Posts

At The Crossroads

/in Premium /by Bob LoukasStick Save

/in Premium /by Bob LoukasSpidey Sense

/in Premium /by Bob LoukasMetals Crash Update

/in Premium /by Bob LoukasThe Golden Gift

/in Premium /by Bob LoukasKeep on Riding

/in Premium /by Bob LoukasGreen Lights

/in Premium /by Bob LoukasModel Portfolio Explained

/in Premium /by Bob LoukasYear in Review and What Might Lie Ahead

/in NewPublic /by Bob Loukas

First Ever Sale of The Financial Tap – ENDS Tuesday Midnight.

Fourteen years ago, I started The Financial Tap on a simple belief: Markets reward process over emotion, allocation over ideology, and patience over noise. 2025 was another proof point of that discipline, from a precious metals overweight to full stock exposure, members weren’t guessing, hoping, or defending narratives. The long term portfolio returned an estimated 45% during 2025, with very little drawdown or volatility.

And that’s the real value of this service:

You don’t subscribe for information — you subscribe for a framework that helps you act on information without sabotaging yourself.

A strategy layer that keeps you out of consensus traps, emotional trading loops, and the high-turnover bias cycles that dominate investor discourse today.

At midnight Tuesday Jan 6th, the opportunity to secure the original founding rate, a $100 recurring discount every single year, forever, disappears with the cycles.

If you’ve been following me or been a member before, you already know: I don’t chase attention, I don’t amplify hype, I don’t curate bias, I study trend, weight allocation, and play the long game.

Claim your 2025 Rate + $100 Off Recurring Link → https://thefinancialtap.com/checkout5-2/?rid=prj2iO&coupon=ROLLBACK

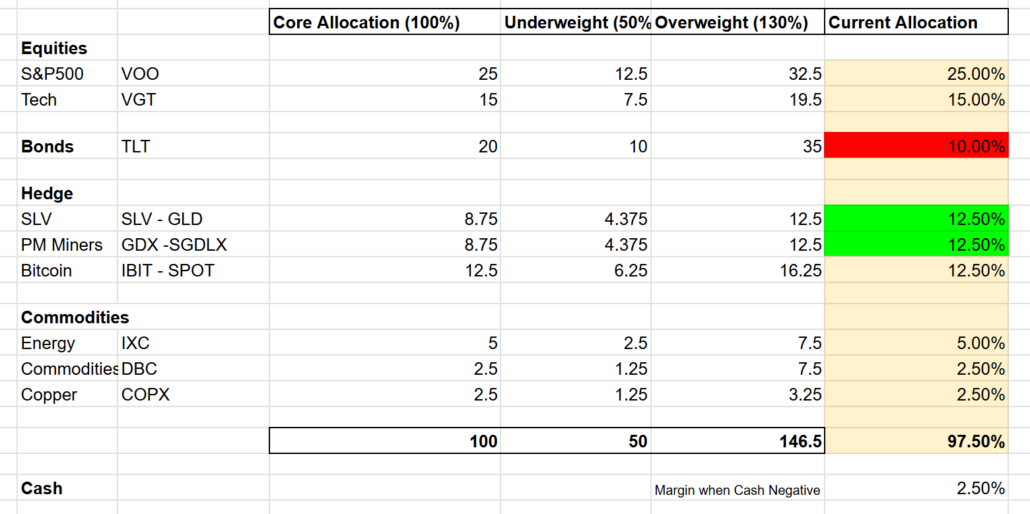

ALLOCATIONS

Model Portfolio Positions –

Gold/Metals – Overweight Position. Transitioned from SLV to GLD.

S&P/Equities – Core Position

Crude Oil/Energy – Core Position

Bonds- Underweight Position

Bitcoin – Core Position (Change)

VIDEO REPORT

CYCLE COUNTS

Gold Cycle

| Cycle | Count | Observation |

Cycle Trend |

Cycle Clarity |

| Daily | Day 47 | Range 24-28 Days | Late Cycle | Green |

| Investor | Week 20 | Range 22-26 Weeks | Late Cycle |

Green |

Supporting Indicators

| Sentiment Level | 74% | Excessive |

| Primary Trend (Weekly Chart) | Bull Trend |

S&P500

| Cycle | Count | Observation |

Cycle Position |

Cycle Clarity |

| Daily | Day 29 | Range 38-44 Days | Mid Cycle | Green |

| Investor | Week 7 | Range 26 Weeks | Early Cycle | Green |

Supporting Indicators

| Sentiment Level | 70% |

Bullish |

| Primary Trend (Weekly Chart) | Bull Trend |

CRUDE OIL

| Cycle | Count | Observation |

Cycle Position |

Cycle Clarity |

| Daily | Day 12 | Range 36-42 Days | Early Cycle | Green |

| Investor | Week 12 | Range 22-26 Weeks | Mid Cycle | Green |

Supporting Indicators

| Sentiment Level | 36% |

Bullish |

| Primary Trend (Weekly Chart) | Bear Trend |

$US DOLLAR

| Cycle | Count | Observation |

Cycle Position |

Cycle Clarity |

| Daily | Day 12 | Range 15-20 Days | Early Cycle | Green |

| Investor | Week 16 | Range 16-20 Weeks | Mid Cycle | Green |

Supporting Indicators

| Sentiment Level | 42% | Neutral |

| Primary Trend (Weekly Chart) | Down Trend |