Bond Cycle Timing

Bond Cycle Timing

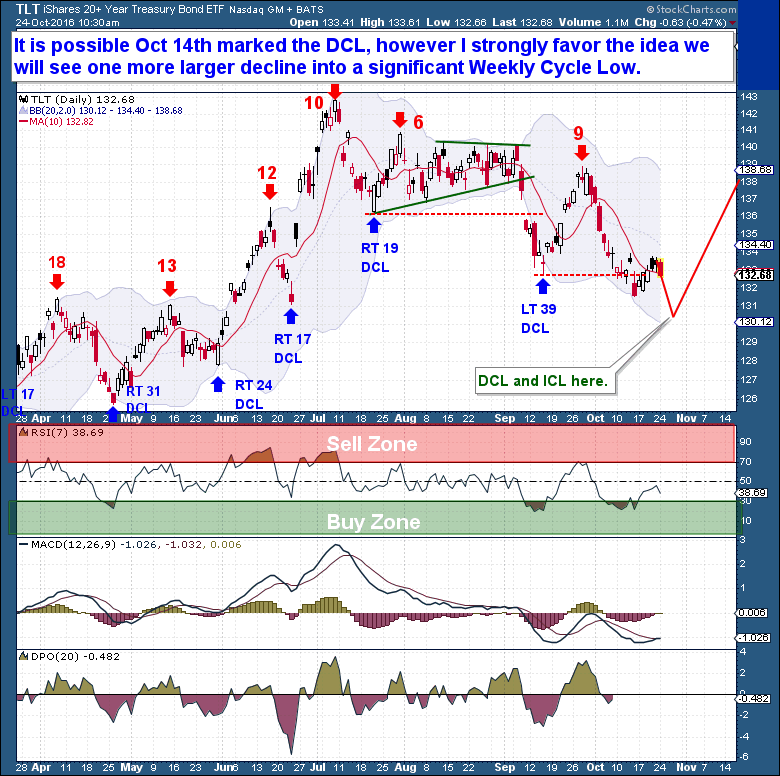

It’s possible that Oct 14th marked the last Daily Cycle Low (DCL) in Bonds, but I continue to believe that we’ll see one more decline before the final low.

In many ways, the Bond and Gold Cycles continue to move in unison. Both assets are generally defensive in nature, so it’s no surprise that both have consolidated for months and that both appear to be on the verge of a new Cycle rally.

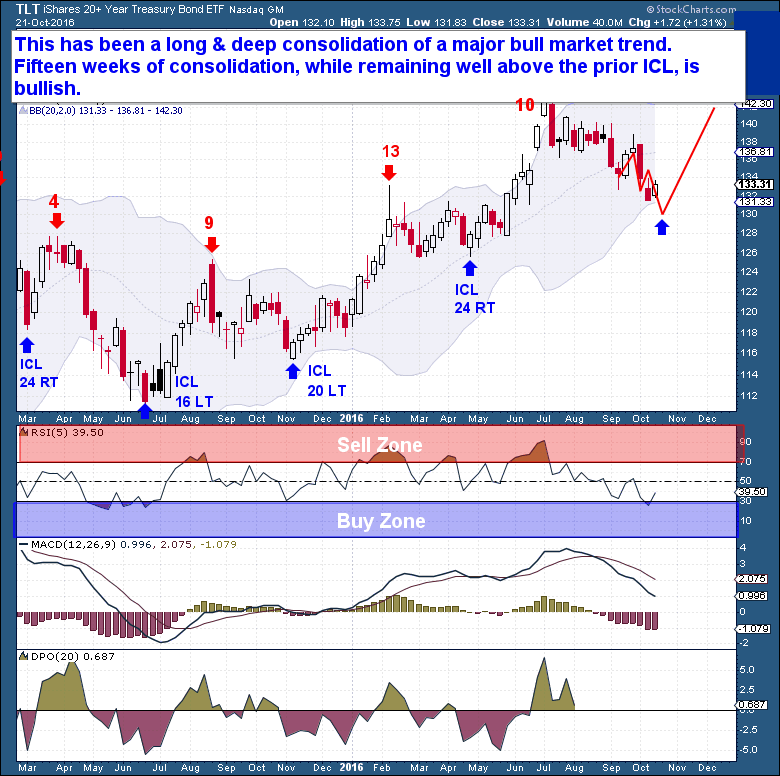

For an asset locked into a bull market trend, Bond’s current consolidation has been both long & deep. In theory, the eventual move out of the next Investor Cycle Low should be inversely similar, with a rise that is both powerful and sustained.

The Financial Tap – Premium

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

NOTE: The Financial Tap offers you a Full 14 day, no risk, money back Trial. It’s just $99 thereafter for a full 3 months of membership, a fraction of what one stopped out trade is likely to cost you. Consider joining The Financial Tap and receive two reports per week and the education you need to become a better trader or investor See >> SIGN UP PAGE!

Bob.