Gold Needs to Shine Quickly

If Gold’s Investor Cycle Low were behind us, then this would be one weak and lifeless 1st Daily Cycle. Typically the rally after a bloodbath Investor Cycle Low is impressive enough where you just know it’s a 1st Daily Cycle. It doesn’t necessarily need to be a V like rally, but in general you should see broad buying day after day and strong daily closes. By Day 10, a 1st Daily Cycle has typically gone a long way to recovering much of the previous drop, but here gold has barely made a dent into recovering any.

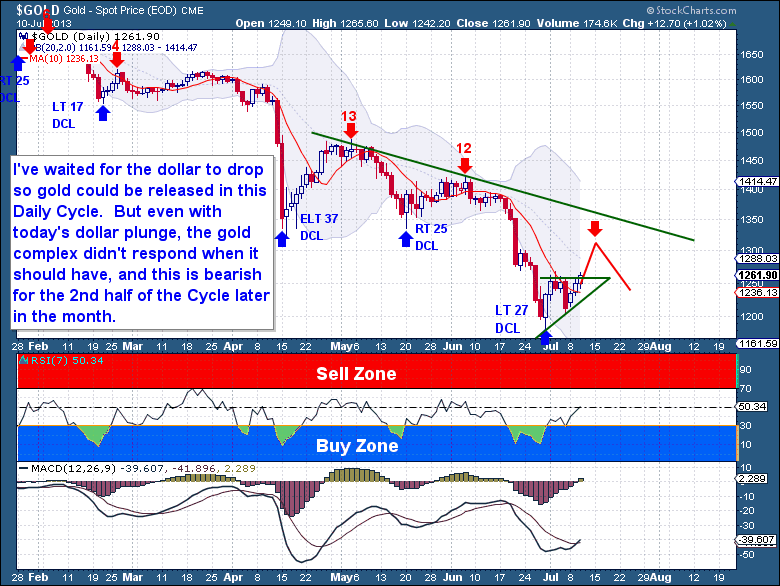

So to this point gold has not shown any of the strength that has me thinking this is a 1st Daily Cycle. I have been a little patient on the Cycle because the dollar was soaring, so I have waited for the dollar to drop to see if gold released quickly to the upside. Today was that day for gold and unfortunately the dollar’s plunge did not equate into a broad precious metal sector rally. Again as I observed over the weekend, silver and the miners were both flat again today. This indicates that there just isn’t any meaningful interest in this sector yet.

The bearish performance to date likely indicates that once the Cycle ages (Day 15 area) that it could quickly turn down sold aggressively. This might well coincide with the dollar coming out of its own DCL late next week. Up until then though, gold still has a chance to prove me wrong, it’s just on Day 9 and its back above the 10dma. I believe even in the bearish case that gold should have enough steam to get it to $1,300. But now is its only chance to shine, the Cycle has days 10 to 15 with potentially a falling dollar to really impress. If the gains cannot come quickly from this setup, then I’m afraid gold is setting up for yet another big fall.

If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/about