Prescious Metals Making a Final Stand – April 10th

CYCLES ANALYSIS

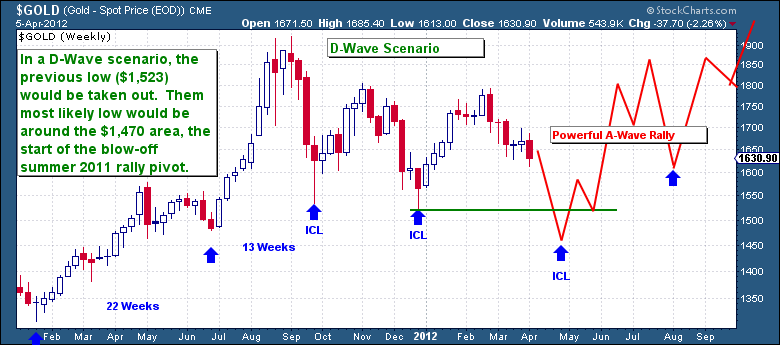

GOLD – Cycle Counts

|

Cycle |

Count |

Observation |

Outlook |

|

Daily |

Day 14 |

Range 22-28 Days |

Avoid |

|

Investor |

Week 15 |

Range 18-22 Weeks – 3rd Daily Cycle |

Bearish |

|

8Yr |

Month 42 |

Range 90-100 Months |

Bullish |

|

Secular |

Bull |

Gold in the latter parts of a powerful secular bull market |

Bullish |

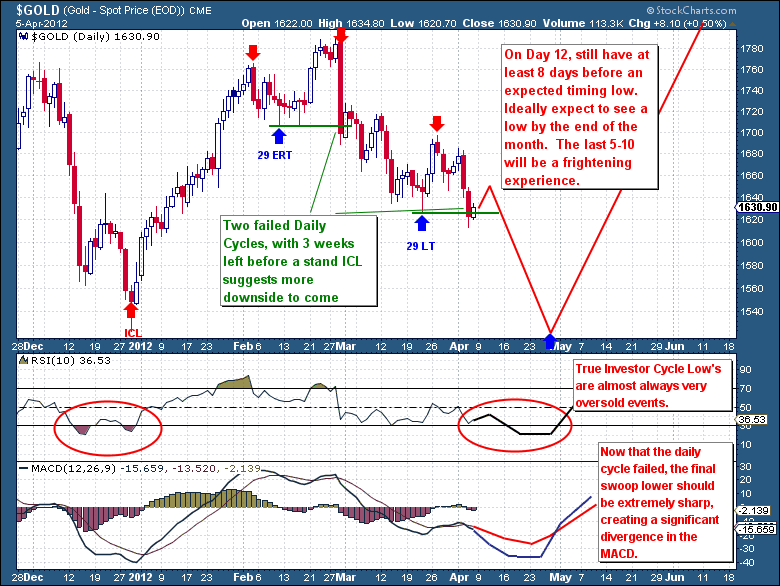

Gold’s Investor Cycle remains in a failed state and we’ve now witnessed two back to back daily cycle failures (see chart). A cycle that fails simply means that the trend is downwards, as the top of the cycles (red arrows) occurs so early in the cycle so it has more time to decline which results in a lower cycle low (blue to blue arrow). A pattern of continuous failed cycles last occurred during the 2008 financial crisis. To see these occurring again is certainly a bearish occurrence. As we’re only on day 12 of this daily cycle, we should see up to another 15 days of generally falling price, ending with a potentially frightening collapse into a cycle low.

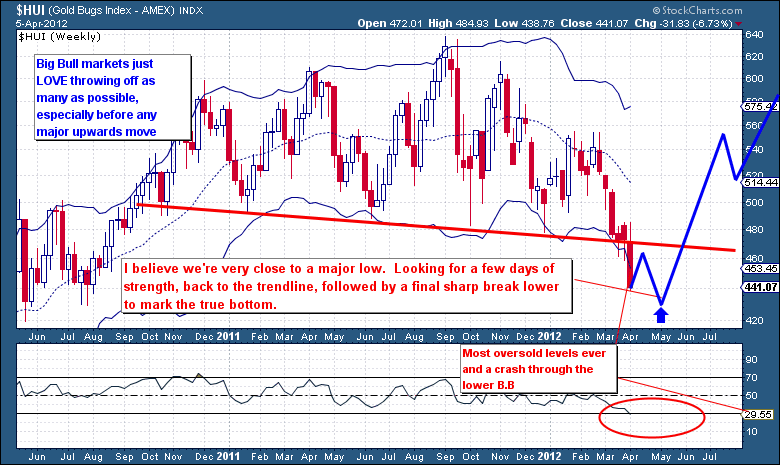

As I’ve been warning for weeks, the well-established resistance trend line on the miners ($HUI) chart has given way. Big bull markets never make it easy to stay invested; this resistance break is just a classic example of this. The miners have been so under-loved and invested for so long that sentiment has reached such bearish levels. Such levels in any secular bull market only mean one thing, a major lower and buying opportunity is at hand.

For there to be any hope of a new Investor Cycle low, we typically need to see rock bottom sentiment. Such levels are typically associated with a lack of sellers and are almost always present during major turning points. As of today, gold sentiment is consistent with all other major lows and turning points.

Trading Strategy – Gold/Silver

Although the miners may already have printed a major bottom, we’re still at least 10 days from a gold Daily Cycle low. This coming low will almost certainly mark an Investor Cycle Low too.

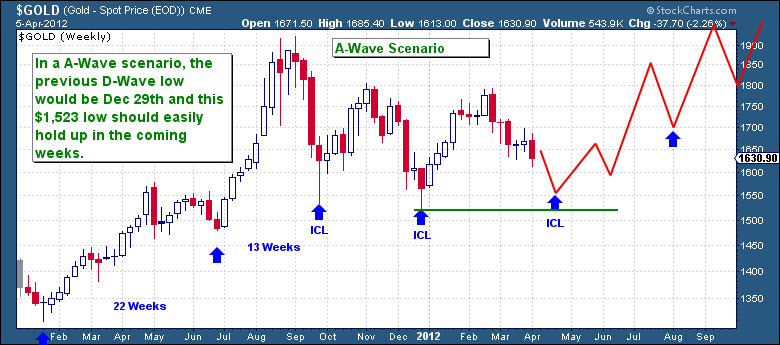

The real uncertainty here is the extent of the coming decline. Unfortuantly we still have two major wave scenarios to consider, either a D-Wave or A-Wave ending low. Both scenario's greatly influence how the coming 10-20 days will play out. Each scenario neatly fits into the timing for a coming low and should result in a significant rally following the low.

My least preferred scenario is the A-Wave ending scenario, which essentially marks Dec 29th 2011 as the D-Wave low and the 16-17 week action since being the A-Wave. If this is an A-Wave ending, then gold would comfortably hold above the previous $1,523 low. This would break the pattern of declining (Sep 2011, Dec 2011, April 2011) Investor Cycle lows and confirm a change in overall trend.

What I hope and expect will unfold is for gold to collapse over the next 15-20 days and find a deep, punishing low somewhere in the $1,400’s. This type of decline, some 35 weeks from the last peak, would mark a D-Wave low with near certainty.

The sentiment and fear at these levels would be such that sellers will be completely exhausted and smart money would begin to flood the sector in search of grossly under-valued assets. The D-wave low should generate a powerful 15-20% A-Wave rally while the eventual move back up to the previous high will be a rich 30% move.

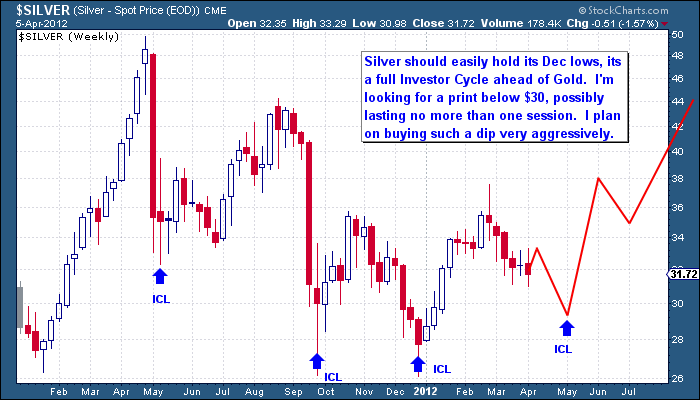

Silver, having already seen 3 lower Investor Cycle lows, should hold well above its previous Dec 29th low and will offer the greatest reward investment of this D-Wave low. Once Silver finds its low, it will quickly begin the process of base-building between the $30 to $45-50 areas. If the previous 5 Silver waves of this bull market are any indication, Silver will move 50% higher over the next two (46 weeks) Investor Cycles.

The coming gold ICL will be bought aggressively, most likely with XXXXXXXXXXXX – Member Content.

$US Dollar – Cycle Counts

|

Cycle |

Count |

Observation |

Outlook |

|

Daily |

Day 5 |

Range 18-22 Days – 2nd Daily Cycle |

Bullish |

|

Investor |

Week 6 |

Range 18-22 Weeks |

Bullish |

|

3Yr |

Month 11 |

Range 36-42 – 3rd Investor Cycle. |

Bullish |

|

Secular |

Bear |

Dollar most likely in tail end of a secular bear market |

Undetermined |

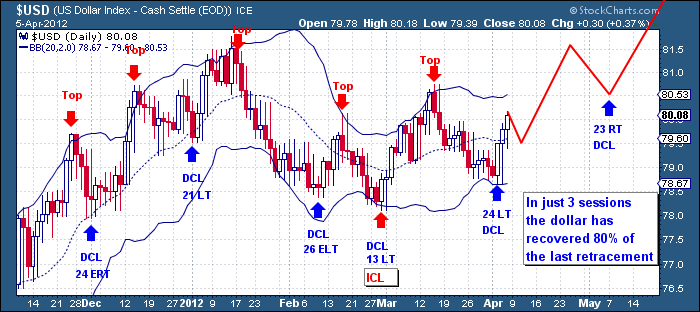

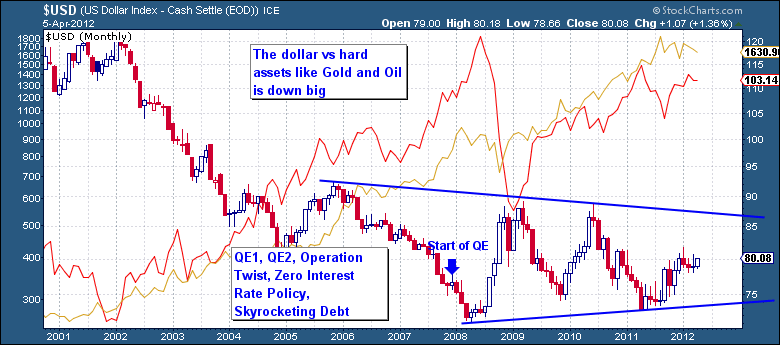

As I had outlined in the mid-week report, the Dollar had taken its time forming a Daily Cycle Low. Since the low, it has wasted little time recovering much of its 1st daily cycle decline. Expect a day of consolidation before it continues its move past the previous cycle high of 80.60. The dollar just loves to ride its Bollinger Bands both on the way up and down, which is why you often see this technical indicator accompany most of my dollar charts.

So for now, as I have since last autumn, I remain bullish on the dollar as it grinds its way higher with each Investor Cycle. As long as the U.S economy outperforms most of the western economies and the Europeans continue to pump massive liquidity into their system, I expect this up trending 3yr cycle to continue.

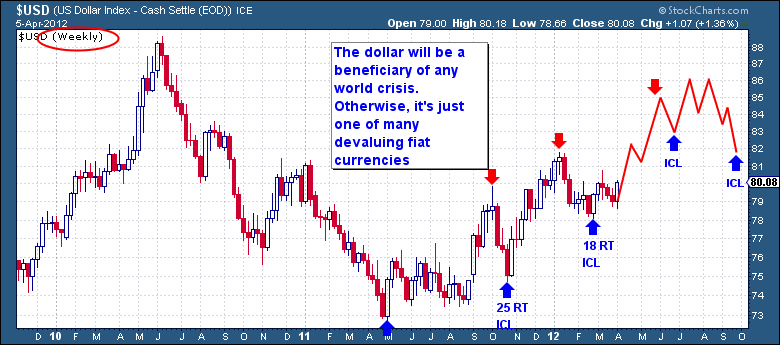

Switching to the broader weekly view, I’m expecting to see the dollar works its way higher towards the previous 89 level. I doubt the 3yr high comes with this Investor Cycle, but by the end of the year we should see the dollar top out and begin a multi Investor Cycle move back down to the low 70’s.

But does it really matter where the dollar is headed anymore? So many are bearish on the dollar for the long term, believing it’s headed for destruction. Are we being a little naïve in thinking this is solely a U.S problem? We’re not the only country actively printing and increasing the base money supply in order to keep the system functioning. Looking across the pond, the Brit’s and the Europeans are writing their own text books on the art of printing. The Japanese are into their 2nd generation of easing, while the Chinese are issuing trillions in state backed loans to fuel capital projects that don’t have a hope of ever getting paid back. So if the world economies are printing like mad, why should the U.S dollar collapse when measure against these currencies?

What we’re forgetting here is that the world is simply living far beyond its means. Never in humanity's history have so many lived so well. You may be blind to this reality, but the western world lives in luxury and it’s just not sustainable. We provide so little of value to the world in exchange for our large homes, multiple cars, our promised pensions, wardrobes of unused clothes, and room after room of expensive disposal material possessions. We’ve become so lazy and privileged that we pay somebody to mow our 1,000 sq. ft. lawn.

So what supports this “perception of wealth”, what allows us to do so little in exchange for such relative luxury? It’s simple really; a massive expansion of debt across all levels (consumer, local, state and federal) and an expansion of base money both support the system, it keeps the party going and the official's elected. While we all remain “seemingly satisfied”, the party continues. But this isn’t a U.S phenomenon; it’s a worldwide one.

So there is little doubt the dollar is losing real value, that is not my argument. But its traditional valuation metrics, such as the currency pairs and the dollar index are now useless metrics. These only measure the value of the dollar compared to other worthless central bank notes. It’s a rather neat little system (for now) that they have created. As long as they all devalue together, then compared to each other it all appears fine. As most nations are in a similar position of adding to debt and printing notes to maintain this illusion, do we really expect the dollar index to simply collapse to the point where the dollar is no longer accepted?

It’s very unlikely in my opinion; in fact I believe it’s possible that we may have seen a long term (nominal) bottom in 2008. How else would you explain the dollar index being higher after 2 QE programs, operation twist, a zero interest rate policy and 15 trillion in debt? Again, it’s because its value is derived from comparing it to similar worthless currencies. All backed by nothing other than the faith in ones government and central fiat bank.

Take a look at the value of gold and oil, just a couple of the hard assets that have sky rocketed in price as the dollar has remained flat. Since the beginning of QE1, the dollar index is higher while gold has more than doubled in price. When measured against any foreign currency, these hard assets have all risen sharply. This proves that all fiat currencies are being simultaneously devalued, we need to stop focusing on the dollar and focus on real assets.

Trading Strategy – US Dollar

XXXXXXXXXXXXXXXXXXXXX – Trades only available via member only panel.