Posts

Midweek Market Update

/in Premium /by Bob LoukasAs Long as the Music is Playing

/in Premium /by Bob LoukasMidweek Market Update

/in Premium /by Bob LoukasCrude Oil – Headed Lower

/in Public /by Bob LoukasAn excerpt from this past weekend member report.

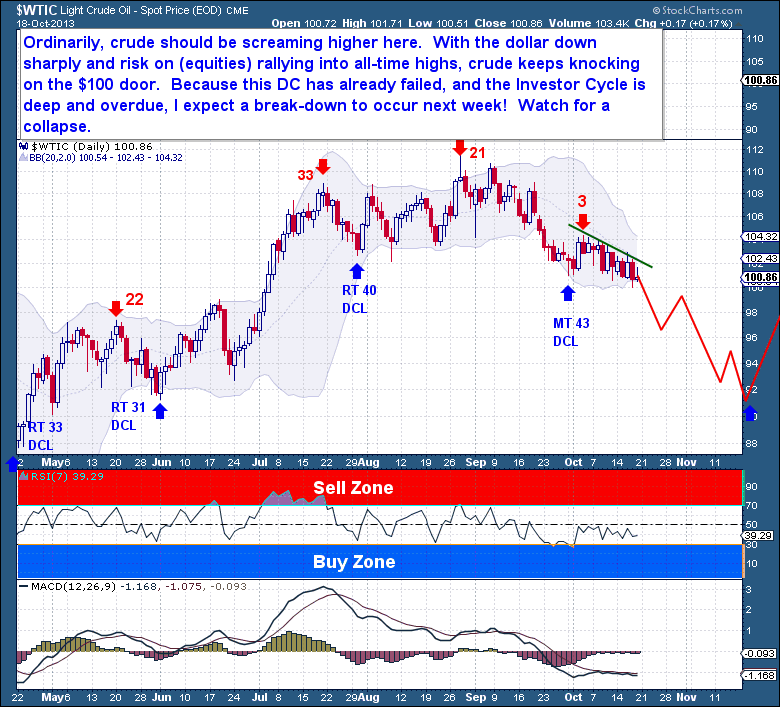

Ordinarily, Crude should currently be screaming higher. The Dollar is down sharply, and equities have been on a tear. Yet, Crude has struggled to hold recent gains while risk markets have exploded upward. This is not a positive development for Crude’s upside.

I believe the weakness in this Daily Cycle foreshadows what lies directly ahead. As Crude continues to knock on the lower resistance area around the $100-$102 level, it is threatening a fall through that floor. Because the current Daily Cycle has already failed, a continued decline into a Daily Cycle Low is a fairly sure thing. The Investor Cycle is 27 weeks deep, well into its final decline into an Investor Cycle Low. As both the Daily and Investor Cycles are in decline, I firmly expect a break-down below $100 to begin next week.

Crude is the most important of all raw materials, so whenever the economy is doing well, higher demand generally drives higher Crude prices. But the world economy is not growing, at least not at a meaningful rate. So demand should remain slack at a time when supply is concurrently increasing. Demand and supply do not impact day-to-day price swings significantly, but they do impact the longer term Cycles.

Crude is the most important of all raw materials, so whenever the economy is doing well, higher demand generally drives higher Crude prices. But the world economy is not growing, at least not at a meaningful rate. So demand should remain slack at a time when supply is concurrently increasing. Demand and supply do not impact day-to-day price swings significantly, but they do impact the longer term Cycles.

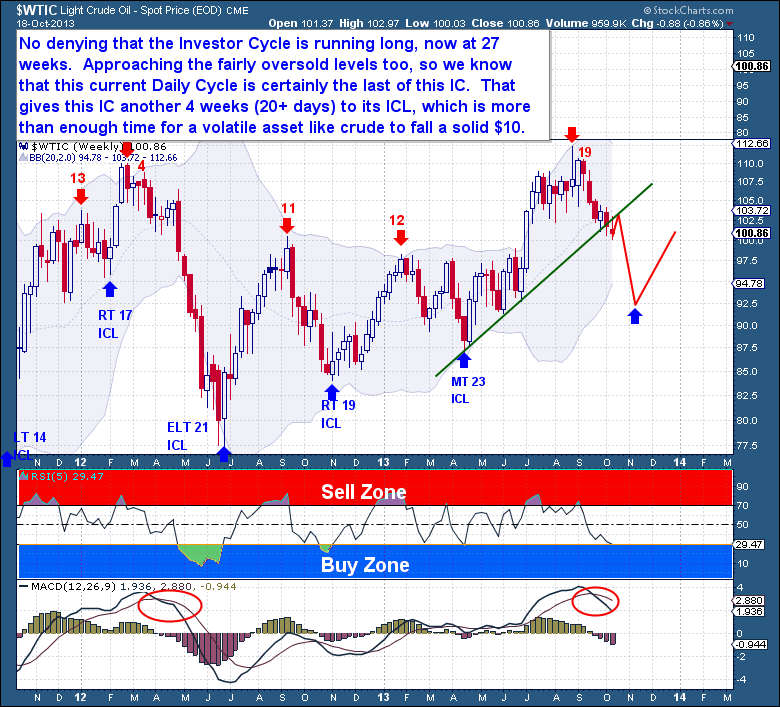

At 27 weeks, the current Investor Cycle is running long. It’s also approaching oversold levels, so the current Daily Cycle is almost certainly going to be the last of the current Investor Cycle. Crude has another 20+ days to find its next major low, more than enough time for a volatile asset to fall significantly. A move of $10-$15 in just 4 weeks may sound implausible, but prior Investor Cycle’s highlight just how capable Crude is of large moves.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences.

You're just 1 minute away from profitable trades! If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/landing/try#

Free Report – Complete the form below