Bond Sentiment Extreme near a Cycle Turning Point

Bond Sentiment will lead to a Cycle Turn

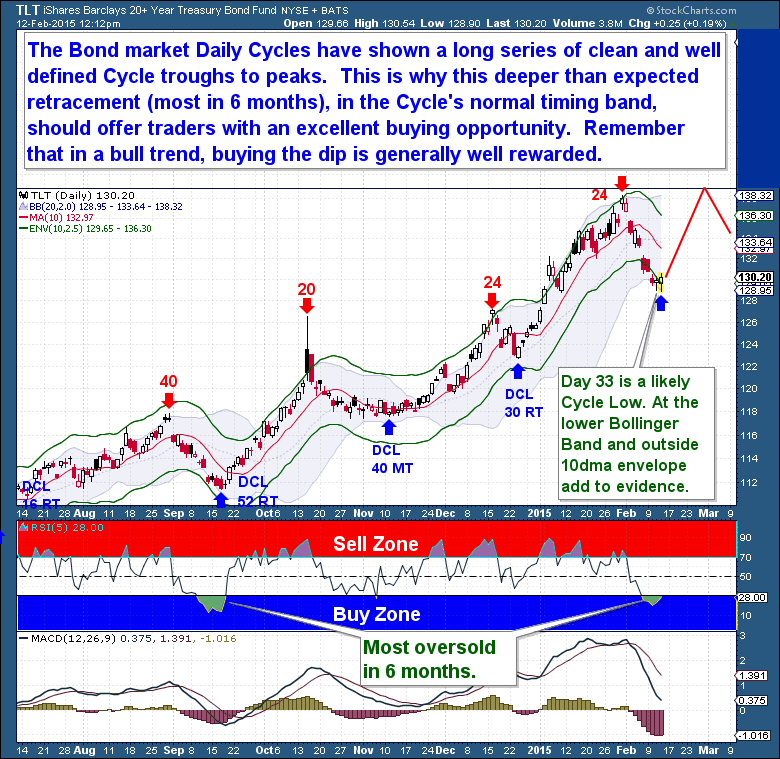

The Bond market has obviously been in a strong rally since the April Investor Cycle Low (ICL). History teaches, however, that even during solid bull market moves, corrections into major Cycle Lows are a normal part of the Cycle flow process.

And this is where we find Bonds today. The Commitment of Traders report shows a massive Long speculative position, while overall Bond Sentiment remains sky-high. Weekly Cycle timing is well into its topping range, and the 4th Daily Cycle (shown below) is beginning to struggle. I would never count Bonds out, at least until we see a failed Daily Cycle, but I am starting to believe that a new down leg in Bonds is almost upon us.

A technical caution – if price were to move higher and exceed the current day 6 high, a bullish continuation is possible. For the bulls, loss of the 10-day moving average would be extremely negative, as it would signal a potential downturn and Left Translated Daily Cycle.

The Financial Tap – Premium

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

NOTE: The Financial Tap offers you a Full 14 day, no risk, money back Trial. It’s just $99 thereafter for a full 3 months of membership, a fraction of what one stopped out trade is likely to cost you. Consider joining The Financial Tap and receive two reports per week and the education you need to become a better trader or investor See >> SIGN UP PAGE!

Bob.