The equity markets are finally seeing action that has even the most hardened bulls running scared. In the past, I’ve been quick to dismiss selling periods – Cycle Lows – as natural regression-to-the-mean events. In a bull market, an oscillating Cycle pattern of two steps forward and one step back is what drives an asset higher. But this time is different…two steps back is completely out of character. So much so, that I now believe that the 3.5 years bull market is now in serious trouble.

If we were to look for reasons to explain the recent selling, there are plenty to be had. The most likely is not a specific piece of news or single data point, but that the collective herd of market participants is fickle and can be easily spooked. The current bull market has broken plenty of records, including the length of time – more than 3 years – since a 10% correction. This has resulted in double-digit market gains for consecutive years, and a near vertical rise over a sustained period of time. Against the backdrop of a soft world economy, this performance is nothing short of remarkable.

What are potentially playing out are the very beginnings of a market turn. We could soon experience an environment of reversing psychology, where all tidbits of news will be construed as negative for the markets. It takes a lot of confidence (and ignorance) to elevate and sustain a market at present levels, especially one built on blind faith and the idea that the FED can keep the market elevated into perpetuity. This has bred a level of speculation, and arrogance, often seen at the top of longer dated Cycles.

If we need a catalyst for a potential market sell-off, we need only look toward Europe. Although the EU is just one market in the inter-connected global economy, it still makes up almost 25% of world GDP. And it’s large enough that any issues will send shock waves through world markets.

The EU’s problems are structural in nature, with too much government red tape, inefficient and constrictive regulations, and a labor policy that is not consistent with a rapidly-changing world economy. In addition, EU leaders have made poor choices of late. In particular was the instance on excessive austerity at precisely the wrong time in the Business Cycle. Austerity is choking what little life remains in the European economy, and is consuming capital needed to support investment and growth initiatives. The time to pay down debts and reign in spending is during good times; doing so gives the flexibility to loosen the reins and deficit spend during bad times.

What’s developing in Europe is a negative economic feedback loop comprised of declining sales, lower production, declining income and lower employment. This is compounded by a general lack of leadership across the continent, and a flawed, unworkable economic union. The northern countries have been somewhat sheltered up to this point, primarily because the single currency has been very advantageous to them versus the consumption-focused economies in the South. In addition, France has faltered recently and has now made it clear that it cannot adhere to a capped budget while the economy shrinks.

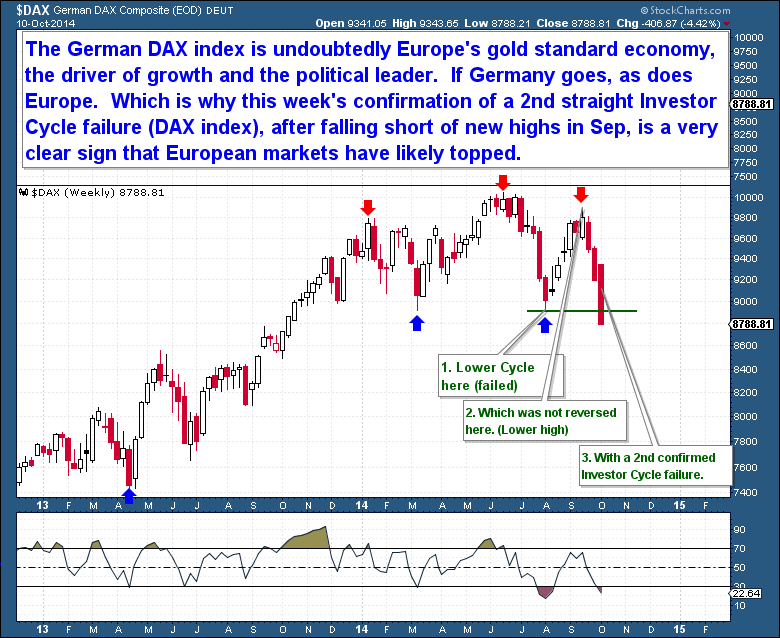

Technically, the stock market is often months ahead of the general economy when it comes to predicting economic recession. Although the German market is near all-time highs, a failed cycle has developed. This is very likely associated with a market that has topped. On the below weekly chart, the first sign of a top was the Cycle failure in August. The market’s inability to rally to new highs in September was a failed opportunity to negate the August Cycle failure. But the nail in the coffin for German equities was Friday’s plunge, which took the index below the August lows and created another failed Cycle. Multiple failed cycles are exactly how markets top and turn over.

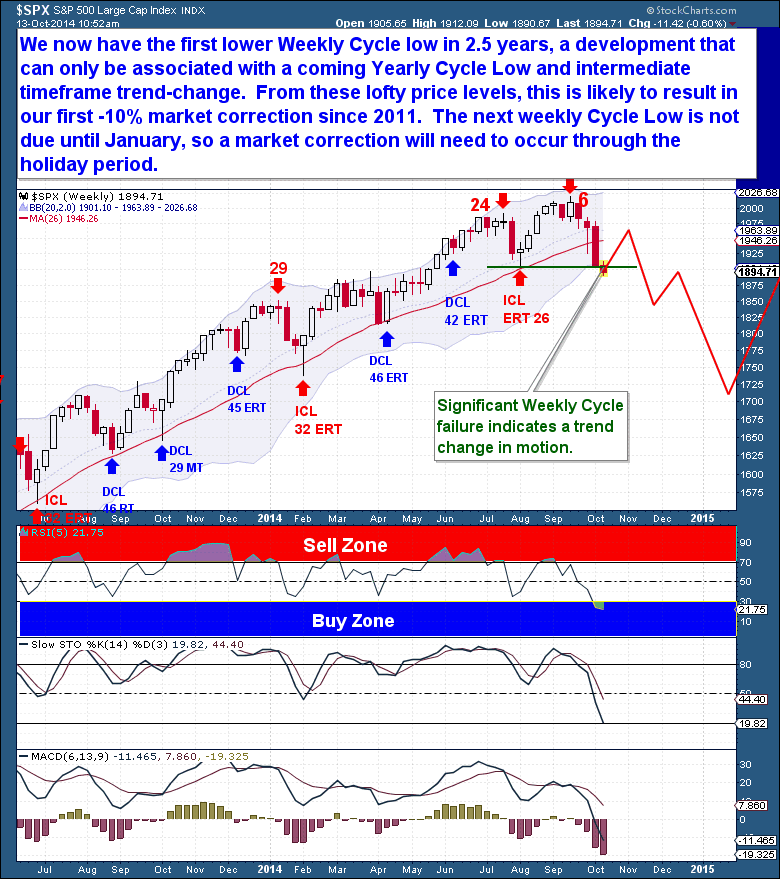

Here in the US, Equity Cycles are also showing similar technical damage. Technically, the great bull market is still intact, and a short-term rally is more than overdue. But to see this 1st Daily Cycle (normally the most bullish Cycle) retrace more than 100% into a failed state, is very odd behavior. A Cycle failure with increased volatility can only be seen as a significant change in character for the bull market, which is why I’m very concerned that the 3 year bull run is coming to an end. With other markets such as the DAX and Russell also showing Cycle failures, we need to strongly consider the possibility that a Left Translated Investor Cycle is in development.

I’m trying to balance bearish evidence (that is suddenly very evident) with what remains a bull market of historic proportions. In 2013 and 2014, the bull market needed to be respected, but was clearly on borrowed time. Because the bull market was not based on fundamentals, and with the market extremely extended, once the market tops, a correction is likely to occur within a very short period of time.

Because the S&P has retraced more than 100% of the Daily Cycle, within the first Daily Cycle, we now have a confirmed Cycle failure on the Weekly chart too. This is likely to be confirmation that the Investor Cycle has topped and 3 long months of declines are ahead for world markets. Of course, it’s never a straight move down, the market is significantly oversold here, so the expectation will be for a rally back toward the 50dma (the 1,975 area). Such a rally would occur as part of the 2nd Daily Cycle, but that rally should fail to make new highs since the market failed to hold the August lows at 1,904 next.

The primary reason for my bearishness is that Cycle failures in all of the major indices (NASDAQ, Russell, S&P and DAX) are leading indicators of a broader market top. And with that evidence in mind, the below monthly chart of the S&P is confirming that divergences are likely a prelude to a move lower into a Yearly Cycle Low. But to be clear, this isn’t a call on the health of the bull market that began in 2009. Even a market correction (-10%) in the coming months will not be enough (at this point) to alter my view of the bull.

On the below monthly chart, the S&P has fallen below a very well-defined 36 month rising wedge. Losing a channel of this size, along with the Cycle failures, are signs of real market trouble. The breakdown in the technical indicators is also indicating that this is the beginning of a multi-month decline. An Investor Cycle failure is always a prerequisite for a Yearly Cycle top, and a week 6 Investor Cycle top (see chart above) fits well with how Yearly Cycles normally come to an end. A week 6 top also allows for at least 12 more weeks before this Investor Cycle concludes, meaning we’re likely to experience a fast, step-down process lower into the next Weekly and Yearly Cycle Lows in early 2015.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, and US Bond Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit https://thefinancialtap.com/landing/try#

Midweek Market Update – Nov 5th

/in Premium /by Bob LoukasYou don’t have access to view this content

You Want War!

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Market Update – Oct 29th

/in Premium /by Bob LoukasYou don’t have access to view this content

It’s a Matter of Trust

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Market Update – Oct 22nd

/in Premium /by Bob LoukasYou don’t have access to view this content

Crude Oil is Hitting Bottom

/in Public /by Bob LoukasIn the past, we’ve discussed at length the structural problems facing Crude. So the pressure the energy markets are under, both from the demand and supply sides, should come as no surprise. This double whammy to the Crude market is not likely to be resolved overnight; demand-supply issues require time to work through a market.

Through hydraulic fracking and a massive influx of investment capital, the US has again become a major oil producer. But it’s the speed with which new supply from the US has come on line that has taken the market by surprise and rocked prices.

The 4 million plus barrels of extra oil that the US is suddenly producing is causing a problem for exporters like Saudi Arabia, who now need to find new markets for their oil. Most of the world’s oil is not sold in futures contracts for delivery one to three months out. Rather oil contracts are long term in nature, made over 1 to 3 year periods. And the competition for existing oil markets has been fierce, forcing suppliers to drastically cut their prices relative to spot.

As the price of oil begins to fall, oil producing nations, most of whom are ill-equipped to handle sub-$80 pricing, will likely try to offset the revenue lost through lower prices by raising their production. Saudi Arabia, the only nation capable of meaningfully cutting production, has stated that it will likely increase production to maintain its revenue levels. The other nations capable of possibly cutting production are Iraq, Iran and Venezuela, but all have economic issues that make any cut (without general consensus) very unlikely.

This should only perpetuate the glut of supply into 2015, setting the scene for much further declines in price as the markets are faced with continuing demand problems. If the European recession turns into a continent-wide event, its impacts on the world economy and, by extension, the demand for oil will put Crude prices under even more severe pressure.

Judging by the Daily chart reversal in the energy stocks in the past 4 days, there is a good chance that Crude has finally hit (an intermediate time-frame) bottom. As outlined earlier, I’m not bullish on Crude’s longer term prospects, but the current sell-off has been severe, and is likely over for now. Given the uncertainty in the Crude markets, we need to see a close above the 10dma and Crude to form a Swing Low ($84.93). Once that occurs, it’s likely that a counter-trend bounce will move price back to at least the $90 level.

This sell-off has been extreme and much deeper than a standard ICL. The depth of the energy sector sell-off is on par with the last, big general market correction in 2011. The entire sector is now extremely oversold and should experience a decent rally during the next few weeks. But as in 2011, we don’t know is whether the current move down is just the beginning of a deeper decline.

Crude’s weakness isn’t surprising – sentiment has collapsed to near record low levels, below even those from late 2008. Based on the overdue nature of Crude’s Investor Cycle Low, extremely low sentiment readings are suggesting that, at the very least, a new Investor Cycle (this Cycle averages 20-24 weeks) rally is about to begin. In the past, at similar sentiment levels, a sell-off comparable to what we’ve seen would have marked the low for the Yearly Cycle. So as with the equity markets, Crude is seeing lows deep enough to spawn a multi-month rally. But we also have evidence that suggests that a structural decline is now in progress.

It’s clear that an extended 46 week Cycle is (or has already) coming to an end. The final 3 weeks yielded $12 in declines, clearly Yearly Cycle capitulation selling. If it hasn’t happened already, a new Investor Cycle will soon launch, so we’re faced with two questions: just how far the current Investor Cycle will rally, and whether a longer term bear market has arrived.

The presence of a new series of lower tops and lower lows on the Investor Cycle chart is suggesting that 2015 is likely to be a very challenging period for the energy markets. Like all assets, energy moves through Cycles of varying time-frames. I believe that the record investment of the past 5 years has resulted in too much production, which will lead to a period of business consolidation and bankruptcy.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, and US Bond Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit https://thefinancialtap.com/landing/try#

Feel free to share this post via the below social media avenues.

Is it Safe to Come Out and Play?

/in Premium /by Bob LoukasYou don’t have access to view this content

Midweek Market Update – Oct 15th

/in Premium /by Bob LoukasYou don’t have access to view this content

Cycle Failures Point to a Market Correction

/in Public /by Bob LoukasThe equity markets are finally seeing action that has even the most hardened bulls running scared. In the past, I’ve been quick to dismiss selling periods – Cycle Lows – as natural regression-to-the-mean events. In a bull market, an oscillating Cycle pattern of two steps forward and one step back is what drives an asset higher. But this time is different…two steps back is completely out of character. So much so, that I now believe that the 3.5 years bull market is now in serious trouble.

If we were to look for reasons to explain the recent selling, there are plenty to be had. The most likely is not a specific piece of news or single data point, but that the collective herd of market participants is fickle and can be easily spooked. The current bull market has broken plenty of records, including the length of time – more than 3 years – since a 10% correction. This has resulted in double-digit market gains for consecutive years, and a near vertical rise over a sustained period of time. Against the backdrop of a soft world economy, this performance is nothing short of remarkable.

What are potentially playing out are the very beginnings of a market turn. We could soon experience an environment of reversing psychology, where all tidbits of news will be construed as negative for the markets. It takes a lot of confidence (and ignorance) to elevate and sustain a market at present levels, especially one built on blind faith and the idea that the FED can keep the market elevated into perpetuity. This has bred a level of speculation, and arrogance, often seen at the top of longer dated Cycles.

If we need a catalyst for a potential market sell-off, we need only look toward Europe. Although the EU is just one market in the inter-connected global economy, it still makes up almost 25% of world GDP. And it’s large enough that any issues will send shock waves through world markets.

The EU’s problems are structural in nature, with too much government red tape, inefficient and constrictive regulations, and a labor policy that is not consistent with a rapidly-changing world economy. In addition, EU leaders have made poor choices of late. In particular was the instance on excessive austerity at precisely the wrong time in the Business Cycle. Austerity is choking what little life remains in the European economy, and is consuming capital needed to support investment and growth initiatives. The time to pay down debts and reign in spending is during good times; doing so gives the flexibility to loosen the reins and deficit spend during bad times.

What’s developing in Europe is a negative economic feedback loop comprised of declining sales, lower production, declining income and lower employment. This is compounded by a general lack of leadership across the continent, and a flawed, unworkable economic union. The northern countries have been somewhat sheltered up to this point, primarily because the single currency has been very advantageous to them versus the consumption-focused economies in the South. In addition, France has faltered recently and has now made it clear that it cannot adhere to a capped budget while the economy shrinks.

Technically, the stock market is often months ahead of the general economy when it comes to predicting economic recession. Although the German market is near all-time highs, a failed cycle has developed. This is very likely associated with a market that has topped. On the below weekly chart, the first sign of a top was the Cycle failure in August. The market’s inability to rally to new highs in September was a failed opportunity to negate the August Cycle failure. But the nail in the coffin for German equities was Friday’s plunge, which took the index below the August lows and created another failed Cycle. Multiple failed cycles are exactly how markets top and turn over.

Here in the US, Equity Cycles are also showing similar technical damage. Technically, the great bull market is still intact, and a short-term rally is more than overdue. But to see this 1st Daily Cycle (normally the most bullish Cycle) retrace more than 100% into a failed state, is very odd behavior. A Cycle failure with increased volatility can only be seen as a significant change in character for the bull market, which is why I’m very concerned that the 3 year bull run is coming to an end. With other markets such as the DAX and Russell also showing Cycle failures, we need to strongly consider the possibility that a Left Translated Investor Cycle is in development.

I’m trying to balance bearish evidence (that is suddenly very evident) with what remains a bull market of historic proportions. In 2013 and 2014, the bull market needed to be respected, but was clearly on borrowed time. Because the bull market was not based on fundamentals, and with the market extremely extended, once the market tops, a correction is likely to occur within a very short period of time.

Because the S&P has retraced more than 100% of the Daily Cycle, within the first Daily Cycle, we now have a confirmed Cycle failure on the Weekly chart too. This is likely to be confirmation that the Investor Cycle has topped and 3 long months of declines are ahead for world markets. Of course, it’s never a straight move down, the market is significantly oversold here, so the expectation will be for a rally back toward the 50dma (the 1,975 area). Such a rally would occur as part of the 2nd Daily Cycle, but that rally should fail to make new highs since the market failed to hold the August lows at 1,904 next.

The primary reason for my bearishness is that Cycle failures in all of the major indices (NASDAQ, Russell, S&P and DAX) are leading indicators of a broader market top. And with that evidence in mind, the below monthly chart of the S&P is confirming that divergences are likely a prelude to a move lower into a Yearly Cycle Low. But to be clear, this isn’t a call on the health of the bull market that began in 2009. Even a market correction (-10%) in the coming months will not be enough (at this point) to alter my view of the bull.

On the below monthly chart, the S&P has fallen below a very well-defined 36 month rising wedge. Losing a channel of this size, along with the Cycle failures, are signs of real market trouble. The breakdown in the technical indicators is also indicating that this is the beginning of a multi-month decline. An Investor Cycle failure is always a prerequisite for a Yearly Cycle top, and a week 6 Investor Cycle top (see chart above) fits well with how Yearly Cycles normally come to an end. A week 6 top also allows for at least 12 more weeks before this Investor Cycle concludes, meaning we’re likely to experience a fast, step-down process lower into the next Weekly and Yearly Cycle Lows in early 2015.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, and US Bond Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit https://thefinancialtap.com/landing/try#

At the Gates

/in Premium /by Bob LoukasYou don’t have access to view this content