Dow 20,000 is Irrelevant

Dow 20,000 is Irrelevant

Seeing so much discussion around the importance of Dow 20,000 and the likelihood that falling just shy signals a market on the verge of collapse. Well, it’s no secret that I am a macro bear and see no value in this market. But that is irrelevant to the market and price today, just as Dow 20,000 is irrelevant too.

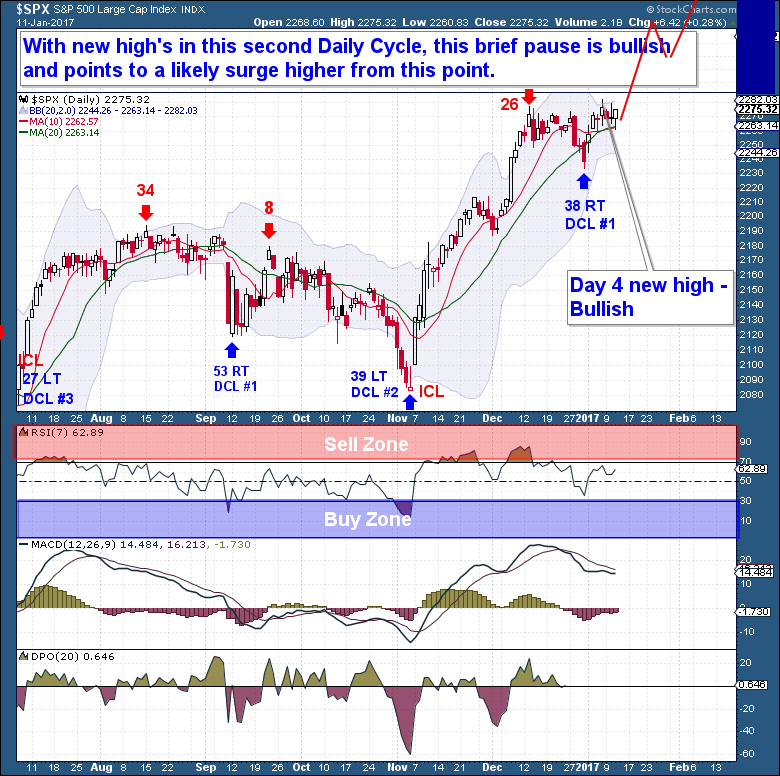

In fact, I’m very bullish on the S&P in the short term, because sentiment remains very high and we’ve seen a pause of late lead to a tightening of the Bollinger bands. Such consolidations, especially in a market that has become so speculative, has the potential to provide a significant amount of fuel behind a move.

With regards to possible direction of any move, we know the Daily and Investor Cycle counts are very favorable for the Long side. Therefore, I’m expecting that a massive push higher is likely to begin soon. The recent Cycle Low would become a clear stopping point, if that interpretation is incorrect, so a good setup is at hand for those who do not have long exposure.

The Financial Tap – Premium

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s Cycles. Along with these reports, members enjoy access to a real-time portfolio with trade alerts.

NOTE: It’s just $99 for a full 3 months of membership, a fraction of what one stopped out trade is likely to cost you. Consider joining The Financial Tap and receive two reports per week and the education you need to become a better trader or investor See >> SIGN UP PAGE!

.

.

Bob.