Show Goes On

/in Premium /by Bob LoukasYou don’t have access to view this content

Cycle Chart Setup – Bonds

/in Public /by Bob LoukasUp until last Friday, the decline shown in the bond market was anticipated because the next logical Cycle Low was due. The ebb & flow nature of the bond Cycles are very visible, clear, and well defined on the chart below. And in a bull market trend, this type of pattern makes it relatively easy for us to predict both the top and low of each Cycle.

But the bond market sell-off has intensified this week, to the point where the expected Daily Cycle Low should have been comfortably behind us by now. The extent of this sell-off is approaching levels normally reserved and experienced during the deeper Investor Cycle Low, and each of those past Investor Cycle Low’s have led to some pretty substantial gains.

I doubt that’s what is occurring here, I still favor a standard Daily Cycle Low here that is likely to produce at least a powerful counter-trend rally. I say counter trend because the worst case scenario is that this coming Daily Cycle rally forms a double top before turning lower towards a true Investor Cycle Low. Regardless, a rally is forthcoming and we know in any bull market uptrend, the dips should be bought.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.

Midweek Market Update – Feb 11th

/in Premium /by Bob LoukasYou don’t have access to view this content

Crude’s Capitulation Phase

/in Public /by Bob Loukas(Note: Our once only annual membership sale details at end of post)

After a long and relentless decline, the Crude market has finally enabled us to anchor its Cycles. Up until 2 weeks ago, Crude was locked in a clear crash Cycle, which made it impossible to expect anything other than a continuation of the crash. But now that Crude has reversed with a 20% rally, its moves are clearly the start of a new intermediate term Cycle.

Based on the duration and the extreme nature of the recent Investor Cycle (IC) decline, Crude’s new-found strength is almost certainly the start of a new Investor Cycle. It’s impossible to know whether the current up-move will be only a counter-trend bounce, but because this is the 1st Daily Cycle of a new Investor Cycle, we should expect the current Cycle to be Right Translated (Meaning it will top beyond the midpoint of the Cycle).

On a longer time-frame though, I’m not convinced that the current 8 month downtrend has marked the bottom for Crude. The crash was supply-driven, and the underlying issue will take time to resolve. The genesis of the crash was excess investment in Crude production, which resulted in a supply glut that can only be solved through lower prices, over an extended period of time. Although the move down has been extreme, it’s a completely natural reaction to a significant supply/demand imbalance.

Three months of prices below production costs is not nearly enough time to have soaked up the current glut of supply. Oil firms have invested heavily in their production facilities, and want to be certain that the demand/supply dynamic is going to persist before shutting off production. And taking production offline is not immediate. It’s a lengthy process, with the decision to remove production leading market impacts by a significant length of time.

As with any bull market, Crude faces a situation where only time and repeated losses will cause participants to accept the market’s new reality. Any decision to close a facility is based primarily on expectations for longer term prices, and price expectations are always intensely biased to the upside at the end of a bull market. If Crude shows even a hint of a quick recovery in price, firms will be encouraged to “weather the storm”, only prolonging the extent and length of the decline.

So long as the massive stockpile of Crude inventory persists, lower production will not – in the short term – correct the imbalance. What’s required will be for facilities to close, production to fall, and enough time to pass for the existing inventory to be worked down. Unfortunately, I believe that the imbalance is structural, so it cannot and will not be corrected quickly on the demand side. Until we see supply better reflect the true demand for Crude, there is little prospect of a longer term recovery in price.

Courtesy Bedspokeinvest

Bankruptcies and closures of Oil companies are underway, and this will help to reduce the supply imbalance. But this process will need much more time, possibly years, to play out. A look at the number of rigs in production makes it clear what led to the crash in prices. Between 2010 and 2014, there was massive over-investment in production, resulting in the addition of 4 million barrels of US Crude production per day. The result was the highest level of production in 30 years.

The current drop in rig counts has, so far, been about 30% from peak to trough. In past crashes, however, the rig count has declined by 50-60%. It takes time for any supply imbalance to work its way through the system because producers find it hard to shut down production. In some cases, producers even ramp up production in an attempt to compensate for the price declines. Netting it out, even with the recent price crash and rig closures, Energy Administration numbers show that the US still produces 9.19 million barrels of Crude per day, the most since 1983.

Given current production, any upside movement in Crude prices will likely be capped. During the past 5 years, Crude witnessed a huge boom and period of over-investment, and it will take longer than 7 months to correct the imbalance. I believe that the best the industry can hope for is that price recovers to the $60 to $70 level, where production is closer to its break-even point. That said, markets rarely work logically, and are typically drawn to the levels that will inflict the greatest pain on the most people in the shortest length of time.

It has been a minimum of 37 weeks since the last Investor Cycle Low. This is one reason why back-to-back powerful weeks, the first such sequence since last May, signal the start of a new Investor Cycle. But with Crude coming out of a crash Cycle, price discovery will be difficult, and we should continue to see heightened volatility. To solve the over-production issue, I believe we’re going to need at least a year of depressed prices. If so, during the next 2 Investor Cycles (52 weeks), Crude prices should fluctuate between $40 and $60, with a real possibility of a drop below recent lows.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

A Long Road Ahead

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Market Update – Feb 4th

/in Premium /by Bob LoukasYou don’t have access to view this content

Precarious Times for Equity Markets

/in Public /by Bob LoukasIt suddenly seems as though the good times in equities might be ending. Though my perspective is based only on “gut feel”, there seems to be an underlying level of fear that has crept into the markets. If so, it’s a real problem for equities. Any market trading at all-time highs and with a valuation far above historical averages requires a continued level of irrational excitement and speculative ignorance to remain sustainable. And fear is not consistent with irrational, speculative ignorance.

When equities price in Risk, it can happen quickly, and I believe the markets are in the early stages of doing just that. Though equities don’t want to believe that significant downside is possible, crashes in commodity prices and massive demand for high quality debt are harbingers of significant declines ahead. In my opinion, the early stages of an equity market decline are unfolding, and it’s only a matter of time before it erupts into a serious event.

Macroeconomic measures don’t always correlate directly with equity market performance, at least not in the immediate term. But when economic numbers begin to look as ugly as they are at present, I can assure you that an overheated and extended market will stand up and take notice. Of particular note this week are several ominous signs:

In quoting the above statistics, I’m mindful of the fact there are always both negative and positive points that an analyst can use to support a point of view. In this case, though, I honestly feel that the severity and depth of current macroeconomic developments are well outside of the norm. The extreme movements in many markets are interrelated, and seem to be a reflection of a rapidly deteriorating economic landscape.

These shifts are showing up as weakness in equity markets. As days tick by, and as the Daily Cycle Low (DCL) draws closer, the S&P has continued to knock against lower support areas. Throughout the past 3 year bull advance, at this point in the Cycle the S&P has pushed higher to new all-time highs. So the current position – bumping against support – is definitely a change in character, one that is telling us that the market may be exhausted. In my opinion, it is also telling us that 2015 is going to be a difficult period for markets. The current Daily Cycle (DC) has not failed yet, but it’s sitting near the lows, and at this point, that’s a very ominous development.

From a Cycle standpoint, the equity markets are still showing higher highs and higher lows. So, following strict Cycle discipline, I could make the argument that the bull market is alive and well. And for this reason, we are forced to show it some respect. But the most surprising development from here would be for equities to roar higher. Such a move would catch many (yet again) by surprise, but I think it’s unlikely this time.

The bull market has had its time, and the bears look like they will finally have a chance to control the action. With the 2nd DC looking ready to roll-over, and with numerous tests of the 26 week moving average in play, the market’s change in character appears ready to play out in prices.

Severe downward pressure is obviously building, and at a point in the Investor Cycle (IC) where a continuing bull market should see us pushing to new highs. The technical indicators confirm that this is an Investor Cycle in its declining phase, and it would be very rare to have the Cycle suddenly change course at this point.

Recent developments are, perhaps, most apparent on a monthly chart. With January’s close, for the first time since the up-move began in 2011, we have a monthly candle that is entirely below the massive bull market channel. This alone is fairly strong evidence to support the idea that the market has topped.

The technical indicators paint a similar picture. The monthly RSI is showing diverging weakness, while the first negative monthly MACD cross since the 19%, 2011 decline is a serious warning sign. When we combine the negative technical indicators and macro-economic weakness with recent Daily Cycle struggles, and then consider them in the context of an overextended cyclical bull market, there’s compelling evidence that the market is on the verge of a major decline.

If the current Daily Cycle fails in the coming weeks, it will set off a domino effect of cascading Cycle failures. A DC failure would almost certainly result in an IC failure with a move below 1,816. This would be, at a minimum, a deep Yearly Cycle decline by the early spring. From there, how deep equities might fall is really anybody’s guess.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.