Gold Sector Shining in a New Cycle

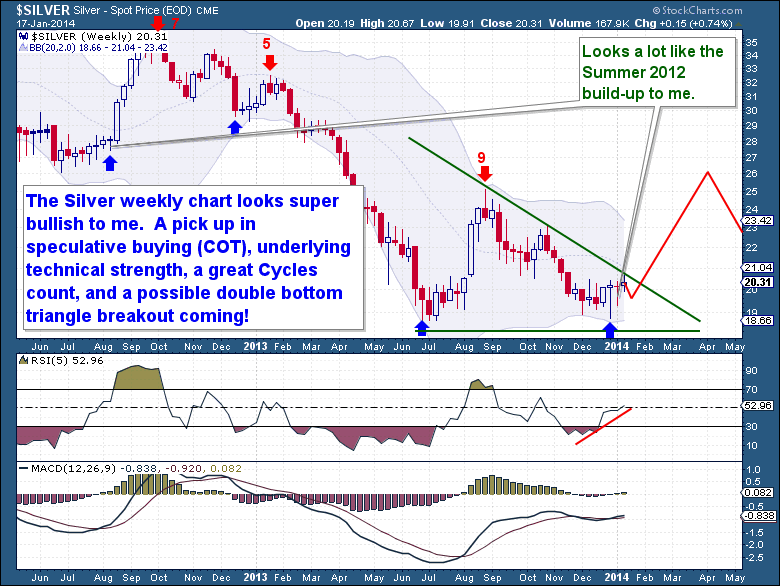

I just cannot emphasize how much I like the silver chart, to me it looks ready to pop in what could be a 20% rally in as little as 4 weeks. We know silver is capable of such moves and I see the current coiling action being extremely similar to the move which occurred over the summer of 2012 (see chart below). We have a good pickup in speculative buying (COT) while the underlying technical strength of this Cycle looks great. The Cycle count is very favorable and we have what looks to be a massive double bottom triangle breakout coming!

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences.

LIMITED TIME PROMOTION. You're just 1 minute away from profitable trades! please visit https://thefinancialtap.com/landing/try# AND ENTER PROMO CODE: 29off This will reduce ANY product by $29 (including the annual).