Sample Premium Member Report published on Feb 6th, 2016.

Gold Cycle

Cycle Counts

| Cycle |

Count |

Observation |

Probable Outlook

|

Cycle Clarity

|

Trend |

| Daily |

Day 25 |

Range 24-28 Days – 2nd Daily Cycle |

Topping Area |

Green

|

Flat |

| Investor |

Week 10 |

Range 22-26 Weeks |

Bullish |

Green

|

Flat |

| 4Yr |

Month 41 |

Range 48-52 Months |

Bearish |

Green

|

Failed |

Finally! After months of tepid action in Gold, a strong Daily Cycle rally is underway. So far, it’s been as strong as any rally of the past four years, and it’s not over. I had wondered why Gold has not benefited from the aggressive equity selloff…but no longer. Bonds are up sharply, and Gold has also begun to rise, fueled by equity outflows in search of a safe haven. Without question, Gold is locked in a powerful Right Translated Daily Cycle, one that has so far added over $100 in 24 trading days.

It’s easy to get carried away whenever we see a move like the current one. Based on comments in the Bull Bear Forum as well as a surge in bullish tweets, traders have become extremely bullish on the precious metals complex. Nothing lifts traders’ spirits like a good rally, and the Gold sector has certainly seen that. From my vantage point, however, the bullish shift in sentiment doesn’t – yet – represent more than the natural flow of emotions during a normal 4 to 6-month Investor Cycle.

Let’s focus first on the Daily Cycle. Although the move higher has been explosive, the DC is at day 24, so expecting further gains goes against the odds. Gold is well past due for a DC Top, and is extremely overbought technically. Based on history and market behavior, it’s difficult to see how the current rally can continue until overly-optimistic sentiment is cleansed through a DCL. In addition, we need to keep the current move in perspective. Since its peak in August 2011, Gold has shown a powerful Daily Cycle in every Investor Cycle. So Gold is not out of the bearish woods quite yet.

Turning to sentiment, history has shown that as sentiment increases, so does the willingness of traders to chase assets higher. A self-fulfilling loop of higher-prices-leading-to-stronger-sentiment-leading-to-higher-prices takes over. Price gets far ahead of itself, and the buying becomes ever more speculative, leveraged, and “weak handed”. Near the top of long term Cycles, inexperienced traders are generally holding significant leverage, hoping for further gains. The first hint of a reversal/top sends them scrambling for the exits, and a selling frenzy begins the process of unwinding overly bullish sentiment. The process isn’t over until bullish sentiment has cleared and a long term Cycle low arrives.

We’re far from that decline at present, but sentiment is rapidly rising. The below sentiment chart doesn’t include most of this week’s rally, but still shows sentiment near the level where every Investor Cycle of the past 4 years has topped. This is hard evidence that we can’t ignore. In past bear market ICs, Gold has topped near current sentiment levels. We can always hope for some sort of a change in character, but trading as if “this time is different” would be placing bias above historical data.

On the weekly chart, our analysis remains fairly straightforward. For the past two months, the current rally has been fairly predictable in terms of magnitude. A 10% rally during the first 10 weeks of an IC is average, and the current $100 move is slightly beneath that level. The Miners, too, show only average Investor Cycle performance so far. And this despite a giddy, sharply rising chart.

The point is that we need to be cautious in looking at the current DC, and in projecting a longer term bullish advance based on its performance. While it’s great to finally have a real rally in Gold, there’s no guarantee that the bear is dead. I’m not saying that it cannot be different this time…in fact, I hope that it is. But until the market and price action tell us Gold has turned the corner, we need to be cautious. The first real test will come at $1,191, the previous Investor Cycle high. If Gold can pierce that level, we can begin to consider whether a change in cyclical trend might be underway.

At this point, I’d like to throw evidence-based analysis aside, and discuss what I feel about precious metals.

I believe that a change in character could be underway across the precious metals complex. There is plenty of evidence to support the view that equities have entered a bear market and, if so, it stands to reason that Gold, which has been inversely correlated to equities for years, will benefit from a flow of funds from equities.

The bear market in Gold brought a 50% decline in 4 ½ years. The Miners have fared even worse, with averages falling by 80% and individual names by as much as 99%. By any account, the bear market has been long enough and the declines deep enough to satisfy even the most virulent bears. Since the Miners’ January low, some of the more viable and well-positioned companies are already up over 100%,. Others have tripled off their lows. These signs of a bottom are so pronounced that it’s easy to see how they could be precursors to a new bullish advance.

I’m an optimist by nature, but in trading I’ve learned to be more cynical due to my aversion to unnecessary risk. I trade from Cycle evidence and Gold has yet to show us a higher IC high, and that’s what we need to have real hope of a new bull. It’s easy to forget, but the most recent ICL made a new multi-year low, while the Miners matched their low from 13 years ago. So caution is still warranted. It’s caution that enabled me to weather the bear market without losing capital.

However, since hope springs eternal, I’ll show a last chart with the ratio of the HUI Index (Gold Miners) to Gold. The mining stocks were sold off to levels against Gold never before seen. The sell-off was so severe that the Miners were trading at 50% discounts to prices seen at trough of the 2000 bear market. We know that extremes can continue for long periods, but the reversal in Miners relative to Gold is now very clear. Remember, each past Gold market bottom has begun with the Miners outperforming Gold.

Investor Cycle Trading Strategy

I sold my Long position when it hit the topping point of a typical Investor Cycle. There are no trades here at present.

Daily Cycle Trader Strategy

No positions for now. I did try a quick topping trade in GDX, but was forced out on the power of Friday’s rally. I bought during an extremely overbought time in the Cycle, so I thought it was a good setup, but the action proved that markets can at times extend well beyond extreme levels. If we see a continuation higher on Monday, I will likely have the confidence to attempt another Short trade.

Portfolio Positions Summary

Open Positions – Investor Portfolio –

None.

Open Positions – Daily Cycle Trader Portfolio –

None.

Equities (S&P500)

Cycle Counts

| Cycle |

Count |

Observation |

Probable Outlook

|

Cycle Clarity |

Trend |

| Daily |

Day 13

|

Range 36-42 Days – 1st or 4th Daily Cycle. |

Avoid

|

Green

|

Failed |

| Investor |

Week 3 or 23 |

Range 20-24 Weeks |

AMBER

|

AMBER |

Failed |

| 4Yr |

Month 78 |

Range 50-56 Months- 8th Investor Cycle. |

Bearish

|

Green |

Up |

It’s been 7 years since the start of the bull market, and signs of a market breakdown are now everywhere. A look at past bull market tops (1998-2000, 2005-2007) shows warning signs and divergences as much as two to three years before the top, all while the general equity indices are making new highs.

These signs are evident in today’s market. The commodity sector represents raw materials, and it has been in a deflationary spiral for a couple of years. Emerging markets, even those not heavily dependent on commodities, have been in a bear market for at least two years as well. In particular, China, the bellwether of the world economy and poster child for the current expansion, has been sounding a bearish alarm for well over a year.

Additional warning signs have appeared. High yield (junk bond) debt has been under enormous pressure recently. As investors begin to rein in speculative risk exposure, the high yield market is one of the first to turn down before of a market top. In addition, cyclical sectors like banking and transportation have already broken down. Moreover, the US treasury yield curve is flattening again, as demand for longer dated treasuries, the ultimate safe-haven asset, is once more rising.

The bottom line is that equities have stopped advancing, and have moved sideways for well over a year. Repeated attempts to breakout on the high side have failed, and the current top has turned into solid resistance. With valuations still at historical extremes and corporate sales growth flat, the ability for the market to sustain its current level is being seriously challenged. In short, I believe that the equity markets have topped and that a bear market is well underway.

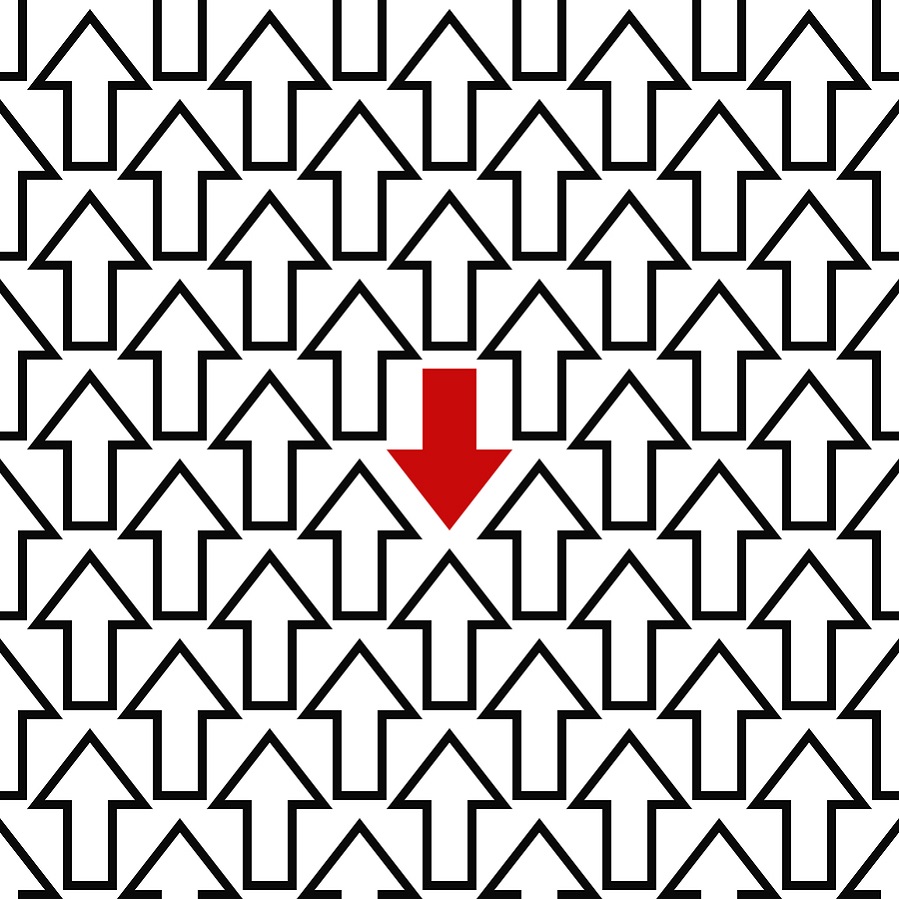

That said, it’s crucial to remember that nobody knows in the short-term where the market is headed. That is both the beauty and the difficulty of trading – the markets are far too complex to predict with certainty over short time periods. And that’s especially true in the current environment, where whipsaws and volatility are so extreme that trading either side – Long or Short – is a challenge. Overall, a near term a rally would not surprise me, but I expect it to be short-lived. With Daily and Weekly Cycle failures in place, the market is showing unmistakable bear market characteristics. That being the case, my primary expectation is for a break below the January 20 low. I see this scenario as more likely than a large, counter-trend rally.

From an Investor Cycle standpoint, the bearish action should be clear. I’m now fully in the bear market camp, so I expect most of the significant moves to be to the downside. The last three attempts at a reversal higher have all failed, so the “buy the dip” ethic is clearly over.

Nevertheless, it would be foolhardy to rush in on the Short side and expect immediate downward pressure. That could happen, since we expect generally lower prices, but we need to be mindful that tops take time to form, and bear market declines are riddled with sharp rallies. My primary concern with trading Short is that equities have not had a particularly sharp rally yet. Sentiment is particularly low, so the door is open for a surprise rally. The trend is down, and I expect massive declines in the near future. But in the short-term, I’m open to all possibilities.

Investor Cycle Trading Strategy

No trades for now. I’m still trying to determine an accurate weekly count. I’m hoping for a good rally, one that would move price back toward 2,000 and provide clarity. We could be looking at a classic Left Translated IC, with a top near week 10 and future Daily Cycle highs testing the declining trend-line.

To see the market break to a new low would confirm the bear market, but it would also mean that the Investor Cycle could be coming to an end. If that happens, Shorts could be subjected to a fairly significant counter-trend move.

Daily Cycle Trader Strategy

I’m out of my Long positions for a small profit. There is no clear choice, Long or Short, at the moment, and the extreme market volatility makes trading equities here not worth the risk. It’s time to wait for the Daily Cycle to resolve itself.

Portfolio Positions Summary

Open Position – Investor Portfolio –

None

Open Position – Daily Cycle Trader –

None.

CRUDE OIL

Cycle Counts

| Cycle |

Count |

Observation |

Probable Outlook

|

Cycle Clarity

|

Trend |

| Daily |

Day 12

|

Range 36-42 Days (1st or 4th Daily Cycle) |

Avoid |

Green |

Down |

| Investor |

Week 3 or 23

|

Range 20-24 Weeks |

Depends on IC

|

AMBER |

Down |

| 4 Year |

Month 10 |

Range 48-52 |

Bearish

|

Green

|

Down |

Along with many other commodities, Crude Oil crashed during the past year. The Crude market has become so erratic that it is impossible to determine what Crude will do next. From here, it could rally 20% or fall 20% and neither would surprise me. So I’m left with no choice other than to declare that I simply have no clue where Crude prices will be 1 to 3 weeks from now. Nor does any other analyst, regardless of what he or she might predict.

In recent weeks, Crude appears to have become highly correlated with risk and equity markets. Maybe it’s the other way around, that is, the equity markets are tracking Crude. Regardless, the markets are trading in tandem, and if equities are preparing for another significant leg lower, Crude will likely sell-off in sympathy. Since Crude Oil is still in the early stage of a bear market, extreme moves in price are normal, especially for this asset class.

Investor Portfolio Trading Strategy

No positions at present.

Daily Cycle Trader Strategy

No positions at present.

Portfolio Positions Summary

Open Positions – Investor Cycle Portfolio –

None.

Open Positions – Daily Cycle Trader Portfolio –

None.

$US DOLLAR

Cycle Counts

| Cycle |

Count |

Observation |

Probable Outlook

|

Cycle Clarity

|

Trend |

| Daily |

Day 40

|

Range 18-22 Days – 4th Daily Cycle |

Bearish

|

Green |

Up |

| Investor |

Week 24

|

Range 18-22 Weeks |

Bearish |

Green

|

Failed |

| 3Yr |

Month 18 |

Range 36-42 – 6th Investor Cycle. |

Bullish |

Green |

Up |

The Dollar sold off sharply as markets came to the realization that the FED will not be able to continue to tighten rates. The idea of higher rates is simply a fantasy. The FED raised rates by 0.25% in December, but recent economic news combined with pressure on risk assets (equities and high yield bonds) all but ensures that the FED will not be raising rates again anytime soon. With both the Daily and Investor Cycles well past their topping points, the realization of no more rate increases was a catalyst for a Dollar decline.

The Dollar fell further at the end of the week, but stabilized by the close on Friday. Friday could well become the Daily Cycle Low. It’s difficult to predict day-to-day Dollar moves after one of the largest declines in years, but I will note that the Daily Cycle Low is due at the same time the sell-off looks to be complete. A failed Daily Cycle is in play, however, so it’s prudent to expect that any rally will quickly roll over.

The Dollar action suggests that the ICL decline I expected is underway. The decline will help to clear out sentiment and prepare the Dollar for what should be another big leg higher.

A double top is, potentially, in play, and many investors are very quick to point it out. Unfortunately, I believe that the investors are falling prey to bias in favor of positions they hold in a correlated asset class. In particular, a double top is not supported by the Cycle evidence. At this point, an uptrend is still underway, with only higher highs and higher lows.

More importantly, a currency trades in relation to other foreign currencies. That is, the Dollar can be priced only in relation to another currency, be it the Euro, Yuan, Yen, etc. When we consider that China is blowing through its FX reserves, that the emerging markets are extremely fragile, and that both the ECB and JCB (Japan Central bank) are deep in quantitative easing, it is hard to see how the Dollar could suffer anything beyond a significant Investor Cycle Low.

Investor Cycle Trading Strategy

No trades.

Daily Cycle Trader Strategy

No trades.

Portfolio Positions Summary

Investor Cycle Portfolio –

None.

Daily Cycle Trader Portfolio –

None.

U.S Bonds

Cycle Counts

| Cycle |

Count |

Observation |

Probable Outlook

|

Cycle Clarity

|

Trend |

| Daily |

Day 25 |

Range 20-26 Days – (DC#3) |

Bearish |

Green |

Up |

| Investor |

Week 13 |

Range 22-26 Weeks |

Neutral

|

Green

|

Failed |

| 3Yr |

Month 23 |

Range 50-56 Months- |

Bullish

|

Green

|

Up |

I’d like to provide additional clarity to earlier comments about an equity market top and general economic weakness. The below chart shows the difference in yield between 10-year and 2-year treasury bonds. As the economy expands, investors seek riskier assets and sell the long bond, driving its yield up, so the spread generally increases.

However, as the economic Cycle ages and sentiment begins to sour, the long-term outlook becomes poorer and risk increases. When this happens, the 10-year bond is bought, either for safety or because investors don’t feel the risk/reward tradeoff of risk assets justifies putting capital to work in them. This drives the yield down on the long bond, and decreases the spread between it and the 2 year.

This fluctuation in yield is apparent in the business Cycle as the economy expands and then contracts. Because the business cycle is already beyond the normal timing for a recession, and with the long bond’s curve flattening quickly (as it has right before past recessions began), only another massive QE program can stop it. Notice below how past QE programs stooped the yield curve from flattening.

This is why I am overall bullish on the US bond market – it is seen as an ultimate safe haven asset. It is not the national debt level or the long-term ability to sustain it that drives price – one look at the Japanese market should made that clear. In times of trouble, US treasury bonds are considered the safest of all asset classes, and almost all large capital flows into them.

A significant weekly trend change has occurred. Because we have an Investor Cycle Low and an Investment Cycle High that exceed those of the last IC, bonds have confirmed an upward trend. And the move higher might not be over yet. With a Week 12 high, the Cycle should both be Right Translated and stay above the prior Cycle Low. This trend change is important in that it confirms the weakness in the equity markets. After a brief decline into the next ICL, bond strength could push yields to record lows.

Investor Cycle Trading Strategy

No trades at present. I will not attempt to catch a top and trade against the trend. Our best bet will be to wait several weeks and buy the next ICL aggressively.

Daily Cycle Trader Strategy

No trades at present. I’m staying out – the market is too strong to Short.

Portfolio Positions Summary

Investor Portfolio –

None.

Daily Cycle Trader Portfolio –

None.

Natural Gas

Cycle Counts

| Cycle |

Count |

Observation |

Probable Outlook

|

Cycle Clarity

|

Trend |

| Daily |

Day 14 (Failed) |

Range 20-26 Days – (2nd DC) |

Bearish |

Green |

AMBER |

| Investor |

Week 8 |

Range 22-26 Weeks |

Depends on Daily

|

Green

|

Down |

| 3Yr |

Month 43 |

Range 48-52 (Months) |

Bearish |

Green |

Down |

Natural gas is an asset locked in a massive bear market, showing a recent failed Daily Cycle and a new set of lower highs and lows. Such an asset is one that cannot be trusted on the Long side anymore, regardless of how bullish the chart or Cycles may have appeared just a few weeks ago. Opinions are loosely held and when the market dictates it, we change our view to match what price is showing us.

Yes it was an extremely impressive move out of those December lows, but the action since topping in early January shows little confidence or a willingness to follow through. Therefore, I can only assume that the bear market is taking hold again and therefore I must remain bearish on natural gas.

Investor Cycle Trader Strategy

N o trades at this time. Long trades should be off the table, a possible short trade not for another 3-4 weeks.

Daily Cycle Trader Strategy

No trades.

Portfolio Positions Summary

Investor Portfolio –

None

Daily Cycle Trader Portfolio –

None.