Bernanke’s Bubble Set For Final Blow

Chairman Bernanke rode into Congress on his white horse again and the markets just “ate it up”. The man just loves double talk, saying all the right things about the economy while quick to point out that if something doesn’t go to plan then they will be accommodating. In other words, he has found a way to “have his cake and eat it” and the market is more than happy to go along with it. If the FED is to tapper, then that means the economy is just fine. If the economy sours, then they keep buying assets (POMO).

The FED is viewed as infallible and that has bred a lot of disrespect towards the natural Business Cycle forces. The market (as it always does near tops) is essentially saying that “this time is different”. But the kicker is that the economy is getting worse and corporate earnings have flat-lined, despite their heavy hand. What the market is not pricing in is the FED’s inability to avert what will be an eventual Business Cycle decline down into a recession. After $3T of asset purchases, all they’ve managed to do is sustain this economy at stall speed, nothing more. But at the same time they’ve help blow yet another massive bubble as the equity markets have now seriously diverged from underlying fundamentals.

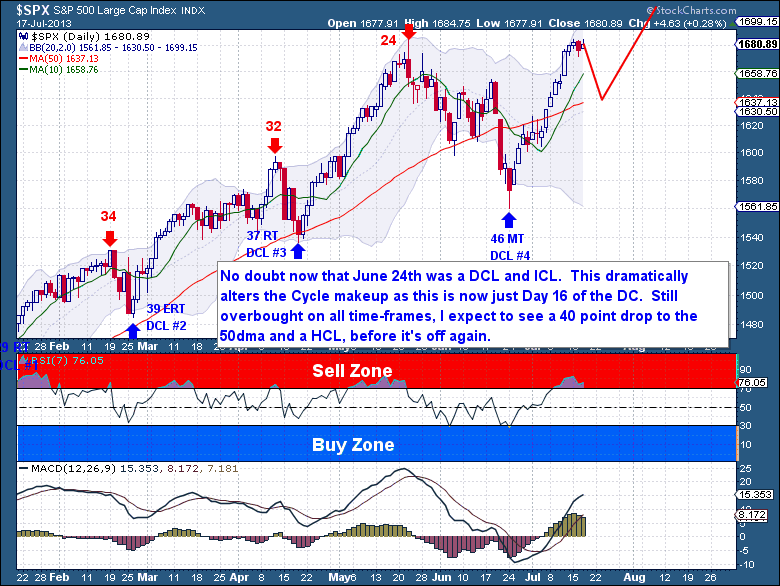

So thanks to the FED, I have no doubt now that June 24th was a DCL and ICL. This dramatically alters the Cycle makeup as this is now just Day 16 of the DC. Still overbought on all time-frames, I expect to see no more than a 40 point drop to the 50dma and a HCL before it's off again. The current double top showing should have the bears thinking that this is finally the big top. But I believe otherwise, the market is getting speculative and far too overconfident, and this is what runaways are made of.

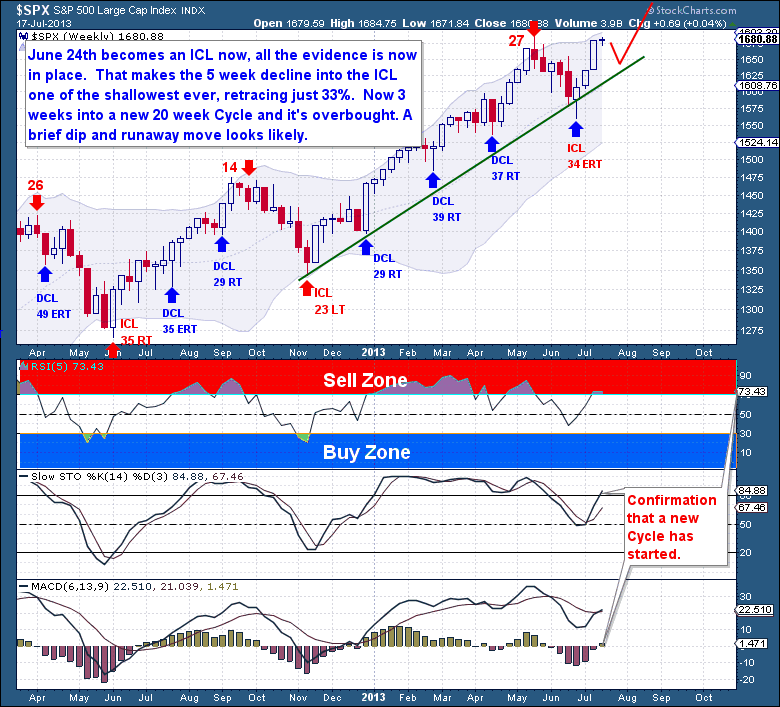

So as June 24th becomes the new ICL, that makes the 5 week decline into the ICL one of the shallowest ever, retracing just 33%. The Cycle barely cleared out any of the bullish sentiment of that massive 6 month rally, so it only reinforced the notion that FED sponsored market is invincible, that every dip should be bought. Over confidence is everywhere as the mere mention of fundamentals is scoffed at as being completely irrelevant to this market.

So it’s no surprise that this new Week 3 (of expected 20 weeks) is starting out in overbought territory. All of the characteristics and emotions that I remember from the big 2000 and 2007 tops are now firmly in play here and we could well be looking at an equity market that is about to go on one last big push higher. I’m thinking that we pullback slightly here (40 points max) and then rip higher for some weeks into what will eventually be a big 4 Year Cycle Top. Of course timing a top is difficult, picking a price even more so.

If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/about