Patience is Always Rewarded

Overall, in any bull market, the trend is always your friend. But a favorable trend doesn’t mean any buy is automatically a good risk/reward trade. For the long term investor, a bull market can be forgiving of any entry. But for the swing trader with a short term focus, it’s buying the dips that present an opportunity to establish a profitable position, with far less risk. Of course, nothing is risk-less, but the ability to buy after a decent retracement should not be passed up.

During well trending markets, almost all declines are simply retracements and profit taking events. Besides the deeper (5%-10%) weekly Cycle retracements, which occur consistently twice a year (Every 24 weeks), these dips are just mean reversion events back towards an up sloping trend-line. As a Cycle becomes overly bullish and latecomers encouraged buying high, it’s around that point where the smart money (buyers of the prior dip) begins offloading their stock.

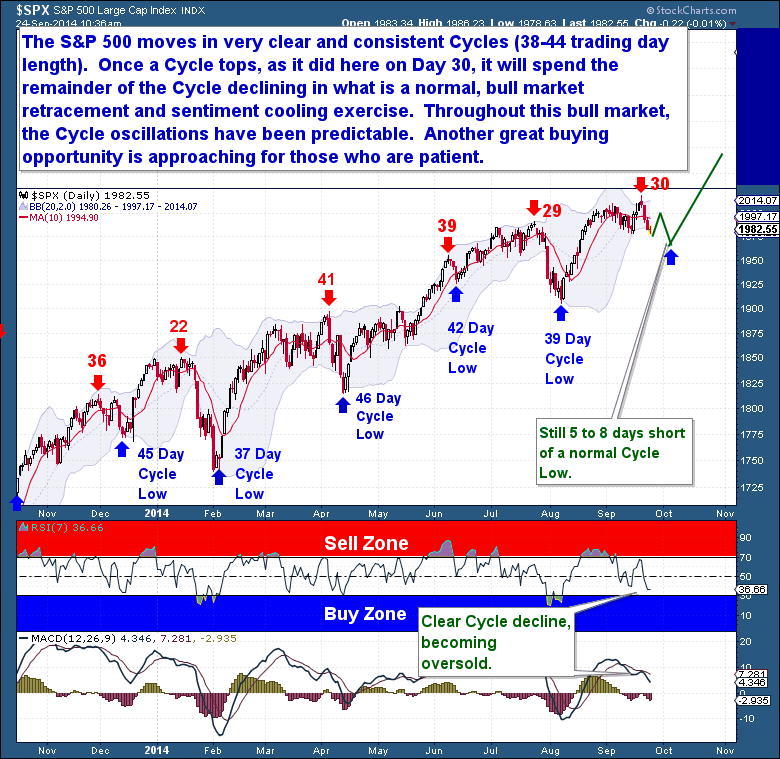

It’s this ebb & flow action that produces Cycles with predictable frequency. The S&P 500 moves in these Cycles every 38-44 trading days and their recent pattern can be clearly seen on the chart below. Beyond this chart, this entire bull market has exhibited similar consistency.

This current Cycle clearly topped 4 sessions ago on Day 30 (since the last Cycle Low) and now the profit taking and sentiment clearing process of the Cycle is in full swing. This type of retracement is normal and expected, as 30 days higher will now be followed with 8 to 12 sessions lower, to complete this Cycle.

Understanding that markets move in such a predictable flow allows the trader to remain patient with their entry. It provides them the opportunity to sit back and wait for the trade to develop, as opposed to being constantly on edge and concerned they’re going to miss the next opportunity. And yet another of these Cycle Low buying opportunities is approaching. To profit from it, it will require you to be emotionless when confronted with daily swings and high volatility, while remaining fixated on executing your trading plan.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, and US Bond Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit https://thefinancialtap.com/landing/try#