Don’t Fight the Trend

When it comes to the Daily Cycle, especially 1st Daily Cycles from a series of up trending Investor Cycles, there is only so much downside one should expect. That’s essentially what we have in the equity markets, a long history (4 years) of 1st Daily Cycles finding the necessary bid to power out of Cycle Lows.

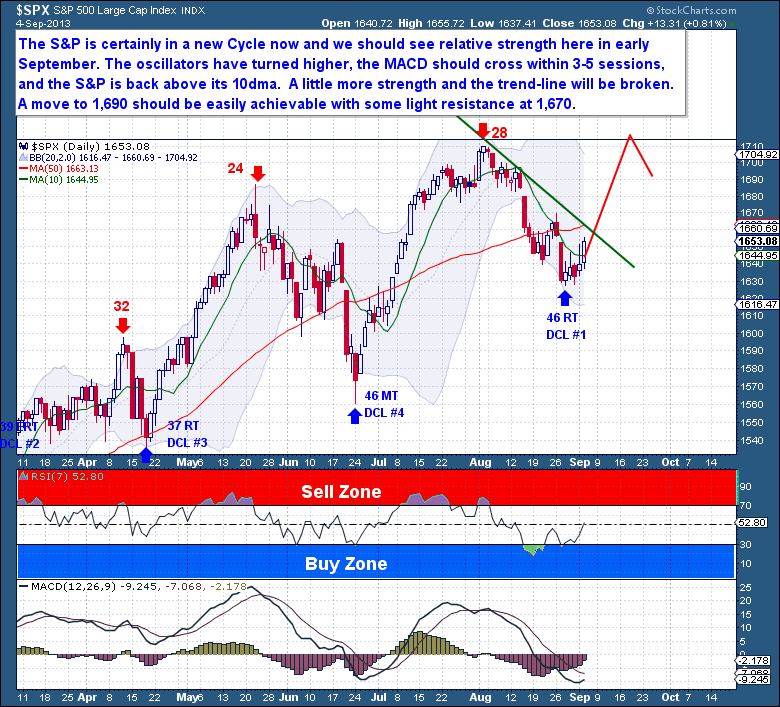

In this particular case, there is now little doubt that a new Cycle is underway. The Cycle extended out to 46 trading days (4 more than normal) and was technically a much deeper correction than one would expect. The oscillators have turned higher, the MACD should cross within 3-5 sessions, and the S&P is back above its 10dma. A little more strength and the trend-line will be broken too.

So with a new Daily Cycle we should see relative strength in early September. Although I believe one should now treat the equity markets with caution, the fact remains that the overall trend (Investor Cycles) is up and every single 1st Daily Cycle Low of this past 4 Year Cycle has gone on to make comfortable new Investor Cycle highs.

So with a new Daily Cycle we should see relative strength in early September. Although I believe one should now treat the equity markets with caution, the fact remains that the overall trend (Investor Cycles) is up and every single 1st Daily Cycle Low of this past 4 Year Cycle has gone on to make comfortable new Investor Cycle highs.

Those are some formidable odds for the bears, and I see no reason why one should go out on a limb by trading against those odds. This is why I expect a move to 1,690 should be easily achieved in the coming weeks. Beyond that a test of the all-time highs and a surge into the 1,700’s simply cannot be ruled out.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences. If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/landing/try#

Free Report – Complete the form below