If we are to believe market commentators, then Gold is being held back because the FED’s QE may be ending sooner than expected. The argument is that if the economy improves, the FED will back out of asset purchases (QE), and the gold bull market will end. But the FED has said it would continue to purchase assets to the tune of $85B per month, for as long as the unemployment rate remained above the 6.5% mark.

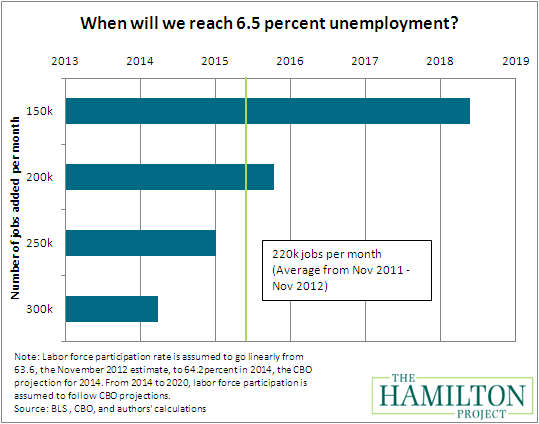

So the question becomes, when should would we realistically expect to see this level achieved. In order to bring unemployment down to that 6.5% level, the economy will need to add nearly 5 million jobs. That amount also includes providing jobs for the first time workers entering the force.

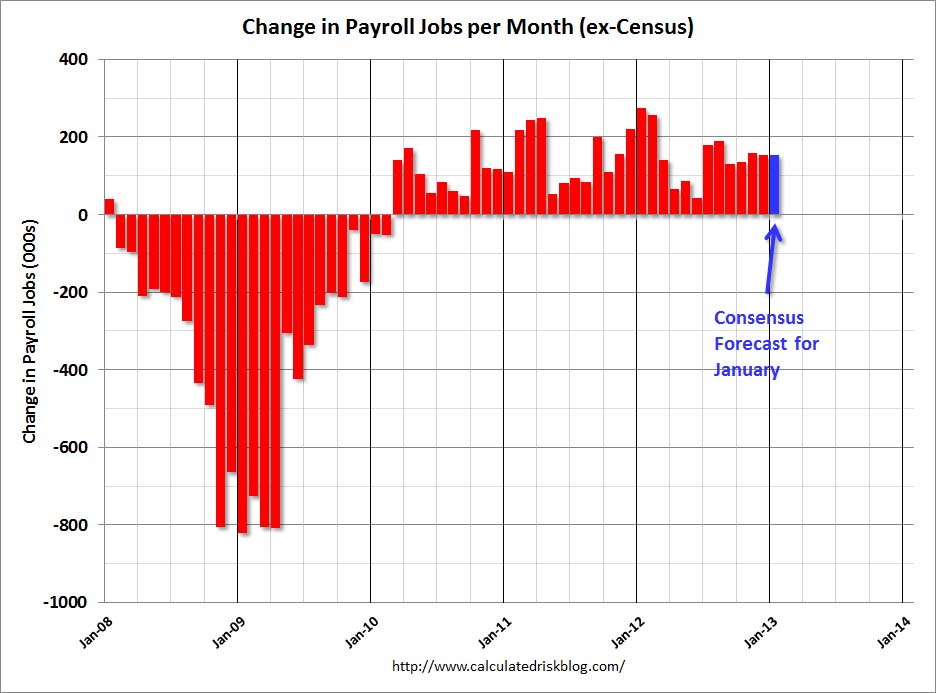

As you can see from the above chart, we’ve struggled to add more than 200k jobs in any given month. Also this business cycle is now in its 4th year and in danger of entering into a recession. The FED has held rates at zero for years and has implemented 5 years of QE, yet the best this economy can manage is employment growth that barely keeps up with a rising population.

In 2013 the economy also faces some headwinds. We’ve moved from an environment where the government was stimulating (spending), to one where they are cutting spending at rates not seen since the 90’s. The coming budget fights will surely result in additional cuts; these will only serve to slow the economy further. The end of the payroll tax holiday has already hit the majority of US taxpayers as have tax increases on the high income earners. These newly implemented policies, along with what will surely be additional austerity measures in the coming budget showdown, add significant downside risk (shock) that is not adequately priced in by the markets.

The impact of these policies was evident within this week’s release of negative Q4 GDP data. The main component bringing down GDP was a reduction in government spending. Although this data was ignorantly dismissed “as a one off” miss, it demonstrates that where the government had a heavy hand in this recovery, its absence or hastily withdrawal from it in 2013 and beyond will only serve to be a drag on employment growth.

Let’s put the threat of a recession and a further slowdown in job creation aside for a minute. Let's choose to ignore it and just assume a more optimistic growth run rate at 200k per month. Even at this rate, we’re talking about the FED pumping in $85B per month for the next 2.5 years! That’s an additional $2.5T to add to their existing $3T balance sheet. So under “rosy forecasts”, we’re looking at a FED balance sheet in the order of $5T-$6T by 2015. If this economy experiences even a mild contraction or slowdown, then that time-frame would easily be pushed out towards 2017-2018 where the FED’s balance sheet will be closer to $8T.

So that brings us back to the FED’s support of the economy through asset purchases of bonds and mortgage back securities. I find it almost impossible that the FED can withdraw prematurely; especially as the economy is now feeling the effects of the government implementing growth slowing austerity. But regardless of the government cuts, the US will continue to rack up $1T annual deficits that will add to the pile of $16T IOU’s that have been issued. By 2017, that number will easily exceed $20T and the US will find itself in the position where it simply could not sustain any increase in the interest rate it pays on this debt. There is just no way the FED could possibly withdraw itself from the bond market at that point, as we’re beyond the 100% of Debt to GDP level and climbing. The interest burden alone will force the FED to remain active, regardless of what the unemployment rate is.

For those members who fear an end to this great gold bull market, please put this into perspective. Understand that the powers to be will not or cannot tell the public what is really occurring. Partisan battles in Washington regarding debt containment are just choreographed noises to appease the masses. We’ve entered the final stages of a debt super cycle and the powers have chosen to confront this cycle by printing more fiat to “cover the tab”. By increasing the amount of fiat is supply, you reduce the burden of debt as you devalue its worth and raise the “nominal” price of all assets.

It’s why within the Long Wealth Portfolio I stay invested in precious metals to the tune of 35-40%. It’s also why I have purchased hard assets such as income producing property. My associated debt on this property is fixed, however the asset value and income will rise in relative proportion to inflation. I’m not calling for a hyper-inflationary crash, but it would be naïve not to believe that the FED’s primary goal here is to inflate all assets.

Come ride the next major Gold Cycle with us. Click onto the "Free Trial" button below for more details regarding our zero obligation and free 15 day trial. Or to find out more about the service, click here for the About Us Page.

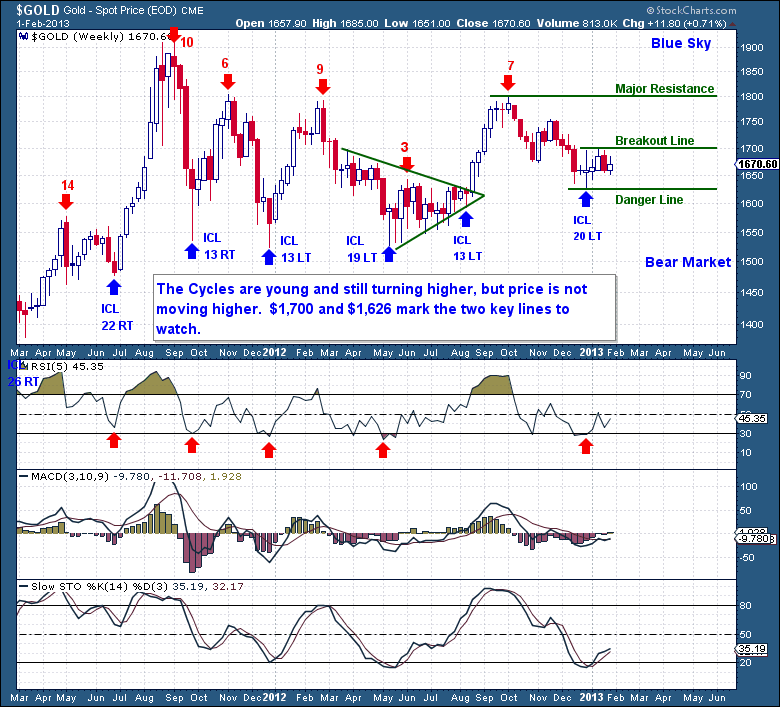

Of course we’re talking about longer term themes in the above section. For the immediate concern of our Investor portfolio positions, the Gold Cycle continues to “spin its wheels”. Any traction gained or attempts at forward progress are quickly reversed with a rush of powerful selling. It’s hard to tell what the intermediate cycle significance of this see-sawing action is. I’m at the point here where I just need to give up on tracking the Daily Cycle swings and focus more of my attention on the Investor Cycle.

The Investor Cycle is only entering Week 5 and it remains under-loved with plenty of potential to make a big run higher. But in the same breath, it has failed to attract the type of demand needed to break out into the $1,700’s and beyond. The Cycle is showing us two very important resistance lines, which when broken, will likely determine the course of the Cycle over the next 10 weeks.

The Investor Cycle is only entering Week 5 and it remains under-loved with plenty of potential to make a big run higher. But in the same breath, it has failed to attract the type of demand needed to break out into the $1,700’s and beyond. The Cycle is showing us two very important resistance lines, which when broken, will likely determine the course of the Cycle over the next 10 weeks.

As has been discussed before, a move above $1,700 will move the Cycle out into new Cycle highs and clearly break the downtrend established since the October top. A move above $1,700 should be aggressively bought. However a drop below $1,651 (prior Half Cycle Low) and more importantly below $1,626 (last ICL), would be a very negative development. Such a failure this early in the Investor Cycle might well signal that this great Gold bull market wants to put the investor through one last massive draw-down.

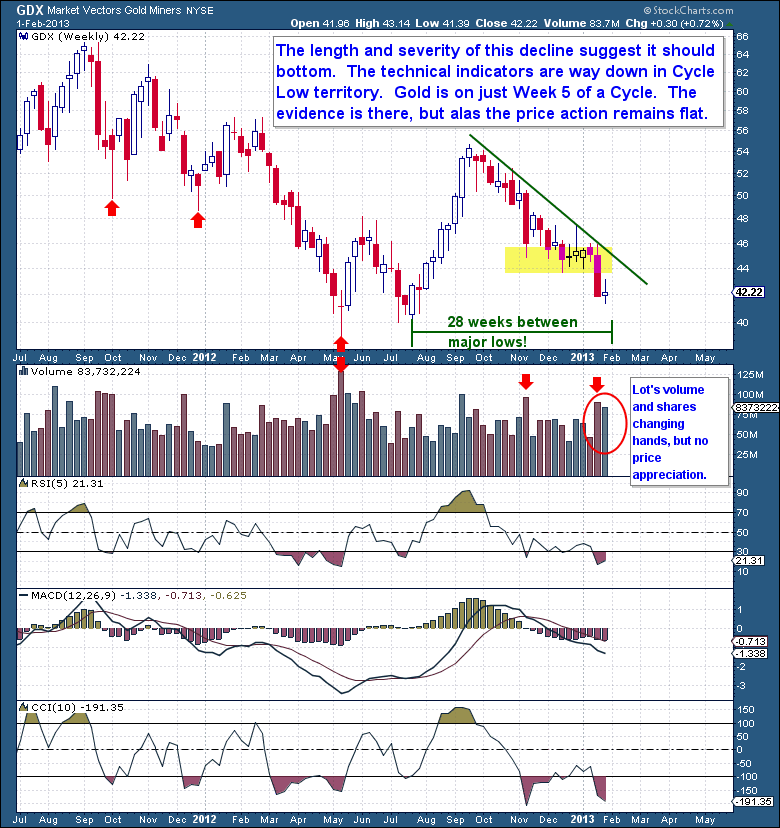

As for the miners, it’s “groundhog day”, again. All members are familiar with the chart below, along with my usual warning that the trend remains lower and the action is weak. Recent volumes and selling pressure have suggested capitulation, possibly pointing to a Cycle that may have reached a significant low. But with so many shares changing hands, we still see no price appreciation, and this is concerning.

This as is an excerpt from "The Financial Tap" weekend premium report focusing on the Gold Cycles. The service is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets, delivered twice weekly, as well as real time trade alerts to profit from market inefficiencies. Click onto the "Free Trial" button below to register for a zero obligation, 15 day trial.

“Showtime”

/in Public /by Bob LoukasShowtime

Nobody ever said riding a (gold) bull market was easy. Unless you’re prepared to buy, close your eyes, and come back years later, then I’m afraid we have to take the good with the bad.

The Investor Cycle is just oversold, overextended, and is now throwing off buy signals that have worked throughout this bull market. This is the 2nd straight weekly close below the Bollinger Bands, the first time ever for this bull market. The COT report is as constructive as its been in well over a year. Because in the short run markets can “do as they please”, we know a slightly lower low can never be ruled out. But a sustained drop from this point just looks extremely unlikely. See Glossary for terms and acronyms

Like past weeks, sentiment just continues to deteriorate further than anyone thought possible. I know sentiment is not a perfect timing tool, but the depths of despair shown by gold-bugs is very important. Please keep this chart in mind when viewing the longer and more dominant Cycles presented further in this report. With sentiment at record lows, it makes it difficult to support a scenario where gold falls much further over a longer period of time.

This next chart is the most important chart this week. On the Daily, Weekly, and Monthly levels, we’re now at that “show me the money” moment. Basically the 12 year bull market as we know it is being tested right here. How it responds in March will likely reveal exactly how this bull market will unfold over the next 1-2 years.

Firstly, the 12 year secular bull market channel on a monthly chart is being challenged. A break below this lower channel opens the floodgates to all sorts of bearish scenarios. A channel breakdown alters the landscape and removes the “known boundaries” of this great bull market.

The monthly Bollinger Bands are also being tested for the first time of this bull market. This is a testament to the length of this consolidation. This 18 month consolidation and basing period has reduced volatility to the lowest levels of this bull market. The result being Bollinger Bands that have tightened to the narrowest levels ever, and this indicates that a massive multi-month move is imminent.

February marked 5 straight declining months for gold, yet another bull market record. If the bull market channel is to break, then we would see a 6th straight declining month, technical indicators and oscillators reaching unimaginable levels, and sentiment consistent with “secular bear markets”.

In short, right here and now, this is either the dawn of a new multi-month rally, or it’s the start of a breakdown to indeterminable levels, over many more Investor Cycles.

Come ride the next major Gold Cycle with us. Click onto the "Free Trial" button below for more details regarding our zero obligation and free 15 day trial. Or to find out more about the service, click here for the About Us Page.

The most significant development was the bullish reversal exhibited by the PM’s today. Today’s move occurred on very heavy volume and was the largest gaining day since September 13th, 2012. More importantly, it came on a day where the morning session was printing fresh new 4 year lows.

A good day for the miners today, but a 4% rally off such lows is not going to fool anyone. I know it’s hard to get excited because its been a brutal 24 week crash for the miners. The past 24 week decline is riddled with 1 to 5 day rallies that only served as fodder for the aggressive short traders. And I believe this is exactly the point now. This is exactly how bear markets end, they surge out of nowhere but just keep going and going. The numerous counter trend tops over the past 24 weeks have served to crush our sentiment and alter our expectations. We’ve become numb and immune to the declines, to the point where we just subconsciously expect it. Of course it does not need to be now, but the conditions for that major low are very firmly in place.

I’m not making a prediction here; I’ve stayed away from doing so during this 24 week drop and its served me well. That’s because no matter how bullish this reversal appears, the trend on the chart is still down. Whatever the outcome, this move should have some legs and be good for a move back to the $40 level, even if we’re eventually headed for further lows.

But let me end my Gold Cycle analysis by saying that I’ve never been more confident in a PM Low throughout this past 24 weeks, as I am now. This type of “hammer” reversal on the weekly chart, on heavy volume (while just having made 4 year lows), is just purely bullish. When this is coupled with the lengthy list of Investor Cycle Low readings I presented in the weekend report, it gives me reason to be optimistic. The timing of this move is also “conveniently” very favorable, as the Gold Cycle should begin to rally now if February marked that major low. So the setup is now in place, but everyone has lost faith in the miners as they repeatedly "cry wolf”. I’m not so sure they will this time.

Come ride the next major Gold Cycle with us. Click onto the "Free Trial" button below for more details regarding our zero obligation and free 15 day trial. Or to find out more about the service, click here for the About Us Page.

Fiat King – March 2nd

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Market Update Report – Feb 27th

/in Premium /by Bob LoukasYou don’t have access to view this content

Blood in the Street – Feb 23rd

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Market Update Report – Feb 20th

/in Premium /by Bob LoukasYou don’t have access to view this content

How About a Shine, Sir – Feb 16th

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Market Update Report – Feb 13th

/in Premium /by Bob LoukasYou don’t have access to view this content

Sleeping Giant – Feb 9th

/in Premium /by Bob LoukasYou don’t have access to view this content

Market Update Report – Feb 6th

/in Premium /by Bob LoukasYou don’t have access to view this content

They’re Trying to Shake You Out!

/in Public /by Bob LoukasIf we are to believe market commentators, then Gold is being held back because the FED’s QE may be ending sooner than expected. The argument is that if the economy improves, the FED will back out of asset purchases (QE), and the gold bull market will end. But the FED has said it would continue to purchase assets to the tune of $85B per month, for as long as the unemployment rate remained above the 6.5% mark.

So the question becomes, when should would we realistically expect to see this level achieved. In order to bring unemployment down to that 6.5% level, the economy will need to add nearly 5 million jobs. That amount also includes providing jobs for the first time workers entering the force.

As you can see from the above chart, we’ve struggled to add more than 200k jobs in any given month. Also this business cycle is now in its 4th year and in danger of entering into a recession. The FED has held rates at zero for years and has implemented 5 years of QE, yet the best this economy can manage is employment growth that barely keeps up with a rising population.

In 2013 the economy also faces some headwinds. We’ve moved from an environment where the government was stimulating (spending), to one where they are cutting spending at rates not seen since the 90’s. The coming budget fights will surely result in additional cuts; these will only serve to slow the economy further. The end of the payroll tax holiday has already hit the majority of US taxpayers as have tax increases on the high income earners. These newly implemented policies, along with what will surely be additional austerity measures in the coming budget showdown, add significant downside risk (shock) that is not adequately priced in by the markets.

The impact of these policies was evident within this week’s release of negative Q4 GDP data. The main component bringing down GDP was a reduction in government spending. Although this data was ignorantly dismissed “as a one off” miss, it demonstrates that where the government had a heavy hand in this recovery, its absence or hastily withdrawal from it in 2013 and beyond will only serve to be a drag on employment growth.

Let’s put the threat of a recession and a further slowdown in job creation aside for a minute. Let's choose to ignore it and just assume a more optimistic growth run rate at 200k per month. Even at this rate, we’re talking about the FED pumping in $85B per month for the next 2.5 years! That’s an additional $2.5T to add to their existing $3T balance sheet. So under “rosy forecasts”, we’re looking at a FED balance sheet in the order of $5T-$6T by 2015. If this economy experiences even a mild contraction or slowdown, then that time-frame would easily be pushed out towards 2017-2018 where the FED’s balance sheet will be closer to $8T.

So that brings us back to the FED’s support of the economy through asset purchases of bonds and mortgage back securities. I find it almost impossible that the FED can withdraw prematurely; especially as the economy is now feeling the effects of the government implementing growth slowing austerity. But regardless of the government cuts, the US will continue to rack up $1T annual deficits that will add to the pile of $16T IOU’s that have been issued. By 2017, that number will easily exceed $20T and the US will find itself in the position where it simply could not sustain any increase in the interest rate it pays on this debt. There is just no way the FED could possibly withdraw itself from the bond market at that point, as we’re beyond the 100% of Debt to GDP level and climbing. The interest burden alone will force the FED to remain active, regardless of what the unemployment rate is.

For those members who fear an end to this great gold bull market, please put this into perspective. Understand that the powers to be will not or cannot tell the public what is really occurring. Partisan battles in Washington regarding debt containment are just choreographed noises to appease the masses. We’ve entered the final stages of a debt super cycle and the powers have chosen to confront this cycle by printing more fiat to “cover the tab”. By increasing the amount of fiat is supply, you reduce the burden of debt as you devalue its worth and raise the “nominal” price of all assets.

It’s why within the Long Wealth Portfolio I stay invested in precious metals to the tune of 35-40%. It’s also why I have purchased hard assets such as income producing property. My associated debt on this property is fixed, however the asset value and income will rise in relative proportion to inflation. I’m not calling for a hyper-inflationary crash, but it would be naïve not to believe that the FED’s primary goal here is to inflate all assets.

Come ride the next major Gold Cycle with us. Click onto the "Free Trial" button below for more details regarding our zero obligation and free 15 day trial. Or to find out more about the service, click here for the About Us Page.

Of course we’re talking about longer term themes in the above section. For the immediate concern of our Investor portfolio positions, the Gold Cycle continues to “spin its wheels”. Any traction gained or attempts at forward progress are quickly reversed with a rush of powerful selling. It’s hard to tell what the intermediate cycle significance of this see-sawing action is. I’m at the point here where I just need to give up on tracking the Daily Cycle swings and focus more of my attention on the Investor Cycle.

As has been discussed before, a move above $1,700 will move the Cycle out into new Cycle highs and clearly break the downtrend established since the October top. A move above $1,700 should be aggressively bought. However a drop below $1,651 (prior Half Cycle Low) and more importantly below $1,626 (last ICL), would be a very negative development. Such a failure this early in the Investor Cycle might well signal that this great Gold bull market wants to put the investor through one last massive draw-down.

As for the miners, it’s “groundhog day”, again. All members are familiar with the chart below, along with my usual warning that the trend remains lower and the action is weak. Recent volumes and selling pressure have suggested capitulation, possibly pointing to a Cycle that may have reached a significant low. But with so many shares changing hands, we still see no price appreciation, and this is concerning.

This as is an excerpt from "The Financial Tap" weekend premium report focusing on the Gold Cycles. The service is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets, delivered twice weekly, as well as real time trade alerts to profit from market inefficiencies. Click onto the "Free Trial" button below to register for a zero obligation, 15 day trial.