Gold is Starting to Shine

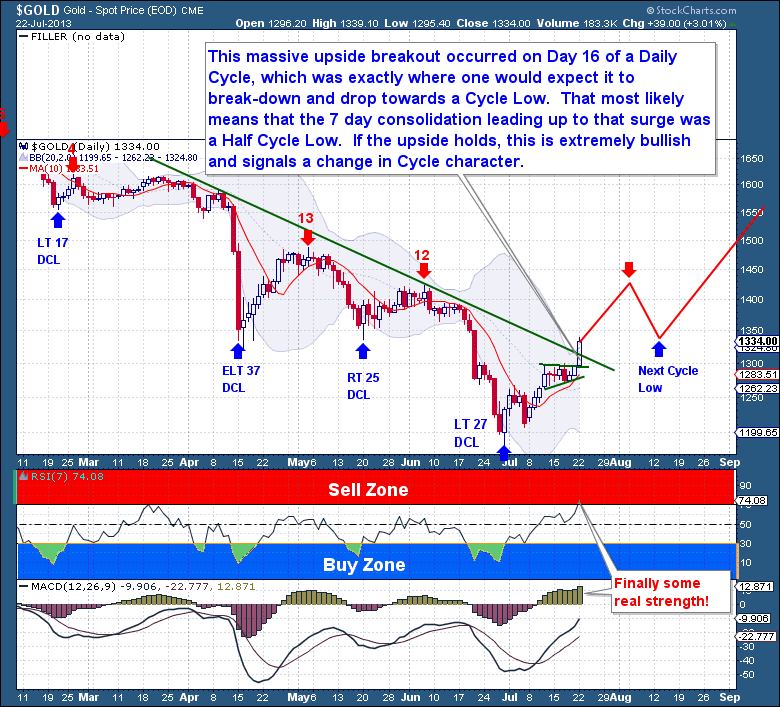

Within the member reports I outlined that last week's pause below the $1,300 level was very characteristic of the declining Cycles of this past 12 months. It was at that very point, Day 12-15 where the Cycle would top and very quickly roll-over into yet another punishing Cycle Low. Technically too all of my tracking indicators and oscillators were at the same level where Cycles typically topped.

But within those reports I’ve also been tracking a bullish secondary scenario that I said held a reasonable (30%) chance of developing. It was the scenario where the consolidation below $1,300 and the declining Cycle trend-line was part of a Half Cycle Low. The theory then was that if gold could launch this late in the Daily Cycle, then it would indicate that this could only be a powerful 1st Daily Cycle, and these tend to run between 27-33 days from trough to trough.

So the bullish scenario is now playing out with that massive upside breakout of the declining trend-line. It occurred on Day 16 of a Daily Cycle, which was exactly where one would expect it to break-down and drop towards a Cycle Low. This is extremely bullish and signals that we’re now in a new dominate Investor Cycle (These run 20 Weeks in length) and with it should make very quick work of taking out $1,400 and then $1,500 respectively.

But first we need some more confirmation; break-outs are often fake-outs. I suggest traders/investors buy this break-out to avoid being shut out of a potential series of powerful lockout days. But if the break-out fails and gold falls back below the break-out point, then the reason for buying has been negated and selling positions is a must.

If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/about