Posts

The Next Crude Spill

/in Public /by Bob Loukas

An important caveat to my Crude Oil outlook is that I continue to believe that Crude is in a bear market, and that its long term trend is down. The past 12 months clearly support my position, but if that no longer applies, if Crude is no longer in a bear market, my subsequent analysis will be incorrect. Some analysts attempt to predict major cyclical turns before they occur, but I believe it is more prudent to wait for evidence and confirmation before reacting.

If Crude is in a bear market, the current advance has gone about as far as it can; since the last major low in February, Crude has risen substantially. And enough weeks have passed that another bear market decline that blindsides the bulls would not be a surprise here.

As with equities, the Crude market’s fundamentals seem to be on vacation for now. And this creates an ideal environment for trapping unsuspecting Long speculators. Greed has taken over, and traders seem determined to drive Crude higher in a speculative rally. In the short term, fundamentals are often swamped by emotion. And in the case of Crude, the amount of excess Oil flooding the markets has become immaterial in the face of substantial, emotion-driven speculation.

With Crude at such an important week 13 crossroads, it’s important to note that speculative Longs are near a record high again. The COT report shows that Longs are making leveraged bets on higher prices at exactly the point in the Cycle where we would expect a downturn. Considering the normal ebb and flow of markets, excessive Long speculation near a potential top is not surprising.

Of course, if a new bull market for Crude is underway, the above observations are pointless. The Investor Cycle rally would likely extend higher by another 3-4 weeks to a likely week 16 to 18 top.

That said, we need to remember that bear markets, especially in the energy sector, are rarely just a 12-month event. The fundamentals of supply and demand, the underlying reason for the original price collapse, are nowhere near the level needed to launch a new bull market. This idea is supported by the fact that the most speculative corner of the energy market, US shale producers, has not seen a significant downturn yet.

We know that Venezuela, Russia, and Iran, all major Crude producers, are struggling to balance their budgets. As such, none are in a position to reduce production to support manipulating price higher. The only producer with the ability to potentially reduce production is Saudi Arabia, but the Saudis are bleeding economically, and simply can’t sustain further cuts in revenues. They are churning through some $10-$20 billion per month in foreign reserves to balance their budget, so do not have the ability to cut production by the 2 million+ barrels per day needed to stabilize supply and demand.

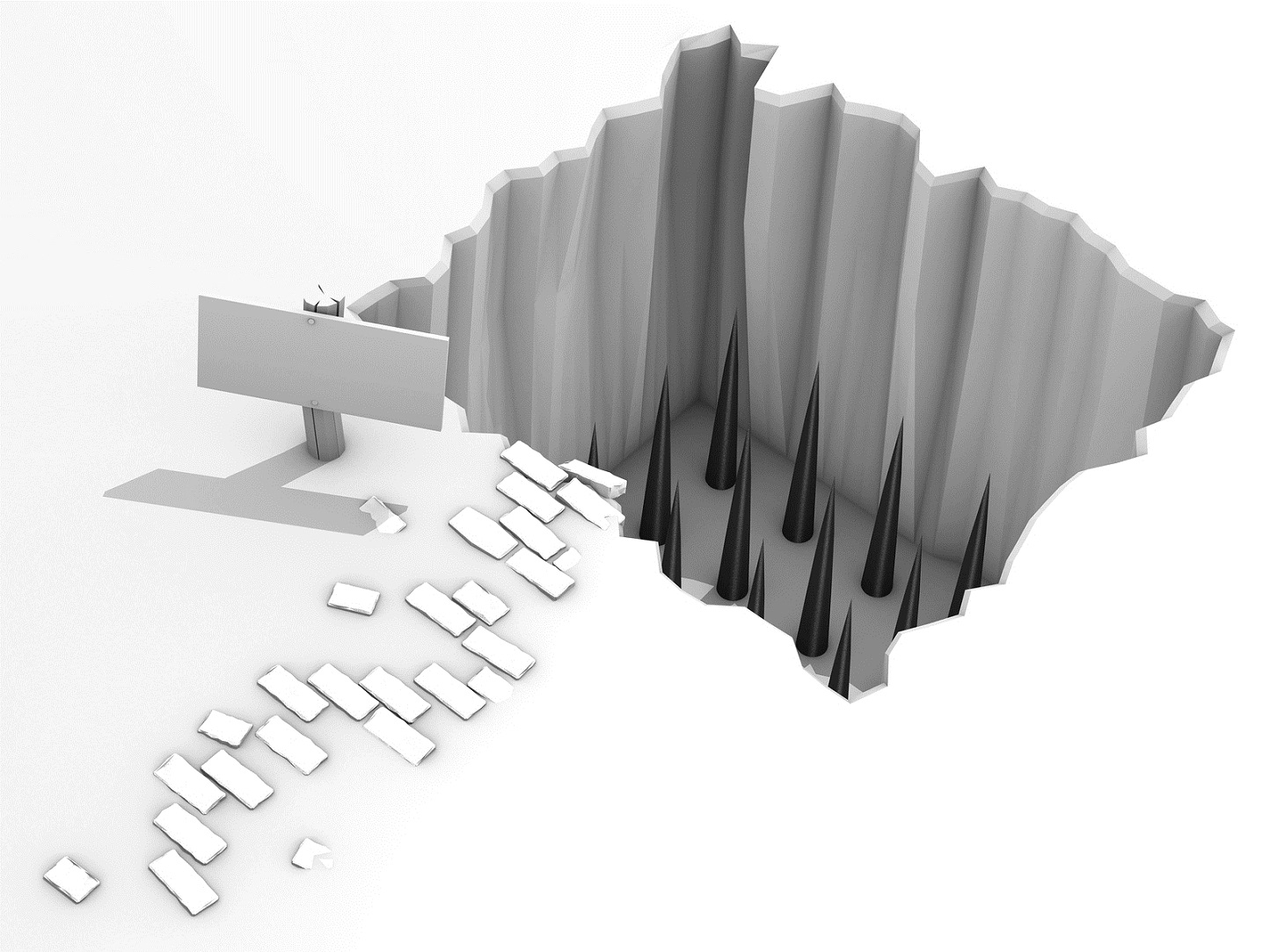

Crude’s advance in the face of poor market dynamics leaves it with an Investor Cycle in a precarious position. As outlined earlier, a bear market Investor Cycle making a new high in week 13 is certainly in the topping zone, so Crude could turn over at any time. The previous IC top was near $50, so, in theory, we could still see another surge higher in the coming week or two. In any event, I fully expect Crude to turn down and to begin to sell-off with relentless ferocity.

NOTE: It’s just $99 for a full 3 months of membership, a fraction of what one stopped out trade is likely to cost you. Consider joining The Financial Tap and receive two week reports and the education you need to become a better trader or investor See >> SIGN UP PAGE!