Follow the Process – Public

Trading Summary

Gold – Short gold and miners

S&P – None

Crude Oil – None

$USD – None

Bitcoin – Long Bitcoin

Video Report

In this video, I cover the standard Cycles of Gold, Equities, Crude, Dollar and Bitcoin, from a Daily and Weekly perspective. See below the video for any charts or images I presented that might be of interest. Also the Cycle counts, sentiment, COT blees rating are listed below the video.

Gold Coverage – Minutes 0:00 – 18:25

Equities – Minutes 18:25- 29:40

Crude Oil – Minutes 29:40 – 35.22

US Dollar – Minutes 35.22 – 38:58

Bitcoin – 38:58 – End

Cycle Counts

Gold Cycle

| Cycle | Count | Observation |

Cycle Trend |

Cycle Clarity |

| Daily | Day 10 | Range 24-28 Days | Topped | GREEN |

| Investor | Week 20 | Range 22-26 Weeks | Topped |

GREEN |

Supporting Indicators

| Sentiment Level | 60% |

Bearish |

| Commitment of Traders (COT) |

Blees Rating – 9(Range 0 = Bearish 100 = Bullish) |

Bearish COT picture

|

| Primary Trend (Weekly Chart) | UP | Bullish – New Bull Trend |

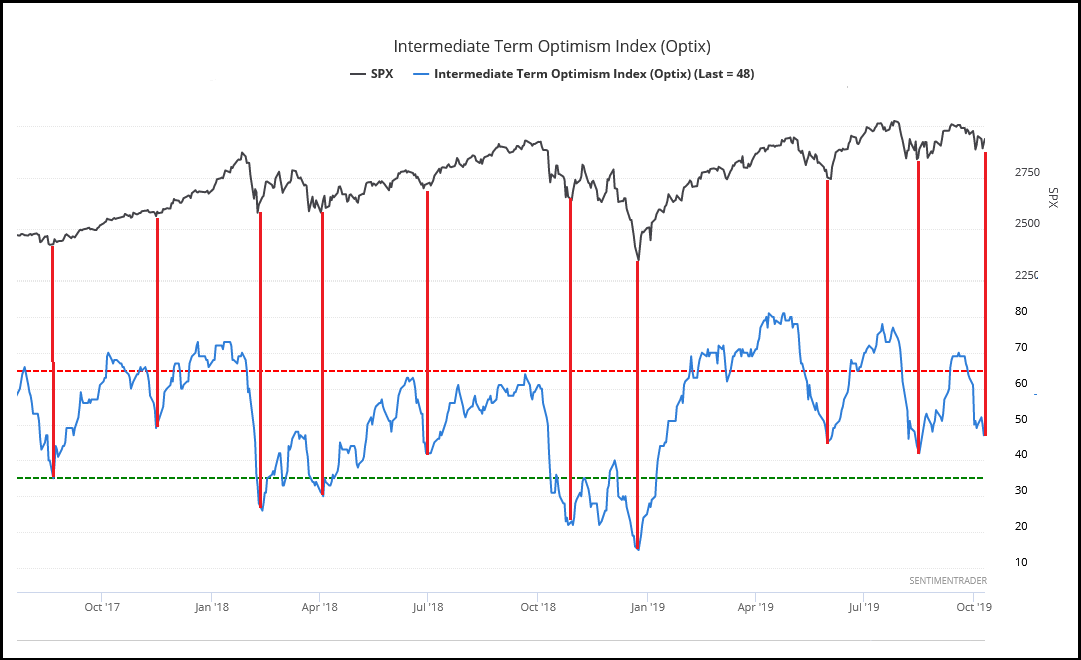

S&P500

| Cycle | Count | Observation |

Cycle Position |

Cycle Clarity |

| Daily | Day 7 | Range 38-44 Days | New Cycle |

Green |

| Investor | Week 19 | Range 26 Weeks | Mid to Late Cycle |

Green |

Supporting Indicators

| Sentiment Level | 48% |

Bullish |

| Primary Trend (Weekly Chart) | Up | Bull Trend |

CRUDE OIL

| Cycle | Count | Observation |

Cycle Position |

Cycle Clarity |

| Daily | Day 7 | Range 36-42 Days | Early Cycle | Green |

| Investor | Week 19 | Range 22-26 Weeks | Mid to Late Cycle | Green |

Supporting Indicators

| Sentiment Level | 35% |

Bullish |

| Commitment of Traders (COT) | Blees Rating (0-100) – 80 | Bullish |

| Primary Trend (Weekly Chart) | Down | Post Crash. |

$US DOLLAR

| Cycle | Count | Observation |

Cycle Position |

Cycle Clarity |

| Daily | Day 7 | Range 15-20 Days | Topped – Failed. |

GREEN |

| Investor | Week 16 | Range 16-20 Weeks | Late Cycle |

GREEN |

Supporting Indicators

| Sentiment Level | 56% | Neutral |

| Primary Trend (Weekly Chart) | UP | Up-trend |