Posts

Approaching the Extremes

/in Premium /by Bob LoukasMidweek Cycles Update – Dec 7th

/in Premium /by Bob LoukasThe Unwind

/in Premium /by Bob LoukasMidweek Cycle’s Update – Nov 30th

/in Premium /by Bob LoukasA Break or a Trap

/in Premium /by Bob LoukasAll is not what it seems

/in Premium /by Bob LoukasMidweek Update – Nov 16th

/in Premium /by Bob LoukasTrump Stock Market

/in Public /by Bob LoukasTrump Stock Market

Equities sold off sharply as the election results started to come in, but by the end of the week, the market had settled generally higher. As with Gold, equities have a Cycle trending in a certain direction, and we should continue to follow the dominant trend until the action directs otherwise.

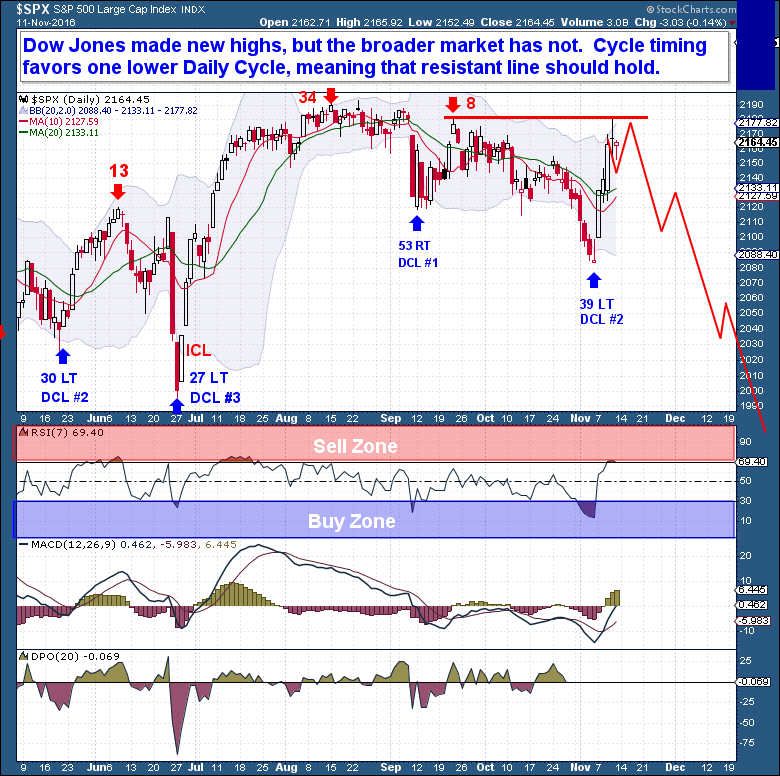

The Dow Jones made a new high this week, but the broader market has yet to follow. And since weekly Cycle timing continues to favor more downside before an Investor Cycle Low (ICL), the resistance line on the below chart should continue to hold. At this point, there is not enough evidence to warrant speculating about a new Investor Cycle (IC) and IC rally.

For now, a reversal lower from here as part of a Left Translated Cycle is the highest probability scenario for equities. But the highest probability scenario does not always come to pass. If, instead of rolling over, the market moves to a new all-time high, we will need to quickly change our perspective.

It is not always easy for traders to shift quickly – too often our egos get tied up in a viewpoint – but the markets do not care. They will go where they go. At best, traders are right on a market’s direction only 60% of the time; it’s how a trader formulates and executes his strategy that matters most. Traders must embrace planning and execution, and must remain adaptive. To do otherwise risks getting caught in a position that is fighting a trend.

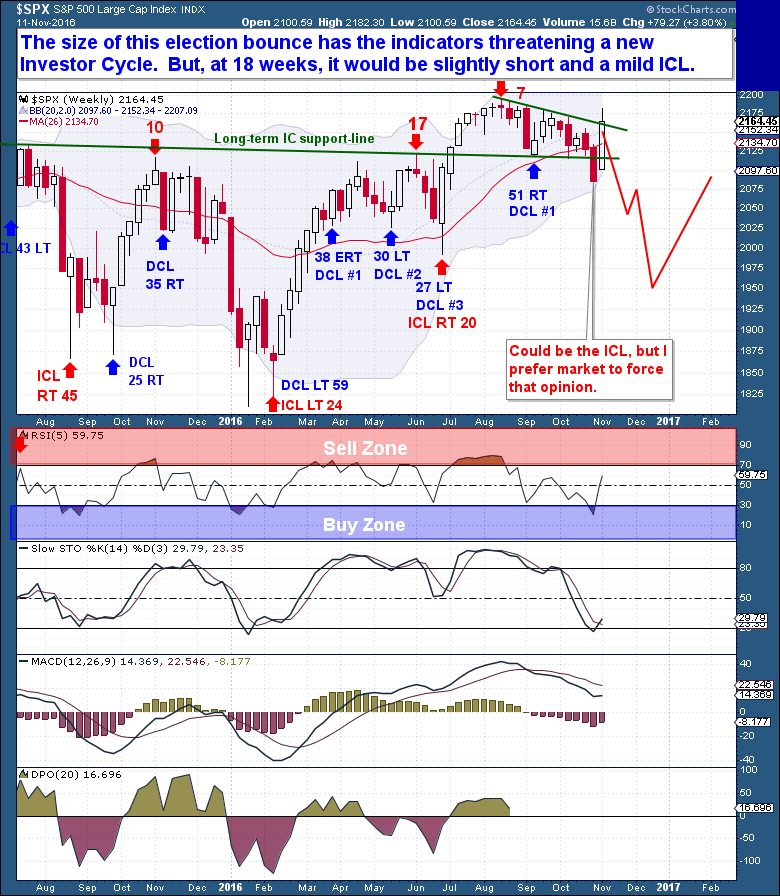

The size of the post-election, Trump Stock Market bounce has pushed the weekly Cycle indicators high enough to threaten a new Investor Cycle. The possibility is very real, but it’s not a slam dunk. If we are in a new IC, an ICL would have been printed at 18 weeks, slightly short of the normal timing band for it. And from a technical standpoint, the ICL would have been very mild.

The S&P has moved back above the 10-week moving average – generally confirmation of a new IC – but it has not yet decisively smashed through this resistance zone and moved to a new all-time high. If it can move quickly to a new high, a major rally could well be brewing. Until then however, I will continue to expect a more traditional ICL selloff in the coming 6 to 8 weeks.

The Financial Tap – Premium

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

NOTE: The Financial Tap offers you a Full 14 day, no risk, money back Trial. It’s just $99 thereafter for a full 3 months of membership, a fraction of what one stopped out trade is likely to cost you. Consider joining The Financial Tap and receive two reports per week and the education you need to become a better trader or investor See >> SIGN UP PAGE!

Bob.