Draghi to Deflate Gold

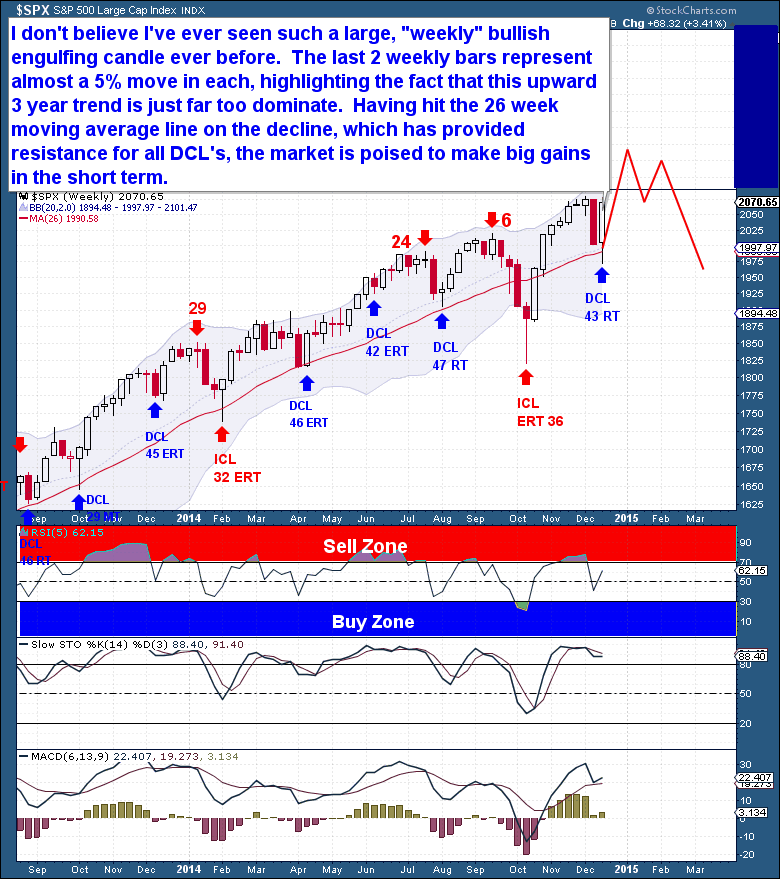

It has been a nice run of late for gold here in the latter part of this Daily Cycle. Gold has closed above the 10 day moving average for 13 straight sessions, which is the type of bullish, Right Translated Cycle behavior we’ve been longing for. And I continue to believe that gold has found a floor here on the longer time-framed Cycle, which means that this positive action is part of a larger move that will eventually show gold has moved out of a wide, 18 month basing pattern.

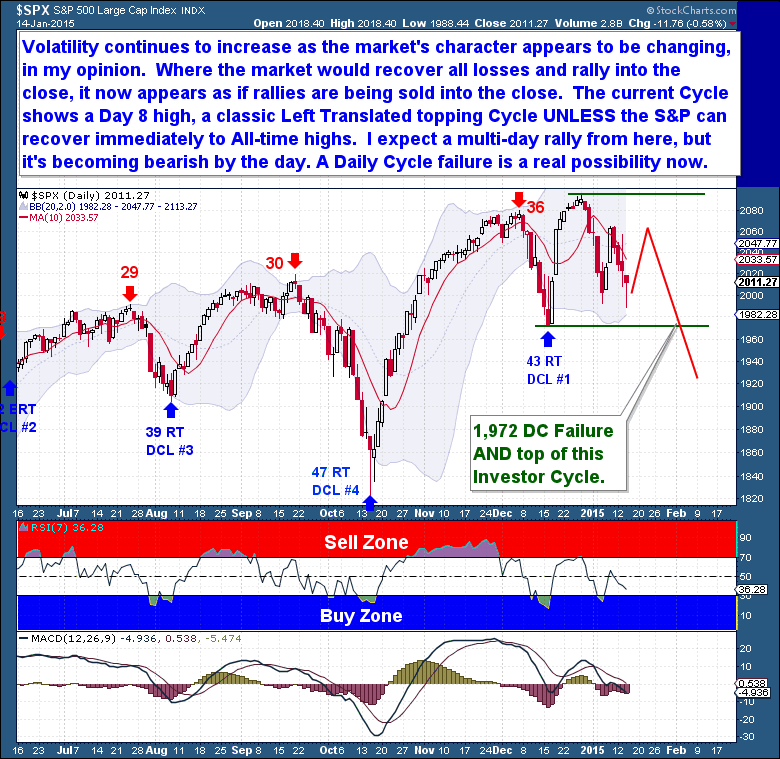

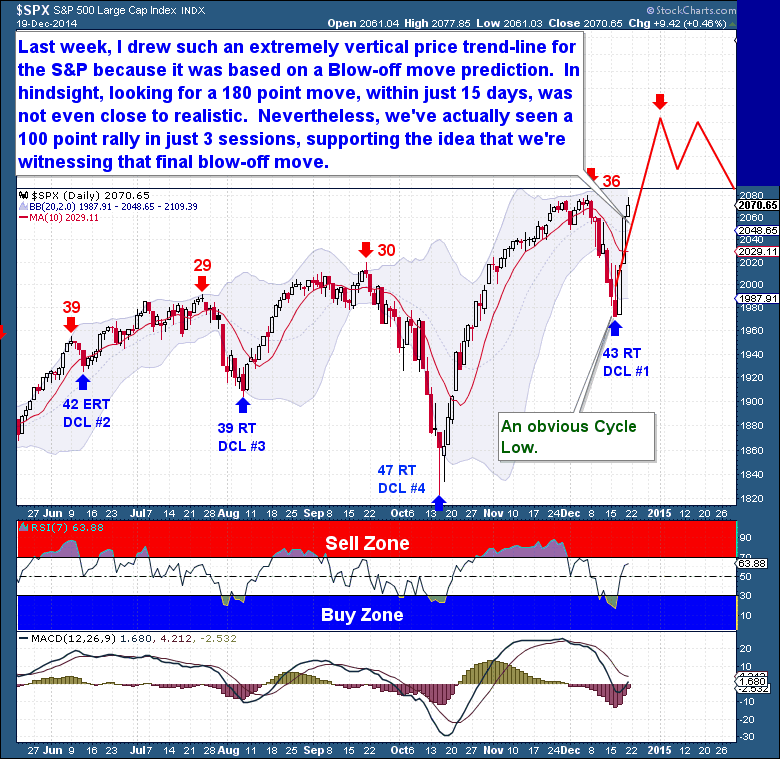

But all assets move in predictable, ebb & flow patterns, across multiple time-frames. And seeing as though gold is nowhere near a parabolic state, which could negate this expectation, I see the next significant move for gold as much more likely being a quick retrace of the recent gains, leading into an expected Daily Cycle Low.

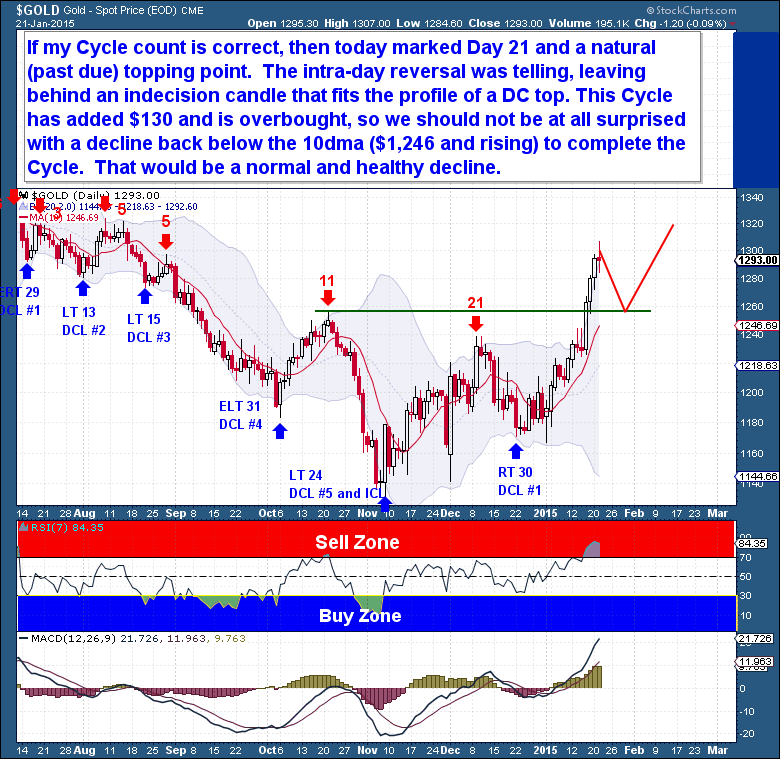

Based on my Gold Cycle count, today marked Day 21 and a natural (actually slightly past due) topping point. Gold has rarely managed to become this overbought in the past 3 years and whenever it did, gold fell almost immediately back towards a Cycle Low. Today’s intra-day reversal was telling in my opinion, leaving behind an indecision candle and the type of action I would expect around a Daily Cycle Top.

Let’s also not get too greedy or ahead of ourselves, this Cycle has after-all added $130 and is now overbought. For all these reasons, we should not be at all surprised to see a decline back below the 10dma ($1,246 and rising), over 3 to 7 sessions, to complete the Daily Cycle. Tomorrow’s ECB meeting is obviously widely anticipated and is likely to be market moving. Therefore, it will likely also be the catalyst to send gold lower into the next Cycle Low. It would after all actually be an expected, normal and healthy decline at this stage.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: https://thefinancialtap.com

Feel free to share this post via the below social media avenues.