Posts

Don’t Believe the Hype on Interest Rates

/in Premium /by Bob LoukasMidweek Market Update – April 1st

/in Premium /by Bob LoukasKeep On Rolling

/in Premium /by Bob LoukasA Gold Trading Idea

/in Public /by Bob LoukasYesterday’s FOMC was bullish for most assets, as the FED indicated it was not ready to beginning raising rates. The FED’s ZIRP policy, designed primarily to encourage lending and speculative asset purchases, is clearly here to stay for a while longer. But for gold, this policy has done little for it over the past 3 years, as speculative money is much more concerned with chasing equity and bond markets higher.

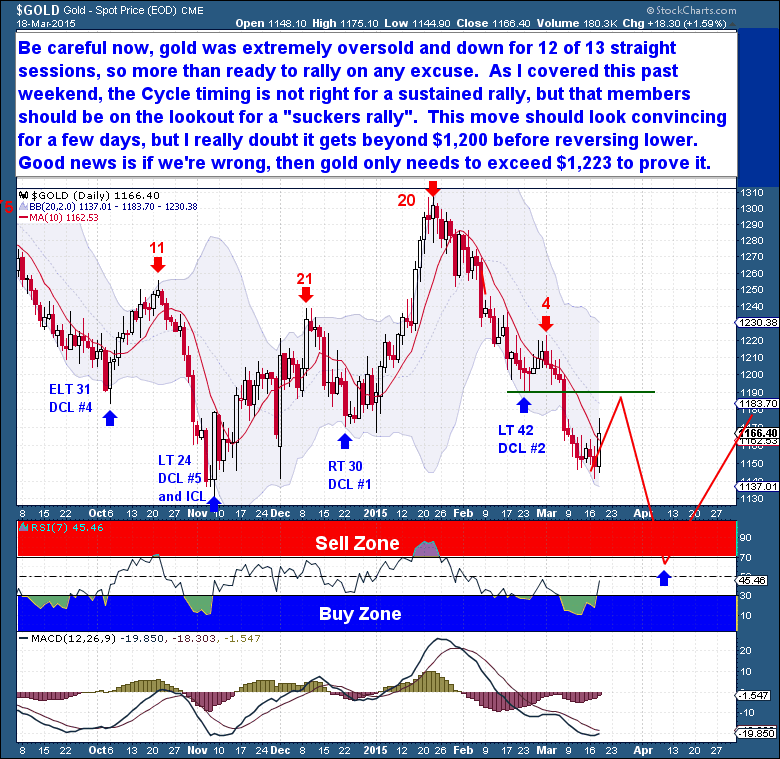

Which is why we should be careful here and to avoid reading into a solitary $20 move on a bullish FOMC day. For starters, the dollar fell by a massive amount, this alone accounted for much of the gold increase. But also more importantly, gold was extremely oversold, being down for 12 of the 13 preceding sessions. Therefore, there was an expectation for gold to move higher yesterday, the asset was setup and ready to rally on almost any excuse.

As I outlined with much more detail (premium report) this past weekend, the Cycle timing is simply not right for a sustained rally. A combination of (early) Weekly Cycle timing, gold sentiment, and the COT report, all show evidence to support an Investor Cycle Low that is just a shy too early. I also cautioned members to be on the lookout for a “suckers rally”, and not to confuse it with a new Investor Cycle rally.

So as yesterday’s move higher was expected, it is also likely that gold will continue higher for the coming days and the action to appear convincing. However, as gold recently entered into the final chapter of this Investor Cycle, it is unlikely to have the strength required to get beyond $1,200. Traders should be on the lookout for a peak around the $1,180-$1,200 from which they could short the gold Cycle, because the decline from that peak should be of the “capitulation variety”. The good news is that if we’re incorrect on this Cycle outlook, then gold only needs to exceed $1,223 (prior Cycle high) to prove us wrong.