A Market Peak

When we look at the current bull market in the context of prior bull markets, we’re immediately struck by the sheer size and strength of this move. Part of the strength comes from the deep generational selling event of 2008; just getting back to a reasonable valuation from such oversold levels represents a significant portion of the current bull market. The other driving force has been the FED, as its accommodative support has provided liquidity to the markets, and its Zero Interest Rate Policy has pushed yield-seeking money into equities from savings accounts and bonds.

At present, there are significant questions about the effectiveness of a continuation of the FED’s policies…at a time when the current bull market is “long in the tooth”. Although the lower and middle classes are generally much worse off than they were prior to the financial crisis, U.S corporations have rebounded and are now much leaner, with balance sheets that are in better shape than they were prior to the crisis.

But significant questions about future growth have emerged at a time when equity markets are pricing in a substantial macroeconomic recovery, including a return to blistering, double-digit growth. Although markets have climbed higher, mainstream consumers have been unable to participate in the “recovery”, so corporate earnings have languished at low single digit growth rates. In the face of tepid growth, already-rich market valuations have continued to rise. It’s these types of overbought, overextended, and overvalued conditions that have presaged the end of the great bull markets of the past.

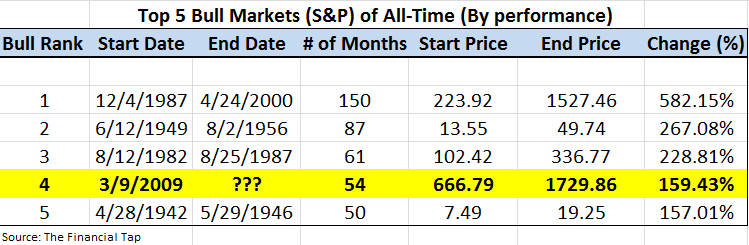

Below are the top 5 performing bull markets in history. Interestingly, and surprisingly, the current bull market is number 4 on the list. Upon closer examination, we see that the top 3 bull markets occurred as part of a general secular bull market. Meaning they were part of a period of true economic expansion, a period of real income growth and wealth creation. The current cyclical bull market, however, appears within a greater secular bear market, which makes this the best performing bull market (in terms of performance, not time) of any secular bear period in history. From a timing perspective, the 1970’s bull market (within a Bear Market) ran for 70+ months, while the 2002-2007 bull market (again within a Bear Market) was 55 months in duration.

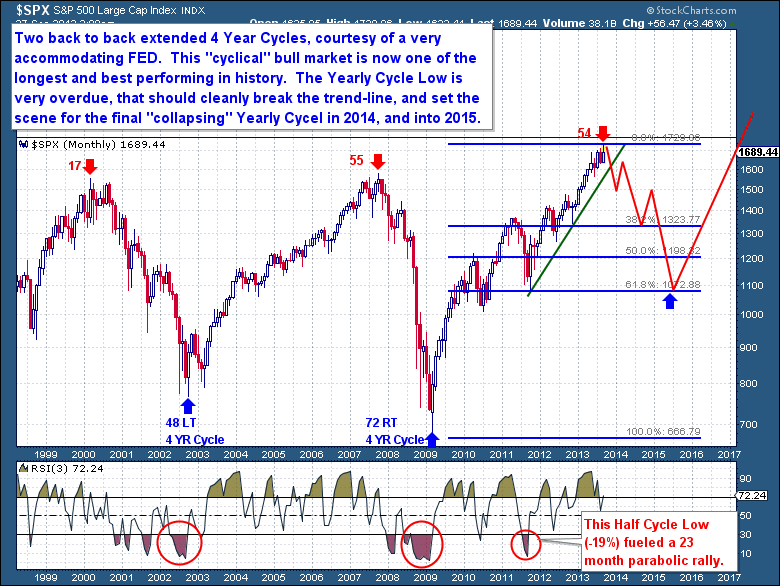

The point is, simply, that the current cyclical bull market, or 4 Year Cycle, is now extremely over-extended from both a performance and time standpoint. With an economy that continues to languish and a Yearly Cycle that is overdue for a significant decline, it’s difficult to expect that the current bull market will continue higher for another Yearly Cycle.

The point is, simply, that the current cyclical bull market, or 4 Year Cycle, is now extremely over-extended from both a performance and time standpoint. With an economy that continues to languish and a Yearly Cycle that is overdue for a significant decline, it’s difficult to expect that the current bull market will continue higher for another Yearly Cycle.

Courtesy of a very accommodative FED, we have two back-to-back extended 4 Year Cycles. Both cyclical bull markets were in the top 4 of the longest and best performing in history, but 13 years since the 2000 peak, the S&P is still only barely positive. From a real (inflation-adjusted) perspective, the markets are down over this 13 year period, and that’s at the end of the current bull with a peaking 4 Year Cycle.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, and $USD Cycles. Along with these reports, members enjoy access to three different portfolios and trade alerts. As these portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences.

You're just 1 minute away from profitable trades! If you’re interested in learning more about The Financial Tap and the services offered, please visit https://thefinancialtap.com/landing/try#

Free Report – Complete the form below